Intuit

Trade Intuit 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About INTU

Intuit, Inc. engages in the provision of business and financial management solutions. It operates through the following segments: Small Business and Self-Employed, Consumer, Credit Karma, and ProTax.

INTU Key Statistics

Stock Snapshot

With a market cap of 133.13B, Intuit(INTU) trades at $480.80. The stock has a price-to-earnings ratio of 30.29 and currently yields dividends of 96.0%.

On 2026-03-06, Intuit(INTU) stock traded between a low of $461.16 and a high of $483.20. Shares are currently priced at $480.80, which is +4.3% above the low and -0.5% below the high.

The Intuit(INTU)'s current trading volume is 5.51M, compared to an average daily volume of 6.27M.

During the past year, Intuit(INTU) stock moved between $349.00 at its lowest and $813.70 at its peak.

During the past year, Intuit(INTU) stock moved between $349.00 at its lowest and $813.70 at its peak.

INTU News

Why software shares are withstanding the war jitters The outbreak of the war in Iran has clearly rattled investors and created a few clear winners — mostly ene...

Northcoast upgraded Intuit (INTU) to Buy from Neutral with a $575 price target The firm cites valuation for the upgrade with the shares down almost 30% in 2026....

Northcoast analyst Kartik Mehta upgraded Intuit (INTU) to Buy from Neutral with a $575 price target Published first on TheFly – the ultimate source for real-ti...

Analyst ratings

82%

of 33 ratingsMore INTU News

In late February 2026, Intuit Inc. reported higher revenue and earnings for its fiscal second quarter and first half, reaffirmed full‑year guidance, and approve...

Intuit (INTU) just reported Q2 2026 results that paired higher revenue and net income with fresh AI momentum and a higher dividend, giving investors a mix of gr...

Investors in Intuit Inc (Symbol: INTU) saw new options begin trading today, for the May 15th expiration. One of the key inputs that goes into the price an optio...

Intuit (NasdaqGS:INTU) has announced a major AI partnership with Anthropic to build custom AI agents and integrated financial tools. The collaboration is aimed...

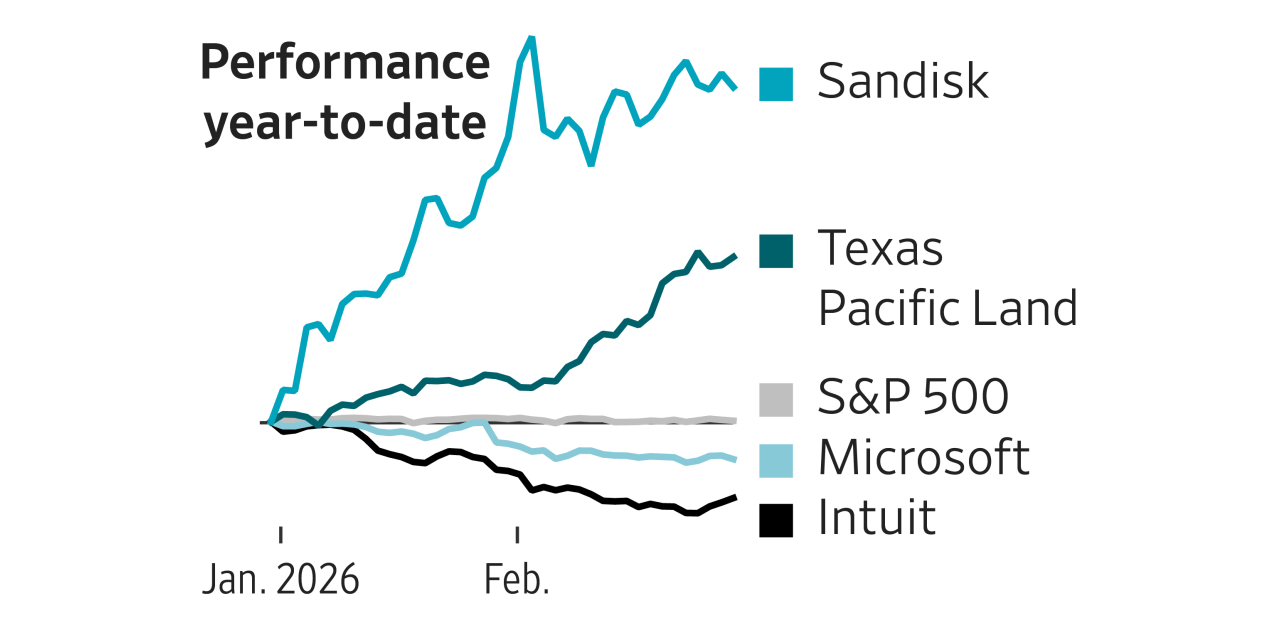

The S&P 500 is clinging to an unremarkable yearly gain, up less than 1% in 2026. But at the single-stock level, swings have been violent. Microsoft has slumped...

Citi analyst Steven Enders lowered the firm’s price target on Intuit (INTU) to $649 from $803 and keeps a Buy rating on the shares. Published first on TheFly –...

If you are wondering whether Intuit stock is attractively priced after a rough patch, this article walks through the key numbers so you can judge the current va...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.