Xerox

Why Robinhood?

Robinhood gives you the tools you need to put your money in motion. You can buy or sell Xerox and other ETFs, options, and stocks.About XRX

Xerox Holdings Corp. is a workplace technology company, which builds and integrates software and hardware for enterprises. It operates through the Print and Other, and Financing (FITTLE) segments.

XRX Key Statistics

Stock Snapshot

With a market cap of 239.19M, Xerox(XRX) trades at $1.88. The stock has a price-to-earnings ratio of -0.23 and currently yields dividends of 10.8%.

As of 2026-02-20, Xerox(XRX) stock has fluctuated between $1.81 and $1.94. The current price stands at $1.88, placing the stock +3.8% above today's low and -3.1% off the high.

The Xerox(XRX)'s current trading volume is 3.74M, compared to an average daily volume of 3.58M.

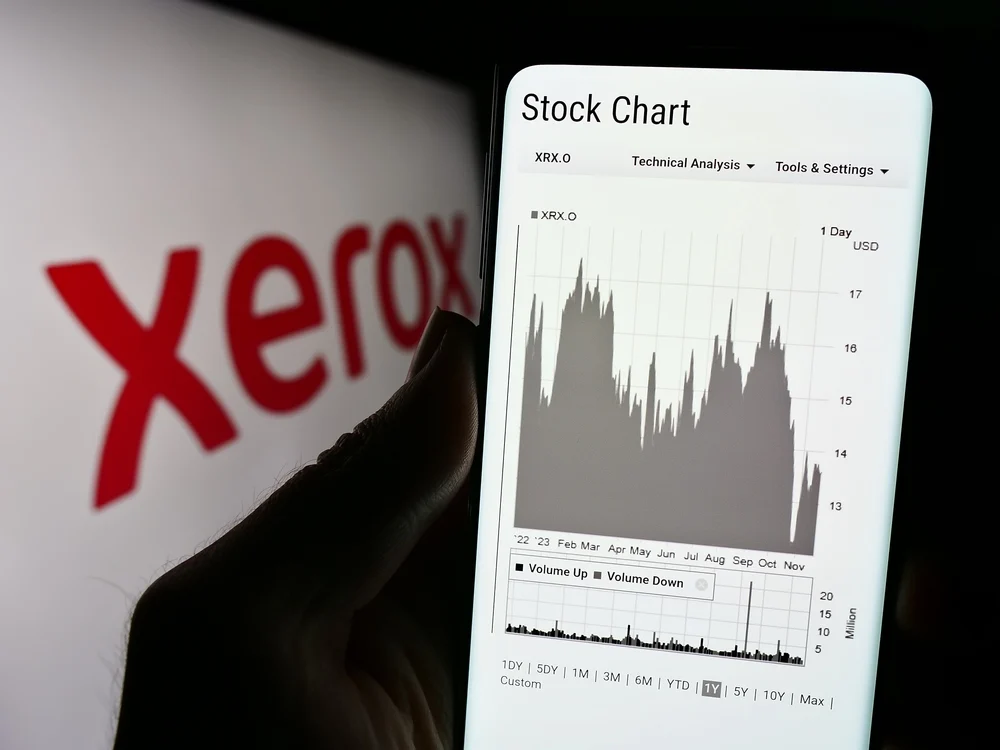

During the past year, Xerox(XRX) stock moved between $1.81 at its lowest and $8.12 at its peak.

During the past year, Xerox(XRX) stock moved between $1.81 at its lowest and $8.12 at its peak.

XRX News

Xerox Holdings Corporation (NASDAQ:XRX) stock rose Tuesday after the company announced the formation of a new joint venture with TPG Inc. (NASDAQ:TPG) to streng...

Xerox (XRX) announced the formation and capitalization of a new joint venture between Xerox and TPG. The joint venture is structured as an intellectual property...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.