Teradyne

Trade Teradyne 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About TER

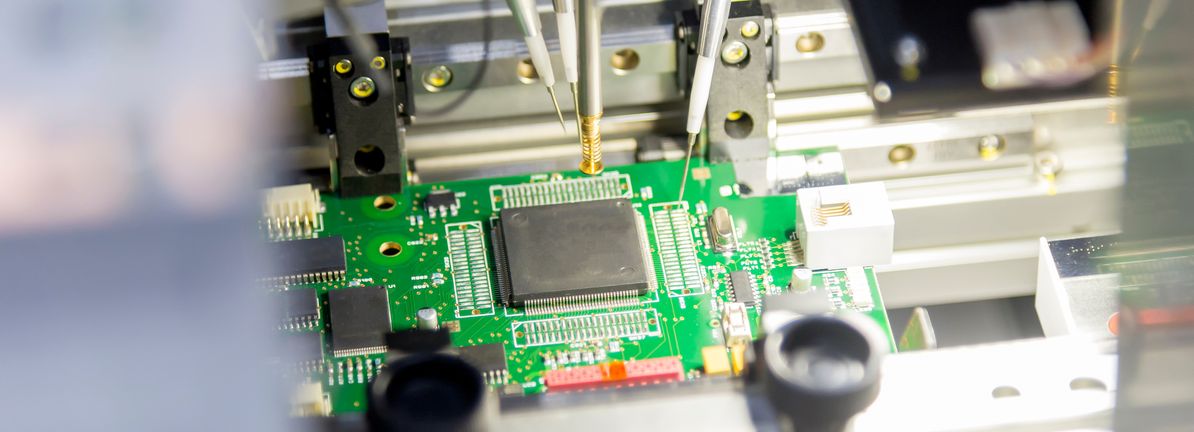

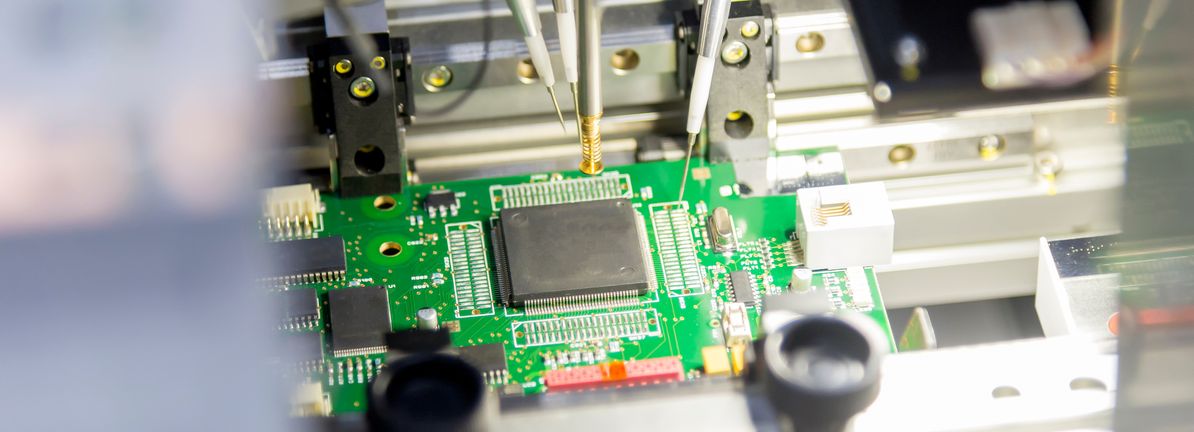

Teradyne, Inc. engages in the development and sale of automatic test systems. It operates through the following business segments: Semiconductor Test, Robotics, and All Other.

TER Key Statistics

Stock Snapshot

As of today, Teradyne(TER) shares are valued at $226.62. The company's market cap stands at 35.49B, with a P/E ratio of 81.66 and a dividend yield of 21.4%.

On 2026-01-14, Teradyne(TER) stock moved within a range of $225.69 to $231.13. With shares now at $226.62, the stock is trading +0.4% above its intraday low and -2.0% below the session's peak.

Trading activity shows a volume of 676.87K, compared to an average daily volume of 2.7M.

The stock's 52-week range extends from a low of $65.77 to a high of $231.13.

The stock's 52-week range extends from a low of $65.77 to a high of $231.13.

TER News

Teradyne recently reported third-quarter fiscal 2025 results with revenue and non-GAAP earnings per share near the upper end of its guidance, while issuing stro...

Susquehanna raised the firm’s price target on Teradyne (TER) to $275 from $215 and keeps a Positive rating on the shares. Recent channel checks checks suggest t...

Vertical Research analyst Robert Jamieson downgraded Teradyne (TER) to Hold from Buy with a price target of $220, up from $200. Claim 70% Off TipRanks Premium...

Analyst ratings

65%

of 20 ratingsMore TER News

Advertisement AI demand reshapes Teradyne’s business mix Recent commentary points to a structural shift at Teradyne (TER). Rising AI chip complexity and a Com...

The latest trading session saw Teradyne (TER) ending at $137.15, denoting a -1.2% adjustment from its last day's close. The stock trailed the S&P 500, which reg...

Key Points Focusing on high-quality cash-generating companies always makes sense. There might be a need for some higher AI-related valuations to come down, bu...