Invesco QQQ

Why Robinhood?

Robinhood gives you the tools you need to put your money in motion. You can buy or sell Invesco QQQ and other ETFs, options, and stocks.About QQQ

QQQ tracks a modified-market-cap-weighted index of 100 NASDAQ-listed stocks. The listed name for QQQ is Invesco QQQ Trust, Series 1.

What's in this fund

Sectors

As of January 12, 2026Top 10 Holdings (48.72% of total assets)

As of January 12, 2026QQQ Key Statistics

Stock Snapshot

As of today, Invesco QQQ(QQQ) shares are valued at $619.03. The company's market cap stands at 407.36B, with a P/E ratio of 36.59 and a dividend yield of 60.6%.

During the trading session on 2026-01-14, Invesco QQQ(QQQ) shares reached a daily high of $625.77 and a low of $614.56. At a current price of $619.03, the stock is +0.7% higher than the low and still -1.1% under the high.

Trading activity shows a volume of 71.92M, compared to an average daily volume of 45.07M.

The stock's 52-week range extends from a low of $402.39 to a high of $637.01.

The stock's 52-week range extends from a low of $402.39 to a high of $637.01.

QQQ News

The Invesco QQQ Trust ETF (QQQ), which tracks the performance of the Nasdaq 100 Index (NDX), fell 0.15% on Tuesday as investors digested key earnings. Notably,...

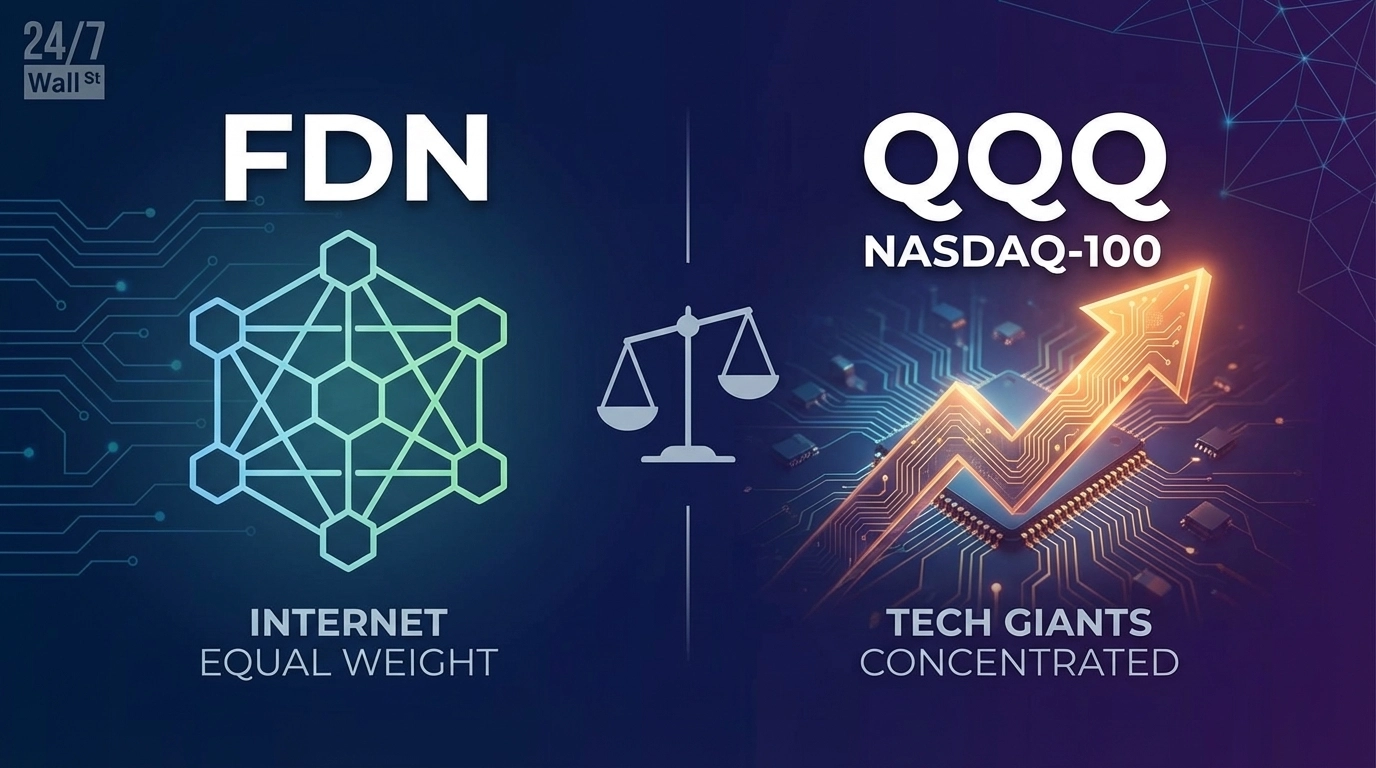

FDN returned 8% over the past year versus QQQ’s 18%. Over five years QQQ gained 97% while FDN gained just 27%. This post may contain links from our sponsors an...

The S&P 500 has generated a total return of 253% in the past decade. That's a fantastic gain for a passive investment vehicle that provides access to a large gr...