Constellation Brands

Trade Constellation Brands 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About STZ

Constellation Brands, Inc. engages in the production, marketing, and distribution of beer, wine, and spirits. It operates through the following segments: Beer, Wine and Spirits, Corporate Operations and Other, and Canopy.

STZ Key Statistics

Stock Snapshot

Constellation Brands(STZ) stock is priced at $160.05, giving the company a market capitalization of 27.76B. It carries a P/E multiple of 25.14 and pays a dividend yield of 2.6%.

On 2026-02-24, Constellation Brands(STZ) stock traded between a low of $158.13 and a high of $160.85. Shares are currently priced at $160.05, which is +1.2% above the low and -0.5% below the high.

Constellation Brands(STZ) shares are trading with a volume of 1.55M, against a daily average of 2.49M.

In the last year, Constellation Brands(STZ) shares hit a 52-week high of $196.91 and a 52-week low of $126.45.

In the last year, Constellation Brands(STZ) shares hit a 52-week high of $196.91 and a 52-week low of $126.45.

STZ News

Coca-Cola and Constellation Brands will benefit from lower aluminum prices. President Trump could soon roll back some tariffs on imported steel and aluminum pr...

Constellation Brands (STZ) has moved into focus after naming board member Nicholas Fink as its next CEO and President, effective April 13, 2026, a leadership re...

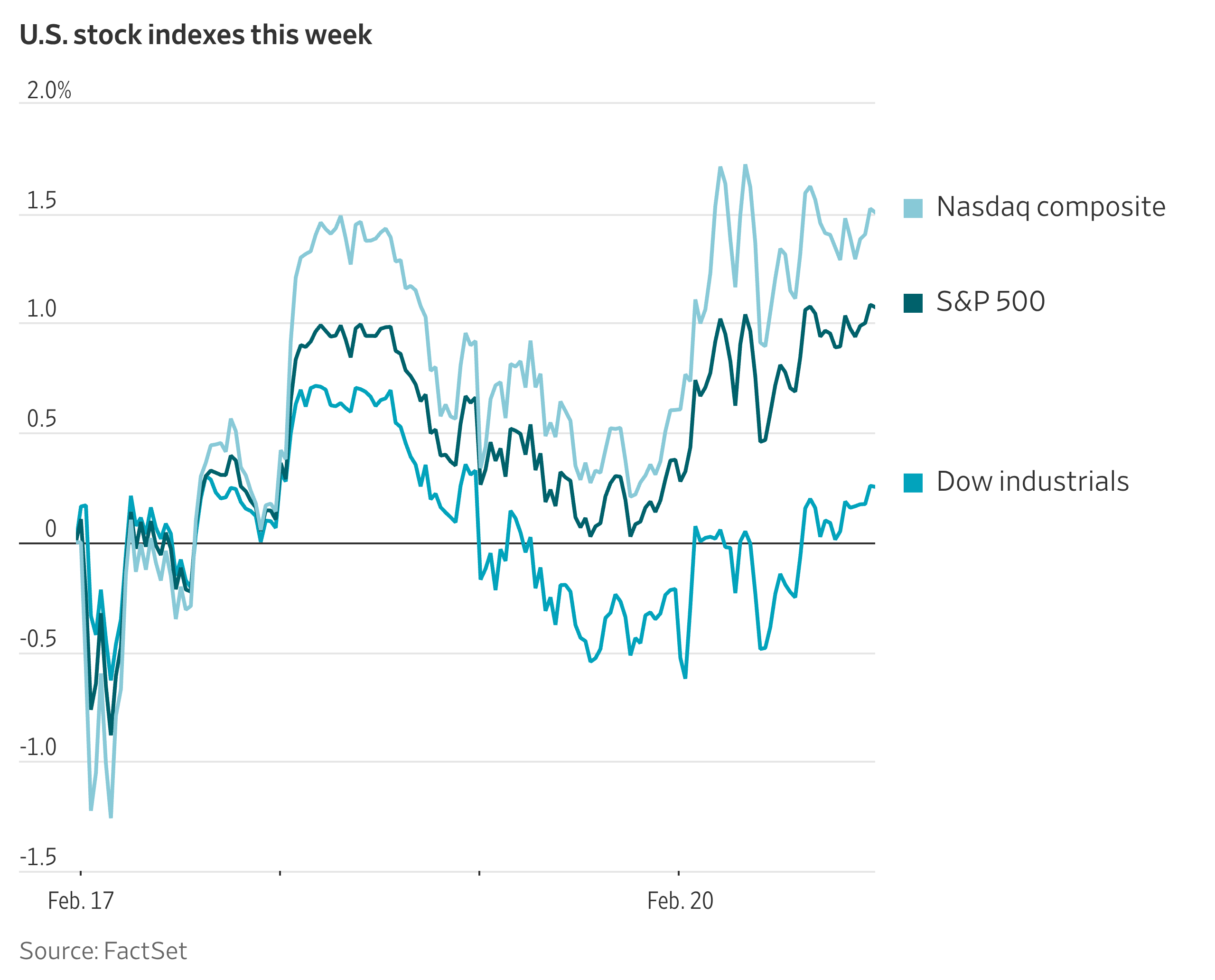

U.S. stocks ended the week on a high note after the Supreme Court threw out President Trump’s sweeping tariffs. The S&P 500 advanced 1.1% for the week, and the...

Analyst ratings

56%

of 25 ratingsMore STZ News

Constellation Brands has announced that its Board appointed Nicholas Fink, currently a director and CEO of Fortune Brands Innovations, as its next President and...

Investors in Constellation Brands Inc (Symbol: STZ) saw new options begin trading today, for the October 16th expiration. One of the key inputs that goes into t...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.