Motorola Solutions

1D

1W

1M

3M

YTD

1Y

5Y

ALL

Why Robinhood?

Robinhood gives you the tools you need to put your money in motion. You can buy or sell MSI and other ETFs, options, and stocks.About MSI

Motorola Solutions, Inc. engages in the provision of communication infrastructure, devices, accessories, software, and services. It operates through the following segments: Products and Systems Integration, and Software and Services.

CEOGregory Q. Brown

CEOGregory Q. Brown

Employees21,000

Employees21,000

HeadquartersChicago, Illinois

HeadquartersChicago, Illinois

Founded1928

Founded1928

Employees21,000

Employees21,000

MSI Key Statistics

Market cap55.99B

Market cap55.99B

Price-Earnings ratio33.84

Price-Earnings ratio33.84

Dividend yield1.11%

Dividend yield1.11%

Average volume954.14K

Average volume954.14K

High today—

High today—

Low today—

Low today—

Open price$335.79

Open price$335.79

Volume0.00

Volume0.00

52 Week high$355.39

52 Week high$355.39

52 Week low$269.65

52 Week low$269.65

MSI News

Reuters 2h

Q1 2024 Motorola Solutions Inc Earnings CallParticipants Gregory Q. Brown; Chairman & CEO; Motorola Solutions, Inc. Jason J. Winkler; Executive VP & CFO; Motorola Solutions, Inc. John P. Molloy; Execut...

Yahoo Finance 16h

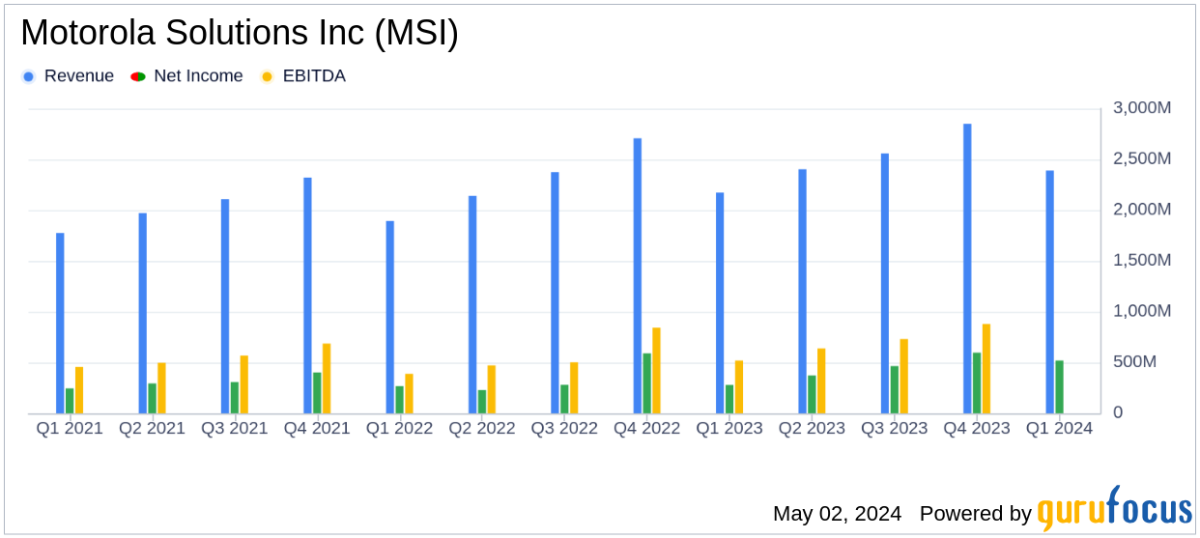

Motorola Solutions Inc. Q1 2024 Earnings: Surpasses Revenue Estimates and Raises ... - Yahoo FinanceRevenue: $2.4 billion, up 10% from the previous year, surpassing the estimate of $2.345 billion. Net Income: Reported a loss of $39 million, significantly belo...

Yahoo Finance 17h

Motorola Solutions Reports First-Quarter 2024 Financial Results - Yahoo FinanceCompany raises full-year revenue and earnings outlook following strong Q1 results Sales of $2.4 billion, up 10% versus a year ago Products and Systems Integrat...

Analyst ratings

67%

of 15 ratingsBuy

66.7%

Hold

33.3%

Sell

0%

More MSI News

Simply Wall St 23h

Motorola Solutions Insiders Sell US$18m Of Stock, Possibly Signalling CautionOver the past year, many Motorola Solutions, Inc. (NYSE:MSI) insiders sold a significant stake in the company which may have piqued investors' interest. When an...