Perpetual futures are complex derivative products, and trading involves significant risk, particularly for perpetuals referencing potentially volatile crypto assets. Leveraged trading can amplify the speed of your losses and increase the chance of losing your initial investment. Carefully consider if this product is appropriate for you in light of your experience and risk tolerance. Restrictions and eligibility requirements apply.

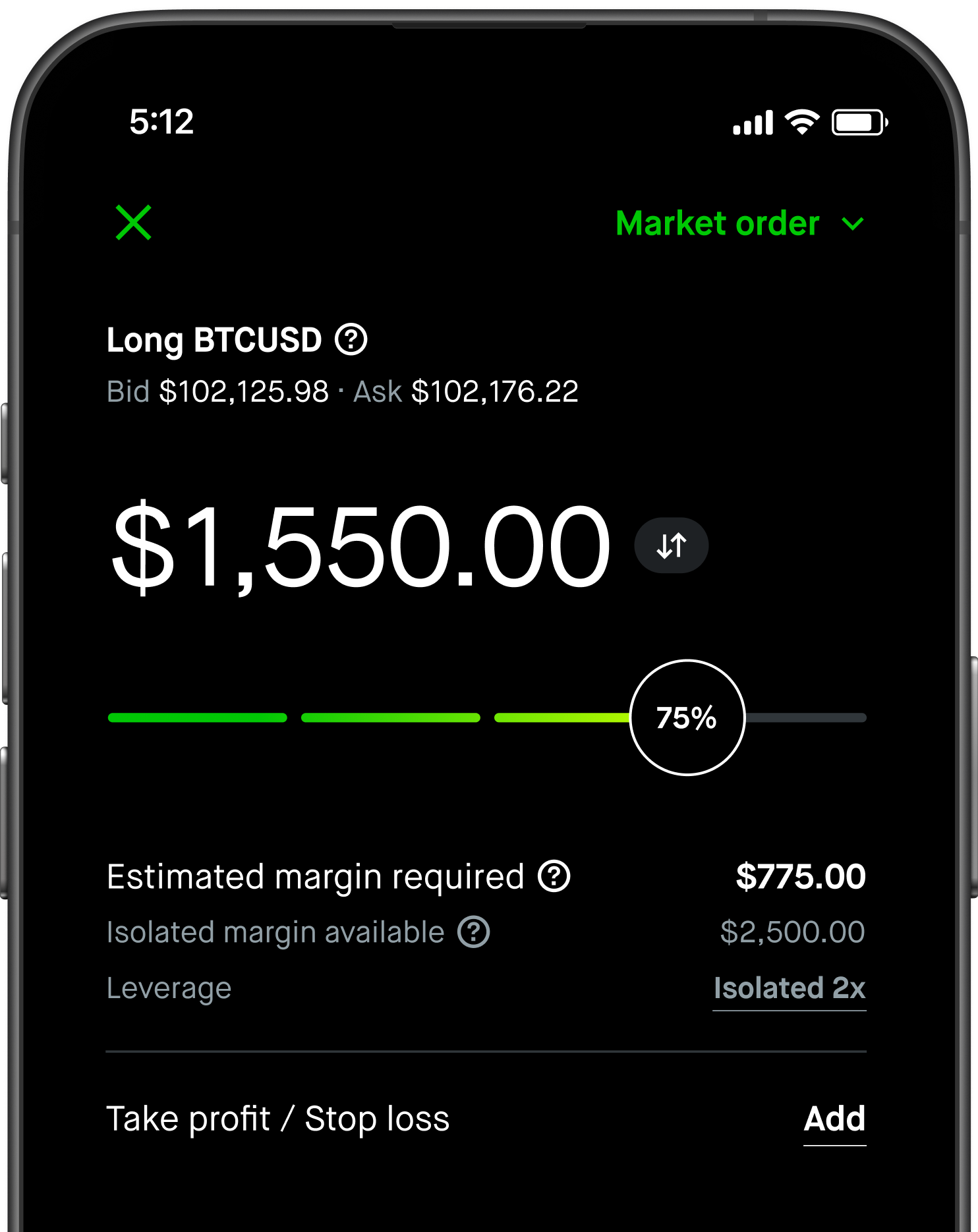

Trade with leverage

Manage risk as

markets move

Go long or short with ease

Curious about perpetual futures?

You’ve got questions.We got answers.

What are perpetual futures?

They’re derivatives that track underlying crypto prices with the option to use leverage—designed for traders who want flexibility to react quickly to the market, without owning the asset itself.

How do perpetual futures work?

