ConocoPhillips

Trade ConocoPhillips 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About COP

ConocoPhillips is an exploration and production company, which engages in the exploration, production, transport, and marketing of crude oil, bitumen, and natural gas. It operates through the following geographical segments: Alaska, Lower 48, Canada, Europe, Middle East, and North Africa, Asia Pacific, and Other International.

COP Key Statistics

Stock Snapshot

ConocoPhillips(COP) stock is priced at $116.15, giving the company a market capitalization of 143.06B. It carries a P/E multiple of 18.43 and pays a dividend yield of 2.8%.

During the trading session on 2026-03-09, ConocoPhillips(COP) shares reached a daily high of $121.55 and a low of $116.14. At a current price of $116.15, the stock is +0.0% higher than the low and still -4.4% under the high.

Trading activity shows a volume of 13.68M, compared to an average daily volume of 10.18M.

Over the past 52 weeks, ConocoPhillips(COP) stock has traded between a high of $122.50 and a low of $79.88.

Over the past 52 weeks, ConocoPhillips(COP) stock has traded between a high of $122.50 and a low of $79.88.

COP News

Key Points Oil prices have spiked further since the war began. Oil stocks haven't continued their pre-war rally. Oil prices could rise or fall, depending on...

In recent days, ConocoPhillips has benefited from higher oil prices linked to renewed conflict involving Iran, alongside upbeat analyst commentary highlighting...

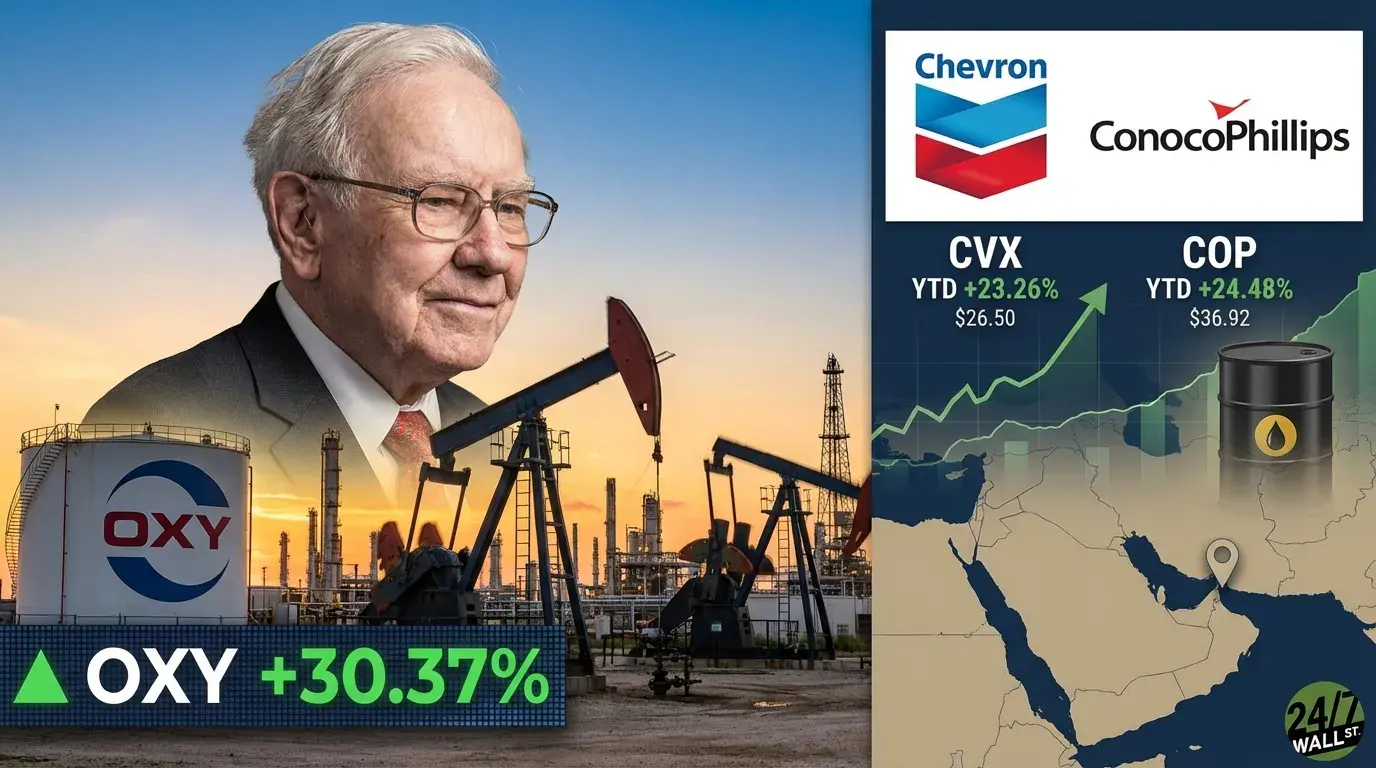

If Oil Hits $100 These Are the Energy Dividends You Want to Own Quick Read Exxon Mobil (XOM) is up 25.35% with $26.13B free cash flow and 2.63% yield, Chevron...

Analyst ratings

69%

of 32 ratingsMore COP News

Warren Buffett’s Oil Bet Looks Genius, Here Is What to Buy Next Quick Read Occidental Petroleum (OXY) rose 30.37% year-to-date and slashed debt by $5.8B after...

UBS raised the firm’s price target on ConocoPhillips (COP) to $144 from $130 and keeps a Buy rating on the shares. Energy is viewed as offering attractive risk/...

ConocoPhillips is reportedly weighing a sale of certain Permian Basin assets as part of a portfolio streamlining effort. This comes alongside the completion of...

After three straight years of dismal performance, energy stocks have emerged as the biggest market winners so far in 2026, posting the biggest gains of the 11 s...

Key Points Oil prices have surged recently due to the war with Iran. They could continue rising if Iran successfully impedes oil exports from the Persian Gulf...

HALO stocks are starting to attract more attention. These stocks feature a fundamentally sound profile of ‘heavy asset, low obsolescence.’ It’s a profile define...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.