Carnival

Trade Carnival 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About CCL

Carnival Corp. engages in the operation of cruise ships. It operates through the following business segments: North America Cruise Operations, Europe Cruise Operations, Cruise Support, and Tour and Others.

CCL Key Statistics

Stock Snapshot

The current Carnival(CCL) stock price is $28.16, with a market capitalization of 38.92B. The stock trades at a price-to-earnings (P/E) ratio of 14.13 and offers a dividend yield of 52.6%.

On 2026-03-04, Carnival(CCL) stock moved within a range of $27.88 to $28.95. With shares now at $28.16, the stock is trading +1.0% above its intraday low and -2.7% below the session's peak.

Trading volume for Carnival(CCL) stock has reached 16.13M, versus its average volume of 21.66M.

The stock's 52-week range extends from a low of $15.07 to a high of $34.03.

The stock's 52-week range extends from a low of $15.07 to a high of $34.03.

CCL News

Carnival ( (GB:CCL) ) just unveiled an update. Carnival plc has confirmed that, as of 28 February 2026, it had 217,413,915 issued ordinary shares, of which 28,...

Carnival Corporation & (NYSE:CCL) reports material disruption from escalating conflict in the Middle East, including the closure of the Strait of Hormuz. The c...

Carnival Corp (NYSE:CCL) shares are extending the recent sell-off Tuesday afternoon, with shares trading lower again as investors stayed on edge over escalating...

Analyst ratings

75%

of 28 ratingsMore CCL News

Carnival Corp (NYSE:CCL) shares are trading lower Monday afternoon as traders punished cruise operators after coordinated U.S. and Israel strikes on Iran target...

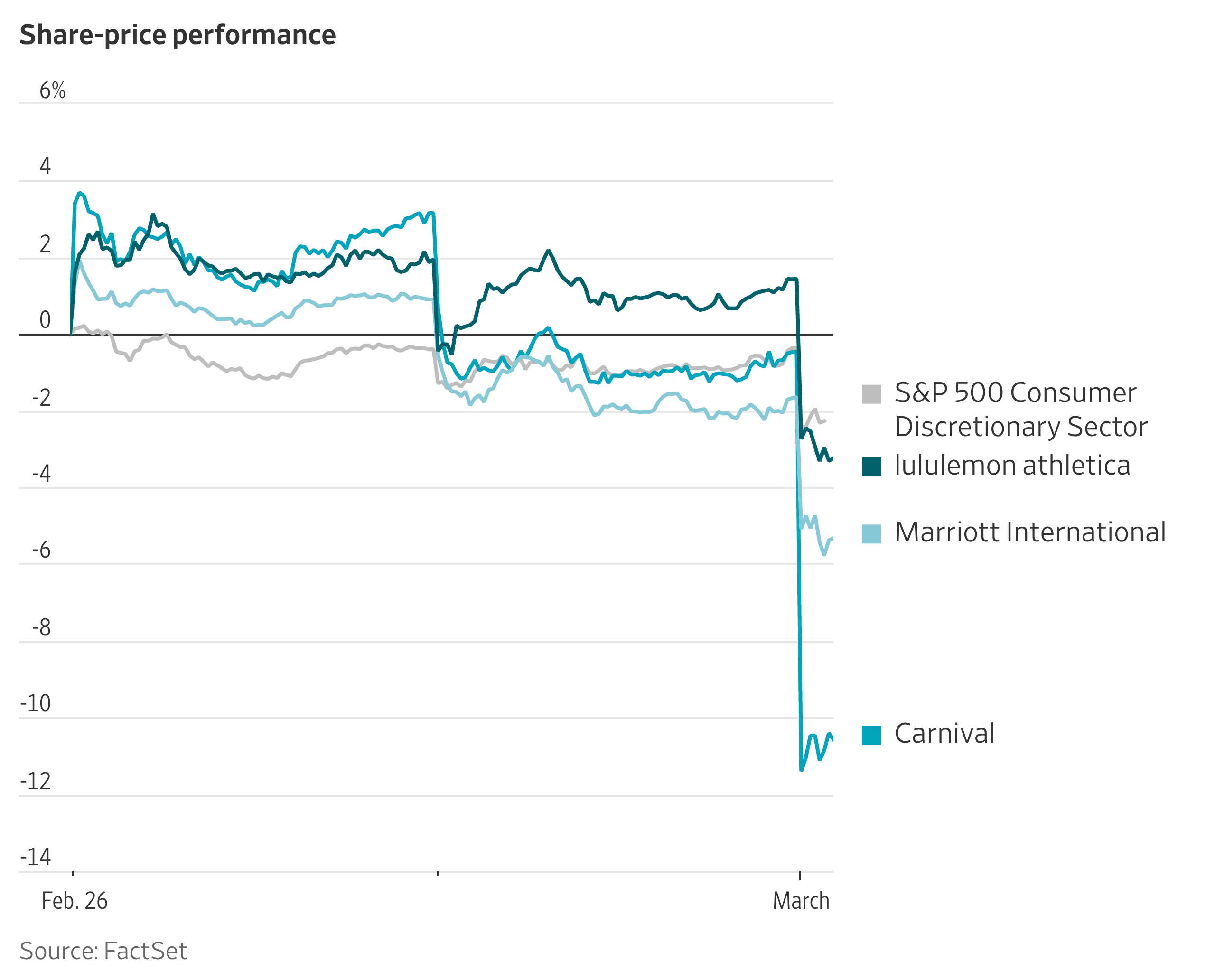

Shares of cruise company Carnival Corp, leggings maker lululemon athletica and hotel operator Marriott International were among the worst-performing members of...

Carnival Cruise Line, part of Carnival Corporation & (NYSE:CCL), has launched "Carnival Millions", described as the cruise industry's first fleetwide interactiv...

Key Points Halvorsen opened several positions across industries in the recent quarter. The following two -- a travel stock and a healthcare player -- trade fo...

Carnival Corporation recently rerouted multiple ships away from Puerto Vallarta and other affected Mexican areas following cartel-related violence and an expand...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.