Urban Outfitters

Why Robinhood?

Robinhood gives you the tools you need to put your money in motion. You can buy or sell URBN and other ETFs, options, and stocks.About URBN

Urban Outfitters, Inc. engages in the operation of a general consumer product retail and wholesale business selling to customers through various channels including retail locations, websites, catalogs, and mobile applications. It operates through the following segments: Retail, Wholesale and Subscription.

URBN Key Statistics

Stock Snapshot

The current Urban Outfitters(URBN) stock price is $71.82, with a market capitalization of 6.44B. The stock trades at a price-to-earnings (P/E) ratio of 13.52.

On 2026-01-14, Urban Outfitters(URBN) stock traded between a low of $70.71 and a high of $74.44. Shares are currently priced at $71.82, which is +1.6% above the low and -3.5% below the high.

Urban Outfitters(URBN) shares are trading with a volume of 684.97K, against a daily average of 2.13M.

In the last year, Urban Outfitters(URBN) shares hit a 52-week high of $84.35 and a 52-week low of $41.89.

In the last year, Urban Outfitters(URBN) shares hit a 52-week high of $84.35 and a 52-week low of $41.89.

URBN News

Urban Outfitters, the Consumer Cyclical sector company, was revisited by a Wall Street analyst yesterday. Analyst Paul Lejuez from Citi maintained a Hold rating...

Bank of America Securities analyst Lorraine Hutchinson reiterated a Buy rating on Urban Outfitters yesterday and set a price target of $93.00. Claim 70% Off Tip...

This top retailer had one of the best-performing years in 2025, and the company's top two insiders are capitalizing on the stock's strong performance. Margaret...

Analyst ratings

56%

of 16 ratingsMore URBN News

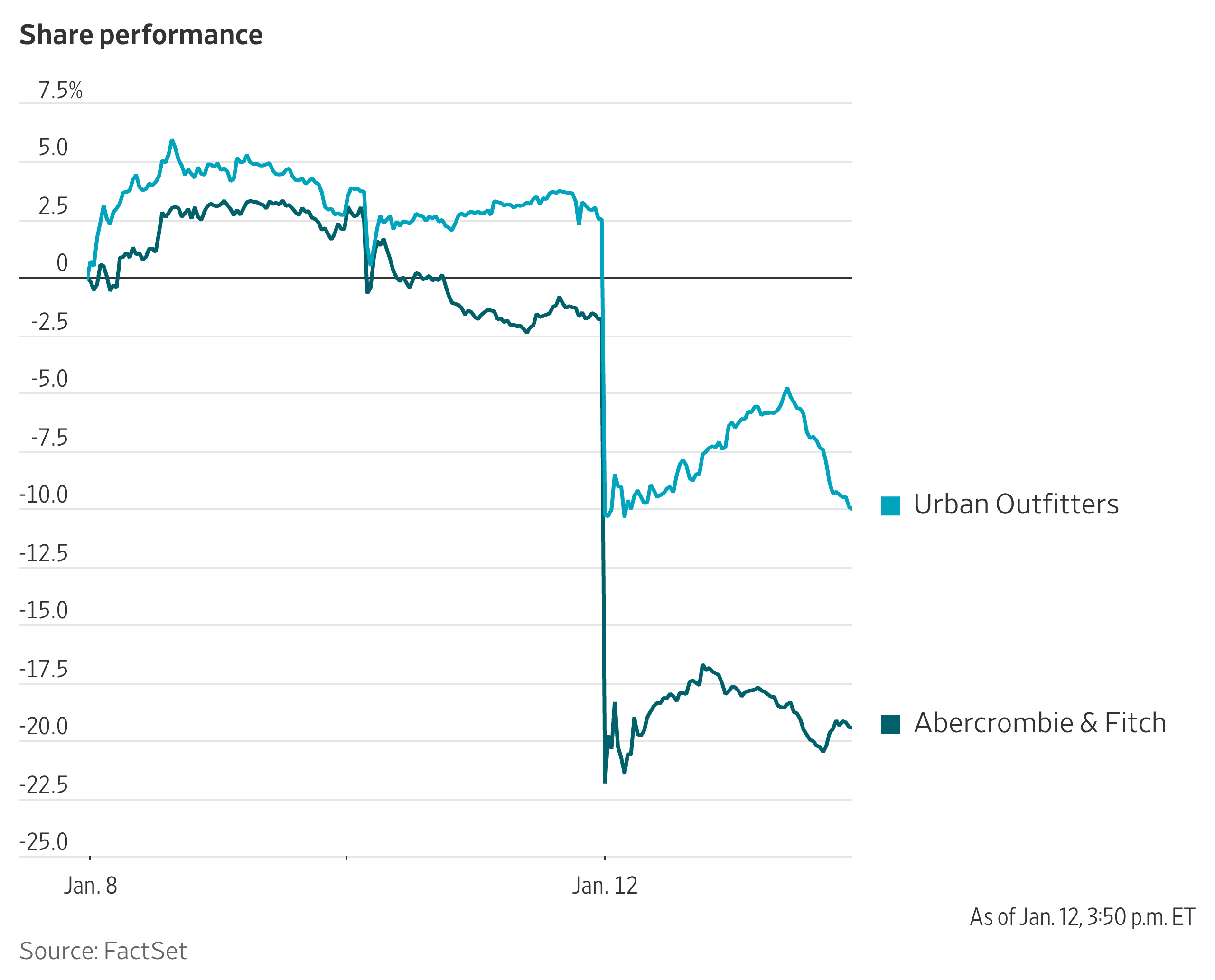

Urban Outfitters said it notched record holiday sales while Abercrombie said that both its Hollister and namesake brands did well in December. But investors rem...

This specialty retailer behind brands like Anthropologie and Free People reported a notable insider sale amid ongoing portfolio shifts. Margaret Hayne, Co-Pres...

Key Points Urban Outfitters appears to have missed sales estimates for the holiday season. Earnings are due out soon, and the stock could be heading for a "mi...

(RTTNews) - Urban Outfitters (URBN) announced net sales for the two and eleven months ended December 31, 2025. Total company net sales for the two months ended...

Urban Outfitters (URBN) announced net sales for the two and eleven months ended December 31, 2025. Total Company net sales for the two months ended December 31,...

Urban Outfitters (URBN) is drawing fresh attention after reporting record third quarter net sales, improved gross margins, and disciplined inventory management....

Key Points Margaret Hayne indirectly sold 18,666 shares of Urban Outfitters for about $1.5 million on Wednesday and Thursday. All shares were sold via indirec...