Powell Industries

Trade Powell Industries 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About POWL

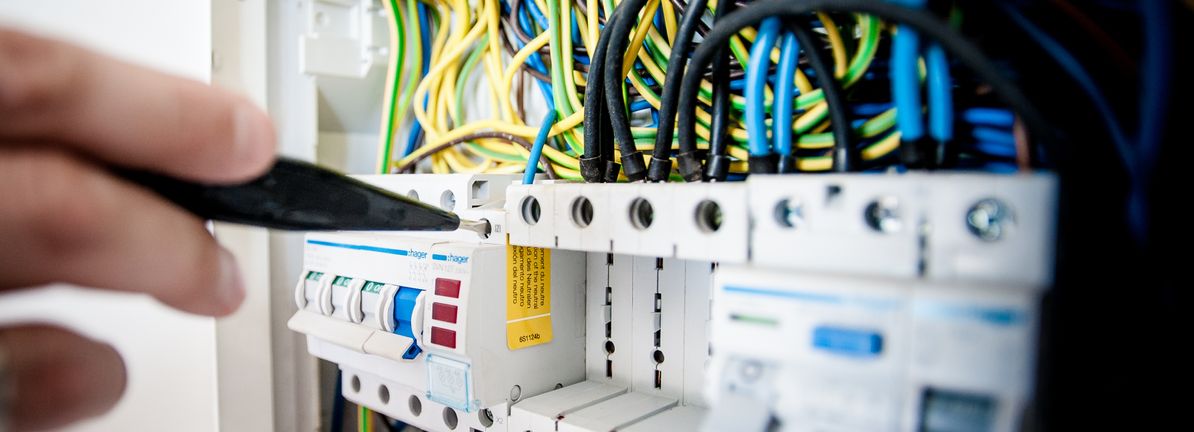

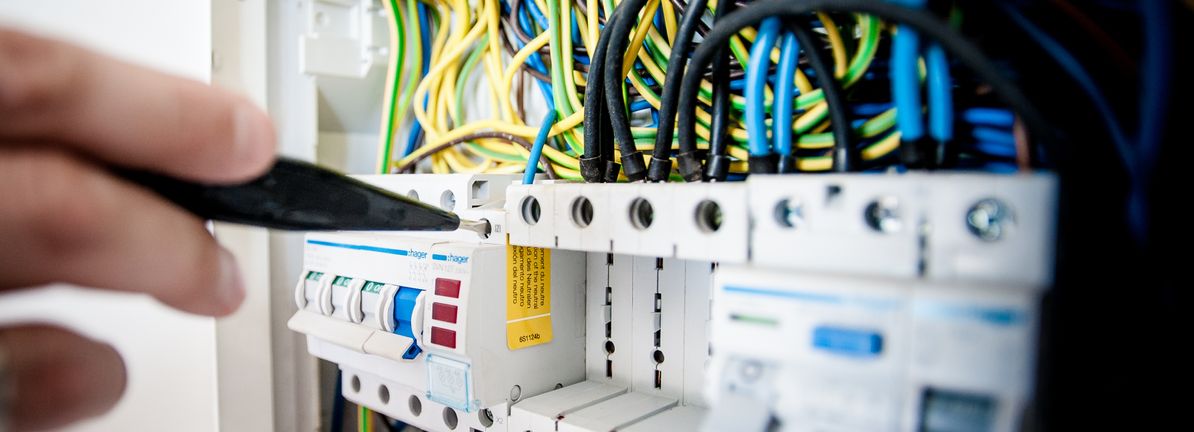

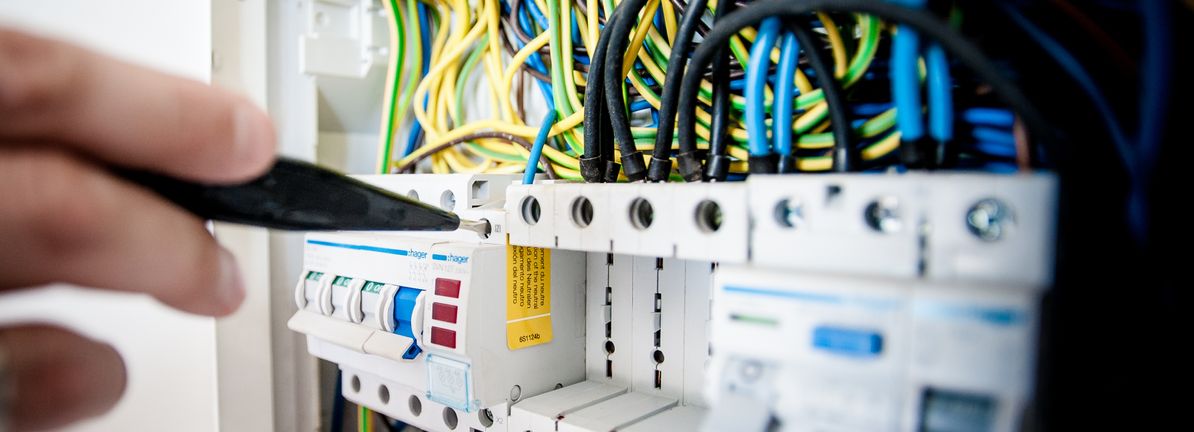

Powell Industries, Inc. engages in the development, design, manufacturing, and provision of services for custom-engineered products and systems. Its products include integrated power control room substation, electrical houses, traditional and arc-resistant distribution switch gear and control gear, medium-voltage circuit breakers, monitoring and control communications systems, motor control centers, and bus duct systems.

POWL Key Statistics

Stock Snapshot

The current Powell Industries(POWL) stock price is $523.60, with a market capitalization of 6.36B. The stock trades at a price-to-earnings (P/E) ratio of 34.49 and offers a dividend yield of 20.2%.

On 2026-02-27, Powell Industries(POWL) stock moved within a range of $504.99 to $529.99. With shares now at $523.60, the stock is trading +3.7% above its intraday low and -1.2% below the session's peak.

Trading activity shows a volume of 184.37K, compared to an average daily volume of 222.93K.

The stock's 52-week range extends from a low of $146.02 to a high of $612.50.

The stock's 52-week range extends from a low of $146.02 to a high of $612.50.

POWL News

New insider activity at Powell Industries ( (POWL) ) has taken place on February 26, 2026. Significant shareholder Thomas W. Powell has reduced his stake in Po...

If you are wondering whether Powell Industries' current share price reflects its underlying worth, you are not alone. This article is built to help you interpre...

Advertisement Powell Industries overview Powell Industries (POWL) has drawn investor attention after sizable share price moves, with the stock showing a negat...

More POWL News

Investors considering a purchase of Powell Industries, Inc. (Symbol: POWL) shares, but tentative about paying the going market price of $540.00/share, might ben...

In recent years, Powell Industries has evolved from a small Houston manufacturer into a global provider of electrical systems, supported by strong demand eviden...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.