General Dynamics

Trade General Dynamics 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About GD

General Dynamics Corp. is a global aerospace and defense company, which engages in design, engineering, and manufacturing to deliver solutions. It operates through the following business segments: Aerospace, Marine Systems, Combat Systems, and Technologies.

GD Key Statistics

Stock Snapshot

General Dynamics(GD) stock is priced at $365.03, giving the company a market capitalization of 98.3B. It carries a P/E multiple of 23.52 and pays a dividend yield of 1.7%.

On 2026-03-08, General Dynamics(GD) stock traded between a low of $354.52 and a high of $365.50. Shares are currently priced at $365.03, which is +3.0% above the low and -0.1% below the high.

The General Dynamics(GD)'s current trading volume is 1.16M, compared to an average daily volume of 1.23M.

In the last year, General Dynamics(GD) shares hit a 52-week high of $369.70 and a 52-week low of $239.20.

In the last year, General Dynamics(GD) shares hit a 52-week high of $369.70 and a 52-week low of $239.20.

GD News

Stocks fell hard on Friday as crude oil prices continued to skyrocketed amid the Iran conflict. Still, a number of names, including dividend plays, are showing...

If you are wondering whether General Dynamics at around US$363.49 is still offering value after a strong run, you are not alone. This article unpacks what the c...

In the past quarter, General Dynamics reported earnings per share of US$4.17, surpassing consensus estimates, with its Marine Systems division lifting revenue a...

Analyst ratings

52%

of 27 ratingsMore GD News

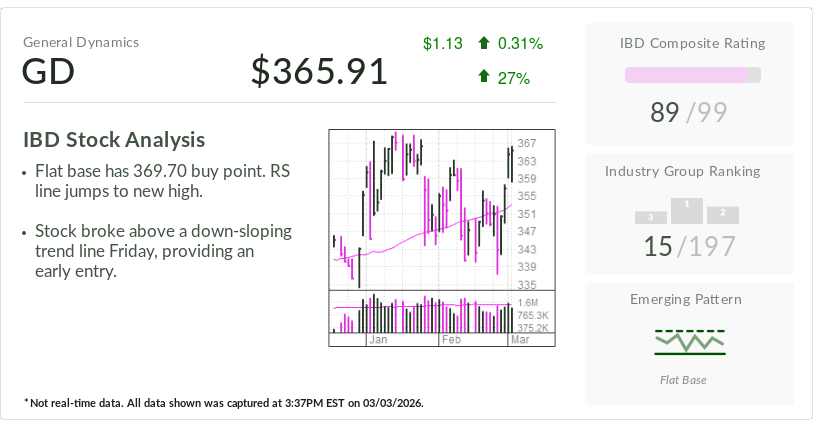

IBD Stock Of The Day General Dynamics, IBD's Stock Of The Day, Nears Entry On Improving Aerospace Outlook Licensing General Dynamics General Dynamics GD $ 365.9...

General Dynamics (GD) is back in the spotlight after reporting fourth quarter 2025 earnings per share of $4.17, which exceeded consensus expectations. The resul...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.