JPMorgan Chase & Co. Depositary Shares, each representing a 1/400th interest in a share of 5.75% No

Why Robinhood?

You can watch JPM-D and buy or sell other stocks, ETFs, and their options commission-free!About JPM-D

JPMorgan Chase & Co. is a financial holding company, which engages in the provision of financial and investment banking services. The firm offers a range of investment banking products and services in all capital markets, including advising on corporate strategy and structure, capital raising in equity and debt markets, risk management, market making in cash securities and derivative instruments, and brokerage and research.

JPM-D Key Statistics

JPM-D News

Elevate Your Investing Strategy: Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to...

Elevate Your Investing Strategy: Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to...

JPMorgan Chase (NYSE:JPM) aims to increase headcount at the banking giant's corporate banking unit in the Asia Pacific region by 20% in 2026, Reuters reported,...

More JPM-D News

Ten Senate Democrats are calling for a congressional hearing over JPMorgan’s (JPM) decision to maintain Jefferey Epstein as a banking client for roughly 15 year...

JPMorgan Chase (NYSE:JPM) is planning a new office building in Canary Wharf, London, which could be the banking giant's biggest in the region, insiders told Blo...

U.S. share buybacks could increase by $600 billion over the coming years, according to strategists at JPMorgan Chase & Co. According to JPMorgan, global corpor...

JPMorgan (JPM) has appointed Foster + Partners to draw up designs for a plot of land in London’s Canary Wharf district that the bank has owned for almost two de...

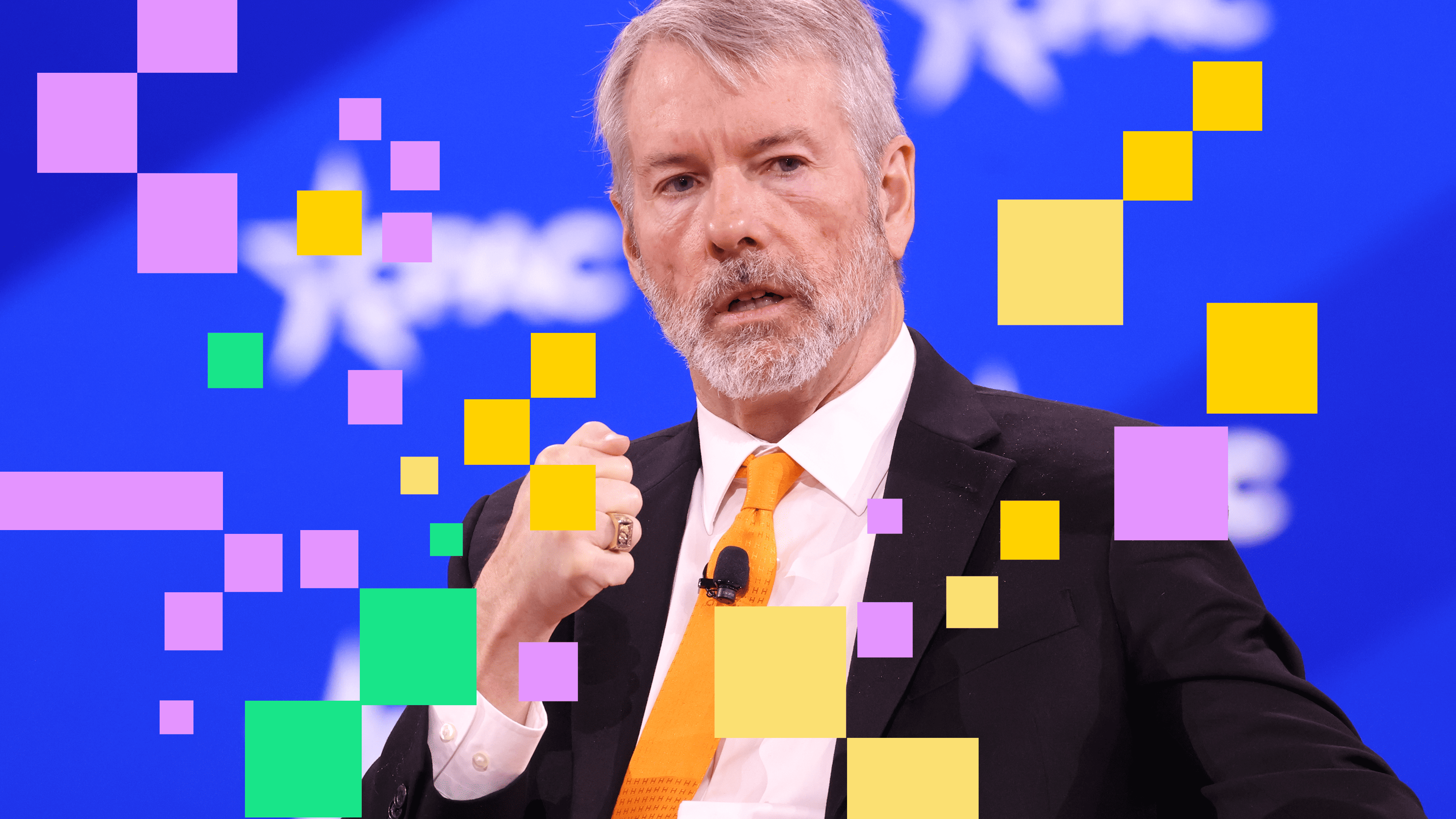

Strategy’s (MSTR) bid to join the S&P 500 index was rejected, despite meeting technical eligibility criteria, in what JPMorgan (JPM) calls a sign of growing cau...

Shares in U.S. banking giant JP Morgan Chase (JPM) edged higher today as it ramped up its expansion plans in Asia off the back of surging Chinese growth. Elevat...

JPMorgan (JPM) is accelerating hiring across its business in the Asia Pacific region, with the goal of increasing its headcount by 20% next year, Yantoultra Ngu...