Occidental Petroleum

Trade Occidental Petroleum 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About OXY

Occidental Petroleum Corp. engages in the exploration and production of oil and natural gas. It operates through the following segments: Oil and Gas, Chemical, and Midstream and Marketing.

OXY Key Statistics

Stock Snapshot

With a market cap of 54.27B, Occidental Petroleum(OXY) trades at $52.75. The stock has a price-to-earnings ratio of 33.62 and currently yields dividends of 1.8%.

On 2026-03-09, Occidental Petroleum(OXY) stock traded between a low of $52.20 and a high of $57.03. Shares are currently priced at $52.75, which is +1.1% above the low and -7.5% below the high.

The Occidental Petroleum(OXY)'s current trading volume is 33.14M, compared to an average daily volume of 19.58M.

In the last year, Occidental Petroleum(OXY) shares hit a 52-week high of $57.03 and a 52-week low of $34.79.

In the last year, Occidental Petroleum(OXY) shares hit a 52-week high of $57.03 and a 52-week low of $34.79.

OXY News

Occidental Petroleum ( (OXY) ) has provided an announcement. On March 5, 2026, Occidental announced early results of cash tender offers for multiple series of...

Unusual total active option classes on open include: Range Resources (RRC), Kraft Heinz (KHC), Cameco (CCJ), Teck Resources (TECK), Direxion Daily Small Cap Bea...

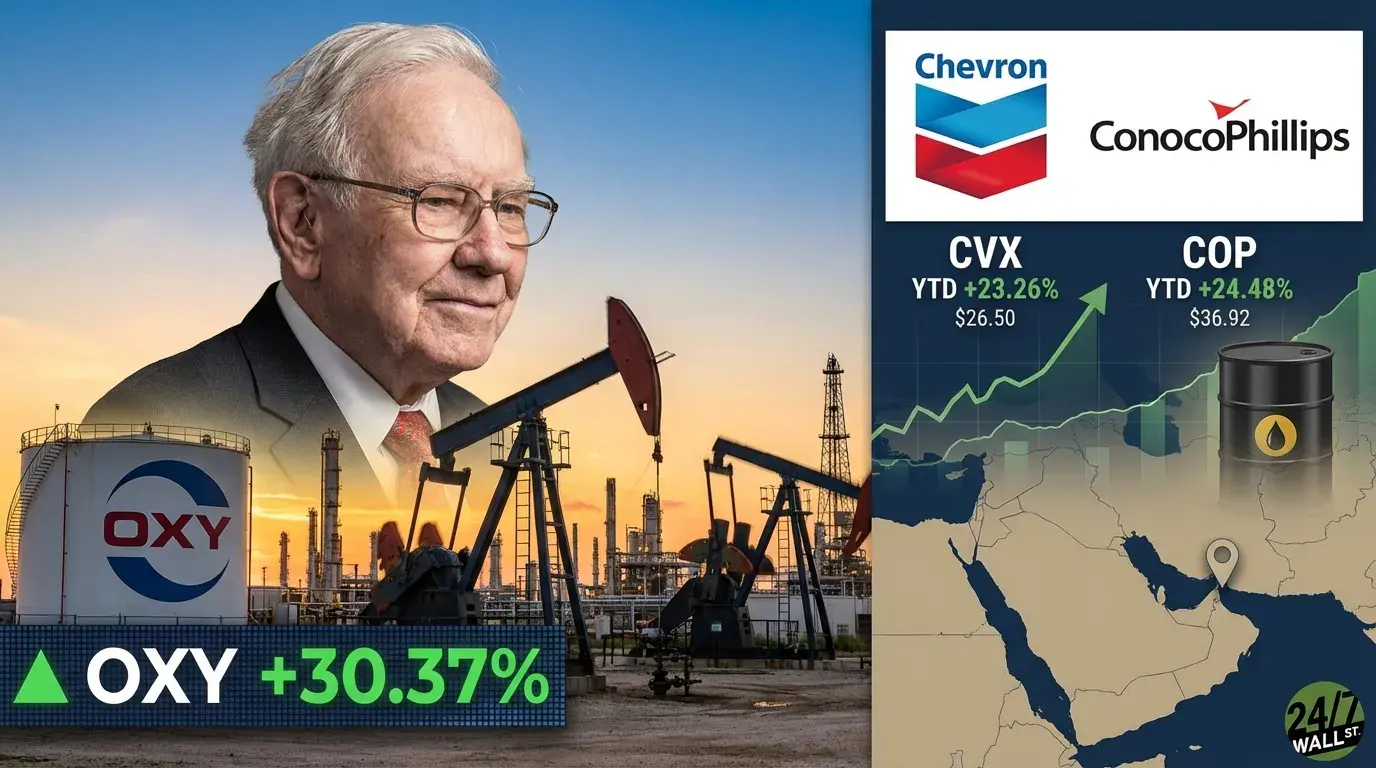

Warren Buffett’s Oil Bet Looks Genius, Here Is What to Buy Next Quick Read Occidental Petroleum (OXY) rose 30.37% year-to-date and slashed debt by $5.8B after...

Analyst ratings

58%

of 31 ratingsMore OXY News

Occidental Petroleum (NYSE:OXY) expanded its cash tender offer for outstanding debt from US$700 million to US$1.2b. The company made the change after strong in...

We Asked a Year Ago If You Should Buy Buffett’s Favorite Oil Stock. Here’s What Happened. Quick Read Occidental Petroleum (OXY) rose 18.07% to $53.68, beat Q3...

Option traders moderately bearish in Occidental Petroleum (OXY), with shares down 59c near $53.62. Options volume running well above average with 109k contracts...

In February 2026, Occidental Petroleum launched cash tender offers to buy back multiple series of senior notes and debentures, alongside consent solicitations,...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.