Bloom Energy

Trade Bloom Energy 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About BE

Bloom Energy Corp. engages in the manufacture and installation of a solid oxide fuel-cell based power generation platform. Its product, Bloom Energy Server, converts standard low-pressure natural gas or biogas into electricity through an electrochemical process without combustion.

BE Key Statistics

Stock Snapshot

As of today, Bloom Energy(BE) shares are valued at $135.30. The company's market cap stands at 37.93B, with a P/E ratio of -354.92.

During the trading session on 2026-03-06, Bloom Energy(BE) shares reached a daily high of $160.99 and a low of $134.66. At a current price of $135.30, the stock is +0.5% higher than the low and still -16.0% under the high.

Trading volume for Bloom Energy(BE) stock has reached 14.85M, versus its average volume of 10.79M.

The stock's 52-week range extends from a low of $15.15 to a high of $180.90.

The stock's 52-week range extends from a low of $15.15 to a high of $180.90.

BE News

CoreWeave (CRWV), an AI cloud computing provider, and Bloom Energy (BE), which supplies power systems for data centers, both closed lower on Friday after a Bloo...

Shares of Bloom Energy (BE) and CoreWeave (CRWV) have both moved lower in afternoon trading after Bloomberg reported that Oracle (ORCL) and OpenAI have scrapped...

If you are wondering whether Bloom Energy's share price still offers value after a big run, or if you might be late to the story, this article walks through wha...

Analyst ratings

42%

of 31 ratingsMore BE News

Mixed options sentiment in Bloom Energy (BE), with shares up $10.19, or 6.66%, near $163.21. Options volume relatively light with 36k contracts traded and calls...

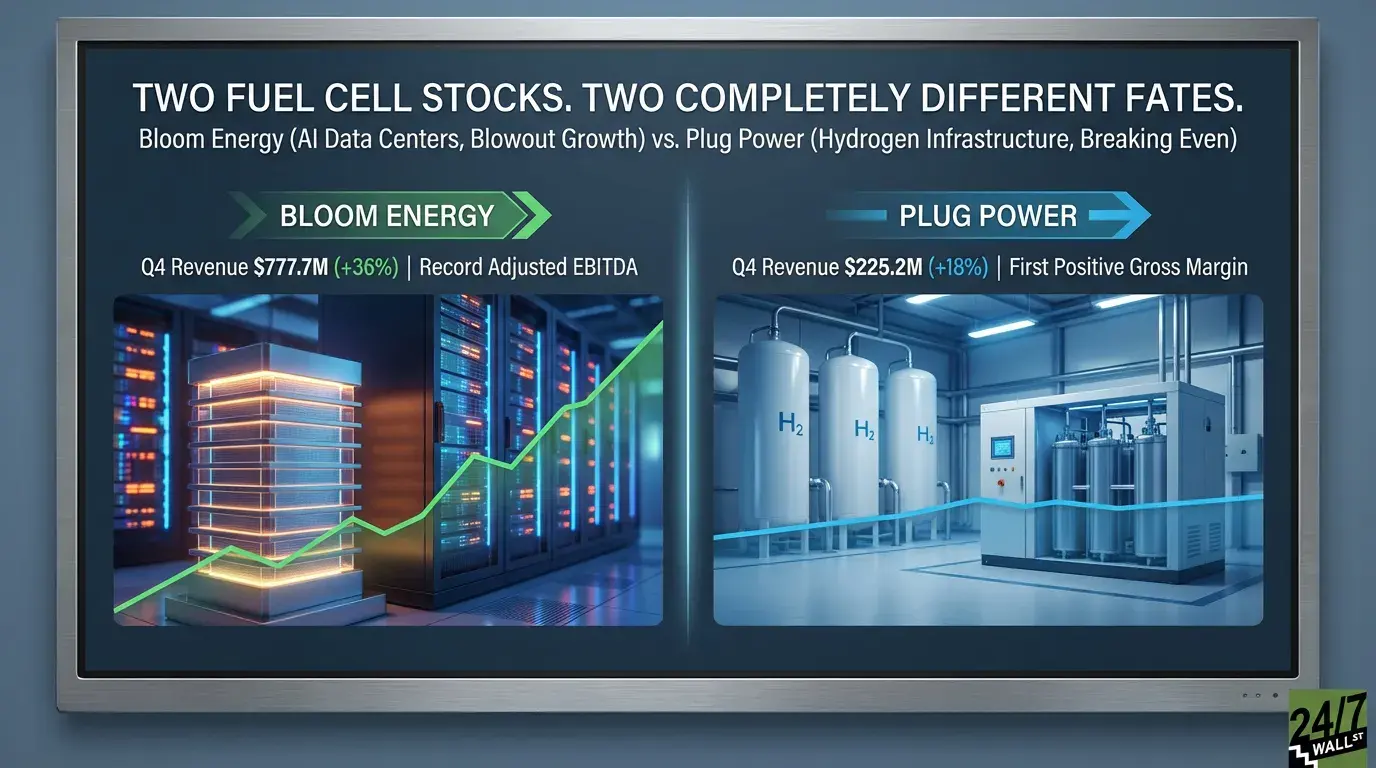

Bloom Energy (BE) just posted a strong fourth quarter for 2025, topping analyst expectations and highlighting a product backlog tied to artificial intelligence...

Key Points Bloom Energy is one of the few names in the hydrogen fuel cell space that’s profitable. Constellation Energy’s restart of a nuclear power plant at...

With the stock market continuing to be buoyed by the advancement of artificial intelligence (AI), tech companies these days aren't short of ambitions. They coul...

Finally! You can open a SoFi Crypto account and access 25 plus cryptocurrencies without juggling apps or logins. Plug Power burned over $3B in cash from 2020 t...

In late February 2026, Bloom Energy reported fourth-quarter 2025 results that exceeded analyst expectations, with earnings per share of US$0.45 and revenue abou...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.