Preformed Line Products

Why Robinhood?

Robinhood gives you the tools you need to put your money in motion. You can buy or sell PLPC and other ETFs, options, and stocks.About PLPC

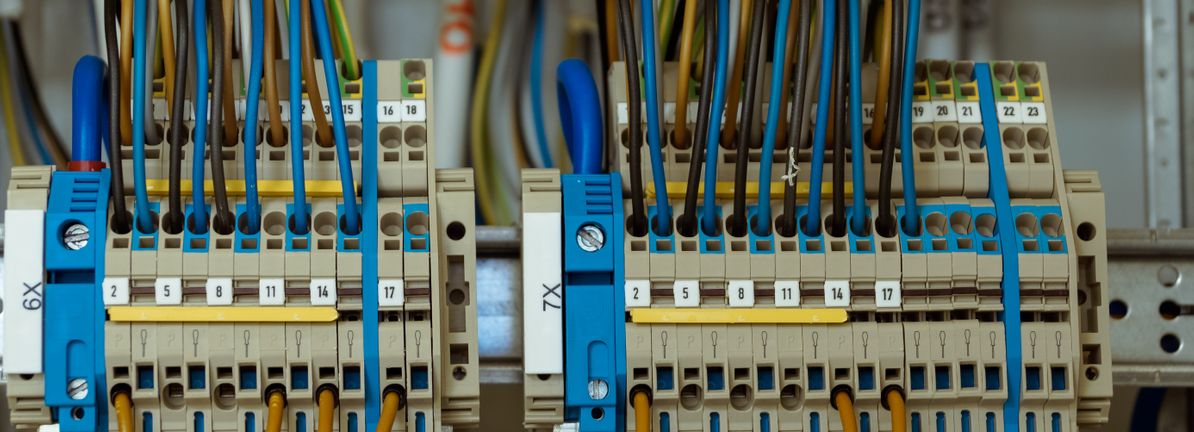

Preformed Line Products Co. engages in the provision of products and systems employed in the construction and maintenance of overhead and underground networks for the energy, telecommunication, cable operators, information, and other similar industries. It operates through the following geographical segments: PLP-USA, Americas, EMEA, and Asia-Pacific.

PLPC Key Statistics

Stock Snapshot

The current Preformed Line Products(PLPC) stock price is $249.03, with a market capitalization of 1.22B. The stock trades at a price-to-earnings (P/E) ratio of 35.80 and offers a dividend yield of 31.7%.

On 2026-03-05, Preformed Line Products(PLPC) stock traded between a low of $224.99 and a high of $256.20. Shares are currently priced at $249.03, which is +10.7% above the low and -2.8% below the high.

The Preformed Line Products(PLPC)'s current trading volume is 194.79K, compared to an average daily volume of 132.39K.

In the last year, Preformed Line Products(PLPC) shares hit a 52-week high of $287.97 and a 52-week low of $118.99.

In the last year, Preformed Line Products(PLPC) shares hit a 52-week high of $287.97 and a 52-week low of $118.99.

PLPC News

Preformed Line Products (PLPC) is back in focus after announcing a multi-year partnership with FulcrumAir to co-develop robotic systems for overhead power line...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.