Albemarle

Trade Albemarle 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About ALB

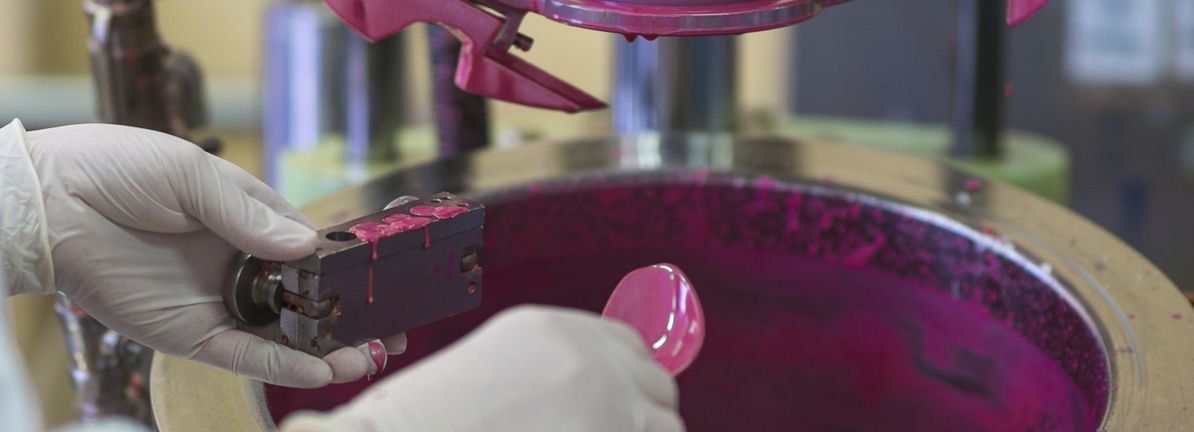

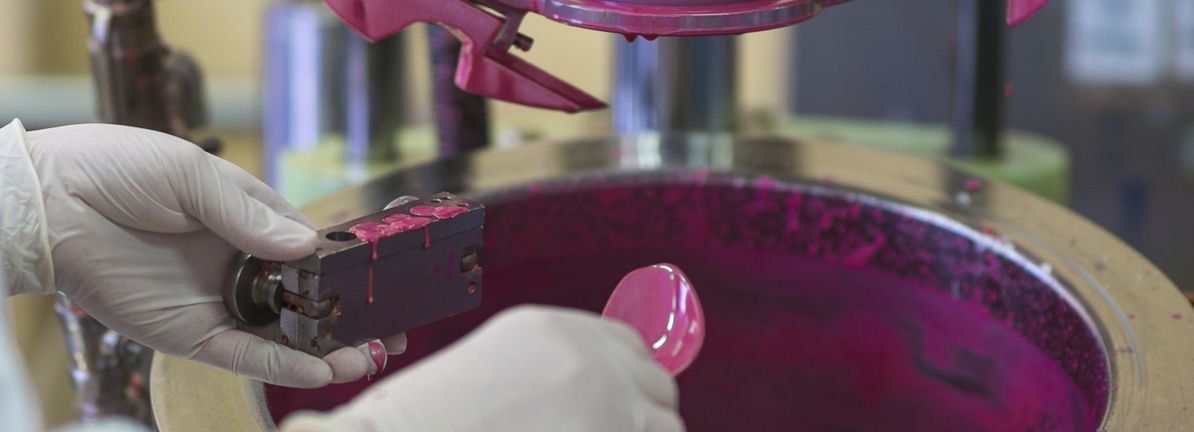

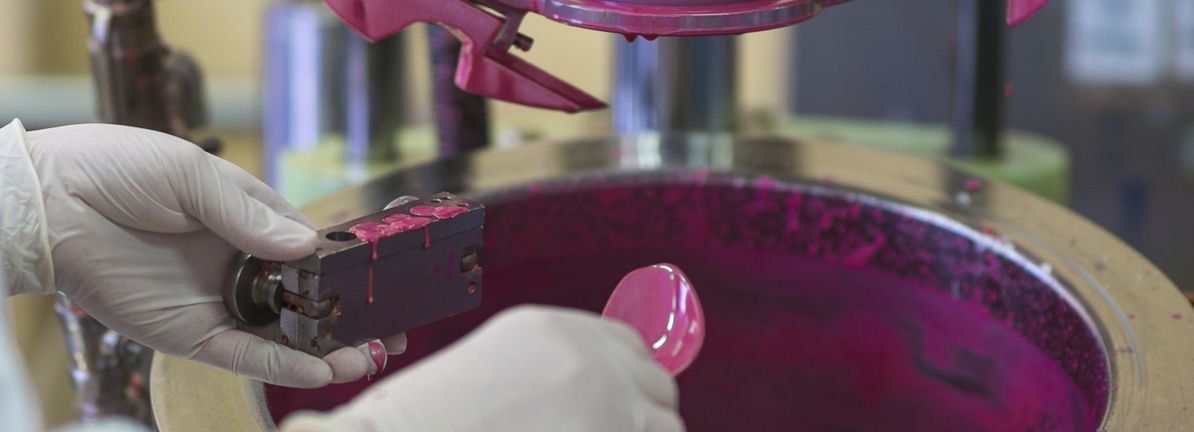

Albemarle Corp. engages in the development, manufacture, and marketing of chemicals for consumer electronics, petroleum refining, utilities, packaging, construction, transportation, pharmaceuticals, crop production, food-safety, and custom chemistry services. It operates through the following segments: Energy Storage, Specialties, Ketjen, and All Other.

ALB Key Statistics

Stock Snapshot

With a market cap of 19.97B, Albemarle(ALB) trades at $169.87. The stock has a price-to-earnings ratio of -28.20 and currently yields dividends of 99.8%.

During the trading session on 2026-03-09, Albemarle(ALB) shares reached a daily high of $169.87 and a low of $157.50. At a current price of $169.87, the stock is +7.9% higher than the low and still 0.0% under the high.

Trading activity shows a volume of 2.42M, compared to an average daily volume of 2.63M.

Over the past 52 weeks, Albemarle(ALB) stock has traded between a high of $206.00 and a low of $49.43.

Over the past 52 weeks, Albemarle(ALB) stock has traded between a high of $206.00 and a low of $49.43.

ALB News

Albemarle ( (ALB) ) has issued an update. On March 2, 2026, Albemarle completed the previously announced sale of its 51% controlling stake in Ketjen Corporatio...

In late February 2026, Albemarle Corporation expanded its Board by adding seasoned finance executive Michelle T. Collins and energy-industry CEO Mark R. Widmar,...

Albemarle (ALB) has been back in focus after lithium prices in China fell, pressuring sentiment across the sector as the company moves parts of its Kemerton lit...

Analyst ratings

57%

of 28 ratingsMore ALB News

Albemarle ( (ALB) ) has shared an update. On February 26, 2026, Albemarle’s board appointed Michelle T. Collins and Mark R. Widmar as independent directors, wi...

Albemarle has completed the sale of a controlling stake in Ketjen Corporation’s refining catalyst solutions business to KPS Capital Partners. The company retai...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.