Options Knowledge Center

An option is a contract between a buyer and a seller, and its value is derived from an underlying value like a stock or index. These contracts are part of a larger group of financial instruments called derivatives. With Robinhood, you can trade options contracts on stocks and indices.

Generally speaking, options are quite flexible, and can be used in different ways depending on your goals. Some people use options to hedge the risk of losses (like helping manage portfolio value during a downturn). Others may use options to pursue additional income by monetizing the stocks they own. However, it’s important to note that trading options is generally riskier than investing in stocks. When trading options, potential losses can accrue at a much faster rate, and it’s possible to lose your entire initial investment (or more). Trading options requires approval on Robinhood, and it isn’t appropriate for everyone.

Check out Trading with Legend to learn more about trading options in Legend.

Options versus stocks

Options are a way to actively interact with stocks you’re interested in without actually trading the stocks themselves. When you trade options, you can control shares of stock without ever having to own them.

Leverage

With options, an investor can magnify their potential gains, relative to their initial investment. This is known as leverage. When a person buys an option, they gain exposure to the movement of a stock, and that contract represents a potential trade of 100 shares (that is, without the investor necessarily owning the underlying shares at any point in time). As a result, even small changes in a stock price—up or down—can have a dramatic effect on the value of an options position. Leverage can provide the opportunity for outsized gains, while exposing an investor to outsized losses or losing the premium paid for the option contract. Leverage is part of what can make options strategies risky. In this context it should be noted that Robinhood does not allow customers to sell uncovered options, which reduces the potential risks (including unlimited losses) due to leverage.

The ask price

The ask price is the least amount of money sellers in the market are willing to receive for an options contract. The ask price will always be higher than the bid price.

The bid price

The bid price is the highest amount of money buyers in the market are willing to pay for an options contract. The bid price will always be lower than the ask price.

The strike price

The strike price of an options contract is the price at which the options contract can be exercised.

Think of the strike price as the anchor of your contract: If you’re buying a call, your call is profitable if the value of the stock goes above the strike price (plus whatever premium, contract, and trading fees you paid). If the value of the stock stays below your strike price, your options contract will expire worthless.

Remember, you’re not actually buying shares of the stock unless you exercise your contract. This is because the contract gives you the option to buy the actual shares of the stock at the strike price.

Buying and selling an Options contract

Options can be tricky, so it’s important to know exactly how the actions you take will get you closer to your goal:

- Buying to open an options position means that you’re purchasing the contract. You’re the owner, and have the right to place an order to sell the contract back into the market, to exercise the contract, or let it expire.

- Selling to close a position means that you’re selling a contract that you own back into the market.

- Selling to open an options contract means that you’re selling the contract to a buyer to collect a premium. You have the obligation to make good on the contract if you’re assigned, or you could buy it back in the market. Robinhood does not allow selling uncovered options as potential losses could be unlimited.

- Buying to close an options position means that you’re buying back a contract that you sold. In this case, you cannot be assigned on the contract you initially sold.

Exercise and assignment

The owner of an options contract has the right to exercise the contract, let it expire worthless, or sell it back into the market before expiration. The owner of the contract is likely to exercise the contract if it’s “in the money.” On the other hand, the person who sold the contract to collect the premium is assigned when the owner of the contract exercises it.

For more information on exercise and assignment, the relevant risks, and particularly for expiration, check out Exercise, assignment, and expiration.

The premium

Since the owner has the right to either exercise the contract or let it simply expire worthless, the owner pays the premium (the per-share cost for holding the contract) to the seller. As a buyer, you can think of the premium as the price to purchase the option. If you buy or sell an option before expiration, the premium is the price it trades for. You can trade the option in the market similar to how you’d trade a stock. The premium is not arbitrary, as it’s tied to the value of the contract and the underlying security. The underlying stock’s price, the underlying stock’s volatility, and the amount of time left until expiration all influence an option’s premium.

Liquidity

Liquidity refers to the ability for a trader to open or close an option position at a given price and time. This is based on supply and demand in the marketplace. Low liquidity can hinder or prevent a trader from being able to buy or sell a contract. For instance, if there isn’t a buyer interested in purchasing an options contract you’d like to sell at a specific price, you may not be able to sell the contract when you’d like to, which can affect your potential gains or losses.

