Alcoa

Trade Alcoa 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About AA

Alcoa Corp. engages in the bauxite mining, alumina refining, and aluminum smelting and casting. It operates through the Alumina and Aluminum segments.

AA Key Statistics

Stock Snapshot

The current Alcoa(AA) stock price is $66.94, with a market capitalization of 16.84B. The stock trades at a price-to-earnings (P/E) ratio of 14.40 and offers a dividend yield of 62.7%.

During the trading session on 2026-03-04, Alcoa(AA) shares reached a daily high of $67.00 and a low of $63.54. At a current price of $66.94, the stock is +5.3% higher than the low and still -0.1% under the high.

Trading volume for Alcoa(AA) stock has reached 170.67K, versus its average volume of 6.25M.

The stock's 52-week range extends from a low of $21.53 to a high of $67.00.

The stock's 52-week range extends from a low of $21.53 to a high of $67.00.

AA News

Stocks Near A Buy Zone Dow Jones Restaurant Giant McDonald's, Alcoa In Or Near Buy Zones Amid Stock Market Sell-Off Licensing As the Dow Jones Industrial Averag...

Alcoa Corporation (AA) has disclosed a new risk, in the Debt & Financing category. Alcoa Corporation’s exposure to Ma’aden shares, classified as marketable sec...

Alcoa (AA) is back in focus after its board declared a quarterly cash dividend of $0.10 per share, payable on March 26, 2026, reinforcing the company’s current...

Analyst ratings

41%

of 17 ratingsMore AA News

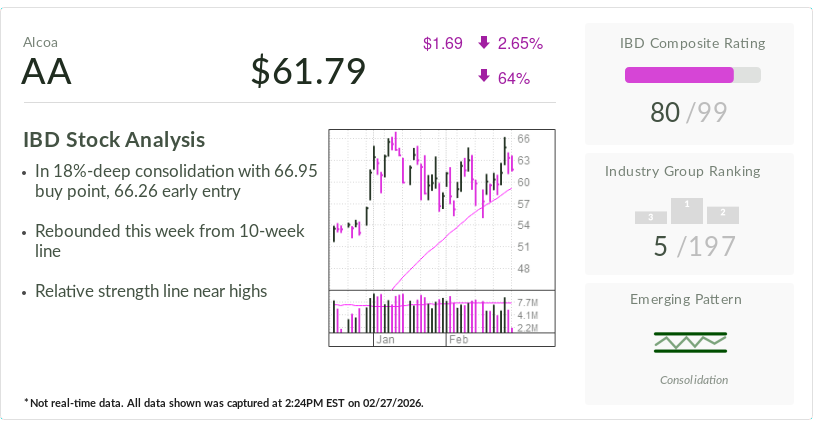

IBD Stock Of The Day Trump Tariff Winner Alcoa, Stock Of The Day, Near Buy Point Licensing Alcoa Alcoa AA $ 61.79 $1.69 2.65% 64% IBD Stock Analysis In 18%-deep...

Technical Analysis Metals & Mining Stocks Poised to Rally With Hecla Mining, Alcoa Emerging as Favorites In this article XME HL AA A tanker unloading at Alcoa's...

Alcoa has recently attracted attention as technical analysts highlight upward momentum and a potential breakout pattern, while short interest in the stock has e...

BofA analyst Lawson Winder raised the firm’s price target on Alcoa (AA) to $42 from $38 and keeps an Underperform rating on the shares. The firm is updating its...

Investors may be wondering whether Alcoa at around US$61.41 a share is offering good value today, or if the easy gains are already behind it. The stock has ret...

Investors in Alcoa Corporation (Symbol: AA) saw new options become available today, for the March 2027 expiration. One of the key data points that goes into the...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.