Monolithic Power Systems

Trade Monolithic Power Systems 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About MPWR

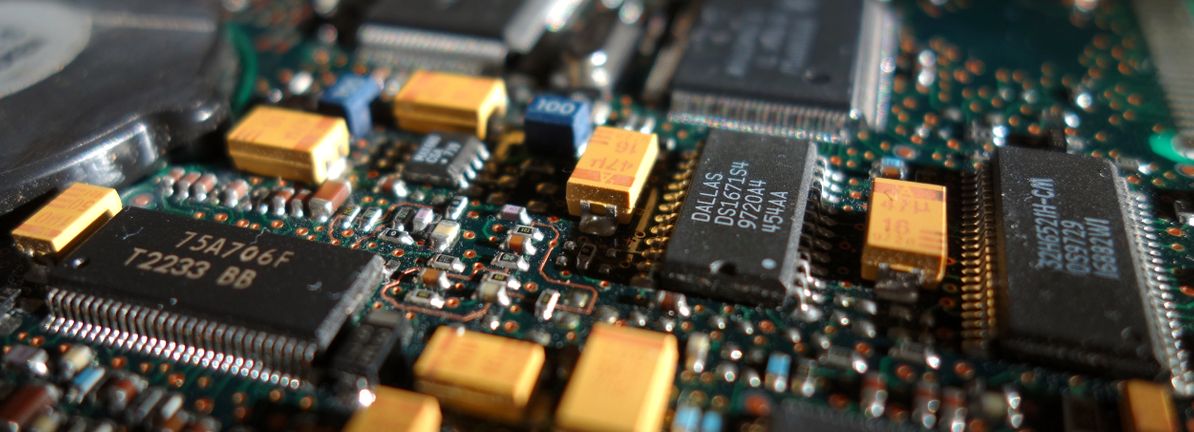

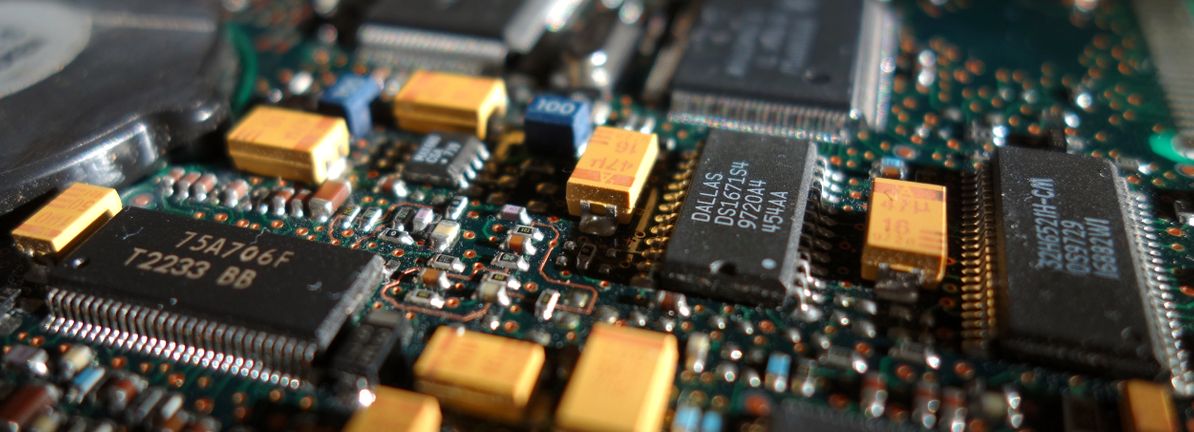

Monolithic Power Systems, Inc. designs, develops, and markets integrated power semiconductor solutions and power delivery architectures for computing and storage, automotive, industrial, communications, and consumer applications markets. It offers direct current (DC) to DC integrated circuits (ICs) that are used to convert and control voltages of various electronic systems, such as portable electronic devices, wireless LAN access points, computers and notebooks, monitors, infotainment applications, and medical equipment.

MPWR Key Statistics

Stock Snapshot

The current Monolithic Power Systems(MPWR) stock price is $1,034.49, with a market capitalization of 49.56B. The stock trades at a price-to-earnings (P/E) ratio of 26.38 and offers a dividend yield of 60.4%.

On 2026-01-20, Monolithic Power Systems(MPWR) stock moved within a range of $1,007.00 to $1,055.00. With shares now at $1,034.49, the stock is trading +2.7% above its intraday low and -1.9% below the session's peak.

Trading volume for Monolithic Power Systems(MPWR) stock has reached 661.87K, versus its average volume of 523.13K.

Over the past 52 weeks, Monolithic Power Systems(MPWR) stock has traded between a high of $1,123.38 and a low of $438.86.

Over the past 52 weeks, Monolithic Power Systems(MPWR) stock has traded between a high of $1,123.38 and a low of $438.86.

MPWR News

Monolithic Power Systems (MPWR) has moved into the spotlight after Wells Fargo shifted its rating on the power chip designer from Equal Weight to Overweight, ci...

Recently, Wells Fargo upgraded Monolithic Power Systems to an Overweight rating, citing an improving outlook for the semiconductor sector and potential customer...

As previously reported, Wells Fargo analyst Joe Quatrochi upgraded Monolithic Power (MPWR) to Overweight from Equal Weight with a price target of $1,125, up fro...

Analyst ratings

79%

of 19 ratingsMore MPWR News

Wells Fargo upgraded Monolithic Power (MPWR) to Overweight from Equal Weight with a $1,125 price target Published first on TheFly – the ultimate source for rea...