Call options

Owners of call options generally expect the stock to increase in value, while sellers of call options generally expect the stock’s value to decrease or remain the same.

Buying a call option gives you the right, but not the obligation, to buy 100 shares of the underlying stock at the designated strike price. The value of a call option tends to appreciate as the value of the underlying stock increases.

Selling a call option allows you to collect the premium while obligating you to sell 100 shares of the underlying stock to the owner at the agreed-upon strike price if the owner of the contract chooses to exercise the contract. Robinhood only allows you to sell a call option if you own the underlying shares. Or in case of a spread (level 3), a corresponding long call option leg in your portfolio to cover for an assignment of the short call option.

What if you think the price of the stock is going up?

In this case, you could buy to open a call position. Buying a call gives you the right to purchase the underlying stocks from the option seller for the agreed-upon strike price. From there, you can sell the stocks back into the market at their current market value if you so choose.

For example, you think YOWL's upcoming product release is going to send the price of the stock soaring, so you buy a call for YOWL at a $10 strike price with a $1 premium (the cost of the contract) expiring in a month.

Let's break that down:

- Symbol: YOWL

- Expiration: A month from now

- Strike price: $10 per share

- Premium: $1 per share

The product release gave the stock a bump, and the day your contract expires, YOWL hits $15. Great! This means you can sell the contract in the market for at least $5 per share and earn at least a $4 profit per share.

The reason the contract is worth at least $5 is that you could exercise the contract to buy the shares at $10, then sell the stocks in the market at their current trading price of $15. You'd earn $4 per share if you exercised the contract instead of selling it.

Put options

Owners of put options generally expect the stock to decrease in value, while sellers of put options generally expect the stock’s value to increase or remain the same.

Buying a put option gives you the right, but not the obligation, to sell 100 shares of the underlying stock at the designated strike price. The value of a put option tends to appreciate as the value of the underlying stock decreases.

Selling a put option allows you to collect the premium, while obligating you to purchase 100 shares of the underlying stock from the owner at the agreed-upon strike price if the owner of the contract chooses to exercise the contract. Robinhood only allows you to sell a put option if you have sufficient cash in your account. Or in case of a spread (level 3), a corresponding long put option leg in your portfolio to cover for an assignment of the short put option.

What if you think the price of the stock is going down?

In this case, you could buy to open a put option. Buying a put gives you the right to sell the underlying stock back to the option seller for the agreed-upon strike price if you so choose.

For example, you think YOWL’s upcoming earnings call is going to tank the price of the stock, so you buy 1 YOWL put option expiring in a week with a strike price of $10 for a premium (the cost of the contract) of $2.

Let’s break that down:

- Symbol: YOWL

- Expiration: A week from now

- Strike price: $10 per share

- Premium: $2 per share

Your prediction is right, and within the week YOWL is trading at $6. Your put option is now worth at least $4, so you can sell it in the market for a profit (less the cost of your $2 premium). You’ve just made $200 on YOWL’s decrease in value.

Knowing when to buy or sell

When opening a position, you can either buy a contract with the intention of exercising it when it reaches its strike price, or you can sell a contract to collect the premium and hope to not be assigned. Buying an options contract makes you the owner/holder of the contract, and in return for paying the premium, you have the right to choose to either exercise the contract, let it expire worthless, or sell it back into the market before expiration. The seller of an options contract collects the premium paid by the buyer, but is obligated to buy or sell the agreed-upon shares of the underlying stock if the owner of the contract chooses to exercise the contract.