Perpetuals track the price of crypto. If you think BTC’s price will fall, you don’t need to sell BTC. Instead, you can open a short BTCUSD perpetual position that tracks BTC’s price. If the price falls, your short position can gain value. But if the price rises, it can lose value. It’s important to continually monitor your position and adjust as needed.

What are the main benefits?

You can trade perpetual contracts based on crypto price movements without owning the asset, use leverage to open larger positions, and stay in the market as long as you have enough margin to support your positions, as perpetual contracts never expire.

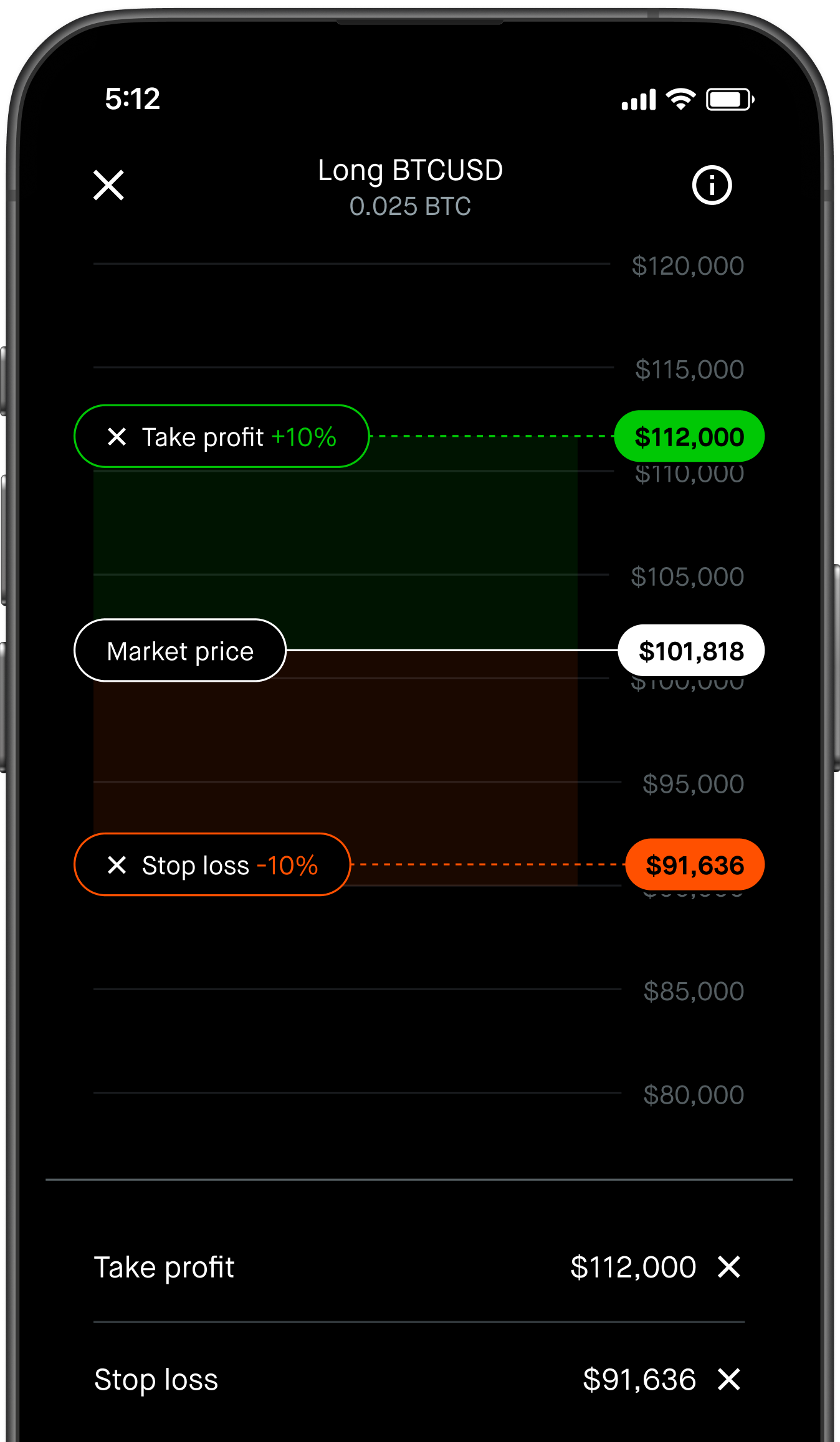

What are the risks involved?

Leverage can lead to larger profits, but it also increases the chance of losing your full investment if prices move against you. You can reduce risk of liquidation by keeping enough margin to support your position, and by using tools like stop loss orders and liquidation alerts—but it’s just as important to fully understand how perpetual futures work before getting started.