Build your portfolio

with Stock Tokens

Stock Tokens are derivative contracts between you and Robinhood. They are priced at the prices of the underlying securities without granting rights to them. Stock Tokens carry a high level of risk and are not appropriate for all investors. Investors may lose up to the full amount of their invested capital due to market conditions or the insolvency of Robinhood. Please review the Description of the Service, Financial Instruments, and Risks and the Key Information Document and fully understand all associated risks before investing.

Stock Tokens are derivative contracts between you and Robinhood. They are priced at the prices of the underlying securities without granting rights to them. Stock Tokens carry a high level of risk and are not appropriate for all investors. Investors may lose up to the full amount of their invested capital due to market conditions or the insolvency of Robinhood. Please review the Description of the Service, Financial Instruments, and Risks and the Key Information Document and fully understand all associated risks before investing.

No hidden fees

Start with as little as €1

Market access.

All day. All night.

Held by a licensed US custodian

Appropriate for eligible investors

Curious about Stock Tokens?

You’ve got questions.We got answers.

What are Stock Tokens?

They’re derivatives tracked on the blockchain that follow traditional stock and ETP prices, giving you exposure to the US market.

How does Stock Token investing work?

You can place orders during the week, or queue them over the weekend for when the market opens. Turn on price alerts to stay informed and make timely decisions. Stock Tokens can’t be sent to other wallets or platforms at this time.

What are the risks of Stock Tokens?

Stock Tokens are derivative contracts between you and Robinhood, which involve investment risk. Stock Tokens’ value depends on the value of the underlying stock or ETP, and may fluctuate based on market conditions. The change in the value of the underlying stocks or ETPs may be significant and therefore you could incur losses - up to the full amount of your invested capital.

Since Stock Tokens are derivatives, they do not grant any rights to the underlying shares or ETPs. Derivatives are complex financial instruments which involve a high level of risk and are therefore not appropriate for all investors. In addition to market volatility risk, when trading Stock Tokens, investors may incur losses - up to the full amount of invested capital - due to liquidity issues (i.e., difficulty in closing a position), currency exposure, and service provider insolvency risk. Please see more information in the Description of the Services, Financial Instruments, and Risks and the Key Information Document.

Are Stock Tokens taxed?

They’re typically treated like other derivative investments but may vary by region. Consult a tax professional for specific guidance.

How much does it cost to trade Stock Tokens?

A 0.1% foreign exchange (FX) fee on each order applies when converting euros to US dollars for a buy order and when converting US dollars back to euros after a sell order. There are no other fees charged by Robinhood.

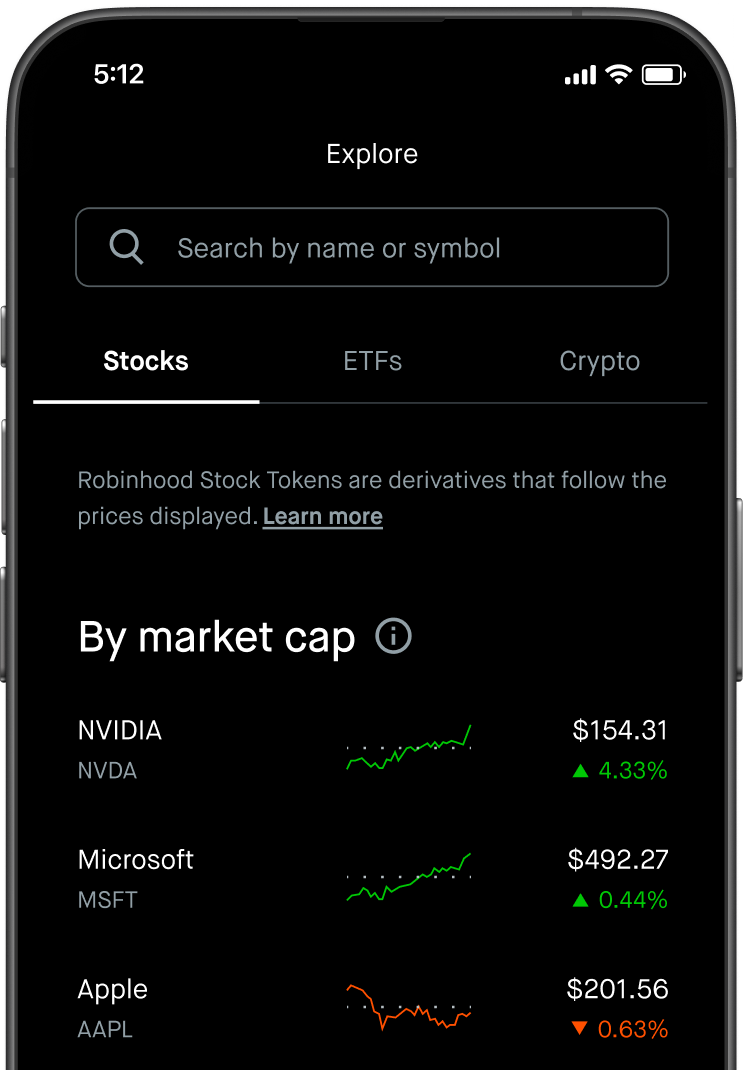

What Stock Tokens can I invest in?

You can explore over 2,000 Stock Tokens that are linked to US stocks and ETPs, including NVIDIA, Microsoft, Apple, Vanguard S&P 500, and more. Stock Tokens are derivative contracts between you and Robinhood that reflect the price of individual stocks and ETPs.

Can I trade Stock Tokens outside of market hours?

Yes. You can trade Stock Tokens from Monday 2 AM CET/CEST to Saturday 2 AM CET/CEST. You can also queue buy or sell orders outside of these hours and they will be placed when the market reopens. Trading during extended hours may carry additional risks such as reduced liquidity and wider spreads in the reference market.

Will I receive dividends from Stock Tokens?

If the underlying stock or ETP pays a dividend, Robinhood will pass on a corresponding amount to eligible holders of Stock Tokens in cash. However, this is not considered dividends in the usual sense, as you do not own the underlying stocks or ETPs. This amount will be credited by Robinhood to your account and may be treated differently for tax purposes compared to direct dividend income.