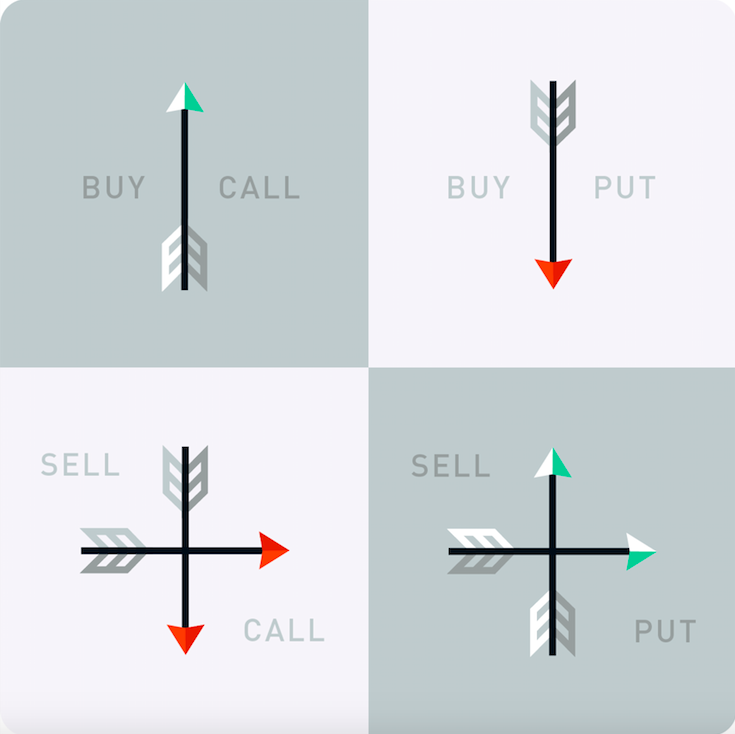

- Buying to open a call: You expect the value of the stock to rise; you pay the premium; you have the right to buy 100 shares at the strike price if you exercise.

- Selling to open a call: You expect the value of the stock to drop or stay the same; you collect the premium; you have the obligation to sell 100 shares at the strike price if you’re assigned.

- Buying to open a put: You expect the value of the stock to drop; you pay the premium; you have the right to sell 100 shares at the strike price if you exercise.

- Selling to open a put: You expect the value of the stock to rise or stay the same; you collect the premium; you have the obligation to buy 100 shares at the strike price if you’re assigned.

Rights and obligations

The owner has the right to exercise the contract or not, whereas the seller has the obligation to make good on the contract if assigned. When the owner of the contract exercises it, the seller is assigned.

Time value

The closer an option is to expiring, the less time value the option will have. The further away a contract is from its expiration date, the more potential there is for price movement, which generally would make the contract trade at a higher price.

The breakeven point

The breakeven point of an options contract is the point at which the contract would be cost-neutral if the owner were to exercise it. It’s important to consider the premium paid for the contract in addition to the strike price when calculating the breakeven point.

Contracts

It’s important to keep in mind that contracts are typically for 100-share blocks. In the above example, you’d be entitled to buy 100 shares of ROAR at the agreed-upon strike price.

Though options contracts typically represent 100 shares, the price of the option is shown on a per-share basis, which is the industry standard.

Options trading levels

Depending on your experience and other factors, you might be eligible for different levels of options trading on Robinhood. With Level 2 approval, you’d have access to some basic strategies, such as:

- Buy long calls and puts

- Sell covered calls

- Sell cash-secured puts

With Level 3 approval, you’d have access to everything available with Level 2 approval and a few more advanced strategies, such as:

- Long straddles and strangles

- Call debit and credit spreads

- Condors and butterflies

For more details, check out Basics options strategies (Level 2) and Advanced options strategies (Level 3).

Note that Robinhood doesn’t allow selling uncovered options, because there's no limit to the amount of money you could lose with some strategies.

Particularly around expiration dates, late assignments can result in short positions and dividend risk. Check out Exercise, assignment, and expiration for further details.

Disclosures

Options are complex products, involve significant risk and are not suitable for all investors. You could lose more than your initial invested capital. You should only invest in financial products that match your knowledge and experience. Review Characteristics and Risks of Standardized Options prior to engaging in options trading.

Review our Day Trading Risk Disclosure Statement and the FINRA Options investing Information to learn about the risks.

Robinhood doesn’t promote day trading. Day trading can be extremely risky. Day trading is generally not appropriate for someone of limited resources, limited investing experience, and low risk tolerance.

Robinhood does not guarantee favorable investment outcomes. The past performance of a security or financial product doesn’t guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should seek tax advice as to how taxes affect the outcome of each options strategy. Examples contained in this article are for illustrative purposes only.