Vishay

Why Robinhood?

Robinhood gives you the tools you need to put your money in motion. You can buy or sell Vishay and other ETFs, options, and stocks.About VSH

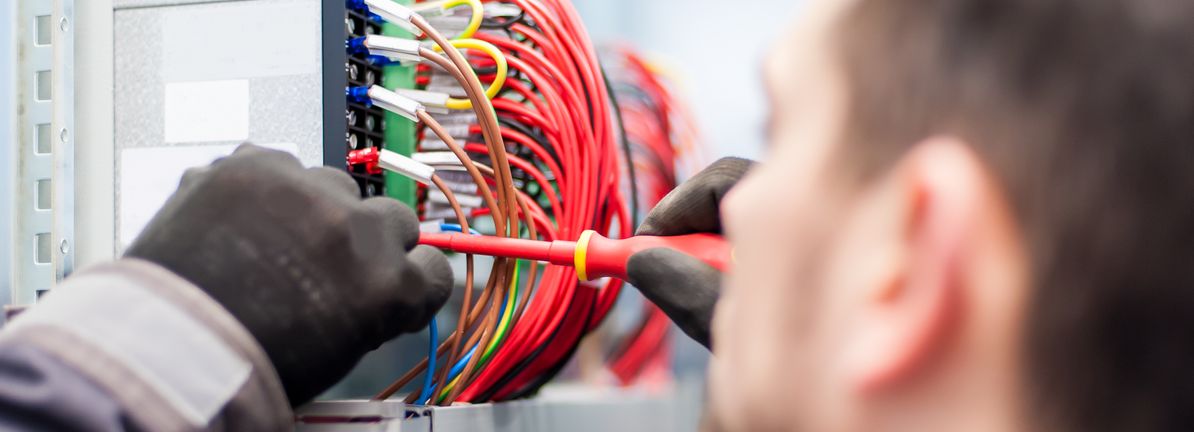

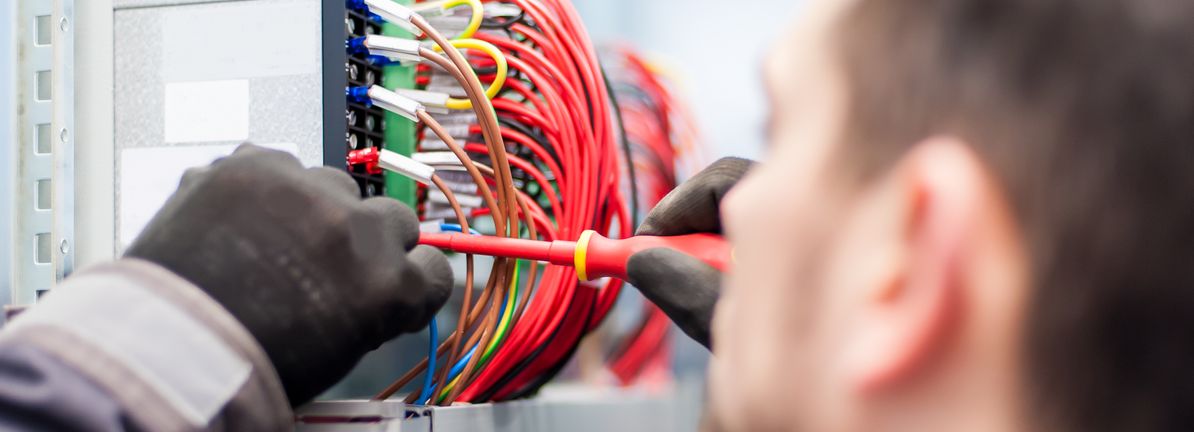

Vishay Intertechnology, Inc. engages in the manufacture and distribution of discrete semiconductors and passive electronic components. It operates through the following segments: MOSFET (metal oxide semiconductor field-effect transistor), Diodes, Optoelectronic Components, Resistors, Inductors, and Capacitors.

VSH Key Statistics

Stock Snapshot

Vishay(VSH) stock is priced at $17.13, giving the company a market capitalization of 2.32B. It carries a P/E multiple of -268.58 and pays a dividend yield of 2.2%.

As of 2026-03-05, Vishay(VSH) stock has fluctuated between $16.75 and $17.80. The current price stands at $17.13, placing the stock +2.3% above today's low and -3.7% off the high.

Vishay(VSH) shares are trading with a volume of 1.78M, against a daily average of 1.9M.

During the past year, Vishay(VSH) stock moved between $10.35 at its lowest and $22.00 at its peak.

During the past year, Vishay(VSH) stock moved between $10.35 at its lowest and $22.00 at its peak.

VSH News

Vishay Intertechnology (VSH) has been active on the product front, introducing VOx619A phototransistor optocouplers and CRCW0201-AT e3 ultra compact chip resist...

In February 2026, Vishay Intertechnology introduced its VOx619A phototransistor optocoupler series, featuring low 0.5 mA forward current, high linear current tr...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.