Deckers Outdoor

Trade Deckers Outdoor 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About DECK

Deckers Outdoor Corp. engages in the business of designing, marketing, and distributing footwear, apparel, and accessories developed for both everyday casual lifestyle use and high performance activities. It operates through the following segments: UGG Brand, HOKA Brand, Teva Brand, Sanuk Brand, Other Brands, and Direct-to-Consumer.

DECK Key Statistics

Stock Snapshot

Deckers Outdoor(DECK) stock is priced at $103.76, giving the company a market capitalization of 15.12B. It carries a P/E multiple of 15.39.

As of 2026-01-11, Deckers Outdoor(DECK) stock has fluctuated between $102.17 and $108.40. The current price stands at $103.76, placing the stock +1.6% above today's low and -4.3% off the high.

The Deckers Outdoor(DECK)'s current trading volume is 2.39M, compared to an average daily volume of 2.55M.

In the last year, Deckers Outdoor(DECK) shares hit a 52-week high of $223.98 and a 52-week low of $78.91.

In the last year, Deckers Outdoor(DECK) shares hit a 52-week high of $223.98 and a 52-week low of $78.91.

DECK News

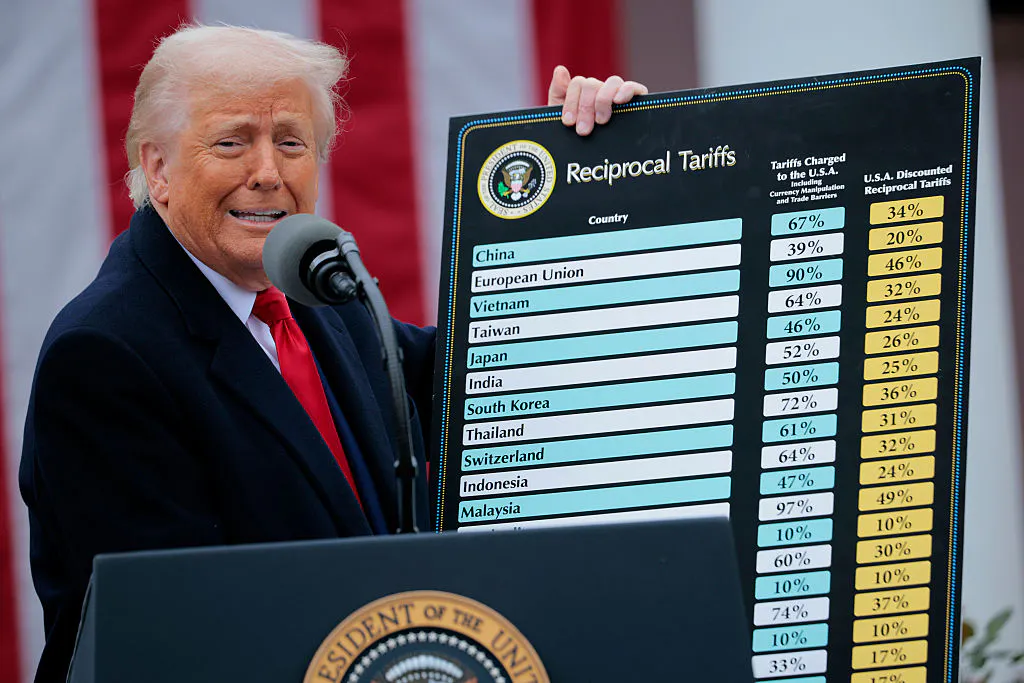

It looks like the stock market was expecting some tariff relief The S&P 500 briefly dipped into negative territory and tariff-sensitive stocks swung from big g...

Needham analyst Tom Nikic removed Deckers Outdoor (DECK) from the firm’s Conviction List while keeping a Buy rating on the shares with a $115 price target The f...

In recent days, Deckers Outdoor has faced several analyst downgrades, with concerns focused on moderating growth at its HOKA brand and the impact of increased d...

Analyst ratings

44%

of 27 ratingsMore DECK News

Key Points Deckers Outdoor, Trade Desk, and Fiserv all crashed in 2025 even as the S&P 500 did well overall. These businesses faced varying headwinds last yea...

Shares of Deckers Outdoor (NYSE: DECK) dropped on Thursday after an analyst downgraded their outlook for the stock. Coincidentally, the company released a produ...

Baird downgraded Deckers Outdoor (DECK) to Neutral from Outperform with an unchanged price target of $125. Claim 70% Off TipRanks Premium Published first on T...

Deckers Outdoor (DECK) has been quietly grinding higher, with the stock up about 7% over the past month and roughly 4% in the past 3 months as investors reasses...