Starbucks

Trade Starbucks 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About SBUX

Starbucks Corp. engages in the production, marketing, and retailing of specialty coffee. It operates through the following segments: North America, International, and Channel Development.

SBUX Key Statistics

Stock Snapshot

The current Starbucks(SBUX) stock price is $98.03, with a market capitalization of 111.68B. The stock trades at a price-to-earnings (P/E) ratio of 82.46 and offers a dividend yield of 2.5%.

On 2026-03-09, Starbucks(SBUX) stock moved within a range of $96.61 to $98.67. With shares now at $98.03, the stock is trading +1.5% above its intraday low and -0.7% below the session's peak.

Trading activity shows a volume of 4.94M, compared to an average daily volume of 7.52M.

Over the past 52 weeks, Starbucks(SBUX) stock has traded between a high of $106.86 and a low of $75.50.

Over the past 52 weeks, Starbucks(SBUX) stock has traded between a high of $106.86 and a low of $75.50.

SBUX News

Just last week, we heard that coffee giant Starbucks (SBUX) was making a move to Tennessee, pulling jobs out of Seattle—which was essentially the birthplace of...

Wolfe Research analyst Greg Badishkanian downgraded Starbucks (SBUX) to Peer Perform from Outperform without a price target after assuming coverage of the name....

Starbucks (SBUX) is in focus after announcing a new corporate office in Nashville, Tennessee, which will consolidate procurement teams to support supply chain e...

Analyst ratings

44%

of 39 ratingsMore SBUX News

Starbucks (NasdaqGS:SBUX) is opening a new corporate office in Nashville to support its North American supply chain and expansion in the Southeast US. The Nash...

In recent days, Starbucks announced it is opening a new North American supply‑chain office in Nashville, Tennessee, consolidating procurement teams and relocati...

As previously reported, DA Davidson initiated coverage of Starbucks (SBUX) with a Neutral rating and $97 price target The company’s turnaround efforts appear to...

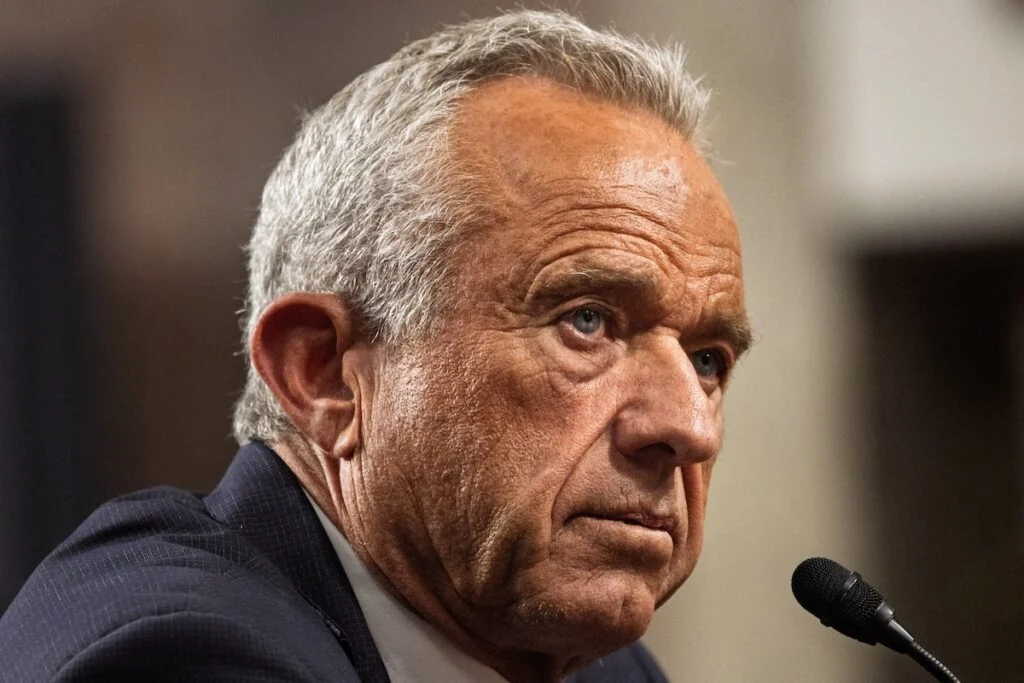

Coffee giant Starbucks (SBUX) is well-known for sweet beverages. In fact, some of them are almost terrifyingly sweet, particularly by RFK Jr.’s reckoning. He is...

Guggenheim raised the firm’s price target on Starbucks (SBUX) to $95 from $90 and keeps a Neutral rating on the shares. The firm is raising its fiscal Q2 U.S. s...

Health and Human Services Secretary Robert F. Kennedy Jr. has called on major coffee chains to prove the safety of their high-sugar drinks, drawing a symbolic r...

Starbucks, NasdaqGS:SBUX, is establishing a new corporate office in Nashville to centralize parts of its supply chain and support North American expansion. The...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.