How much do I need to retire happy?

The value of your investments and the income you receive from them can go up and down, and you may get back less than you invest. Any examples are for illustration purposes only.

Don’t worry. This isn’t a finger-wagging lecture on the importance of investing for retirement.

There’s enough of that around and the truth is we’re already pretty worried about it. 62% of millennials are concerned that inadequate pension pots will mean they’ll need to go back to work after retiring.[1] 66% of Gen Y are stressed that they aren’t saving enough for post-work life [2] and, more broadly, 56% of us are worried our standard of living will drop in retirement.[3]

Read more

How to pick 'forever' stocks

Your £0 to £100,000 investment journey

How much do you need to earn to be rich?

The myth is we’re too busy turmeric-shotting our way through vibecore TikToks to care but it’s just not true. Where we do need help is in understanding exactly what retirement means for each of us. Do you want to down tools and sit on a beach from the day you collect your gold watch? How about stepping back from the day job and monetising a hobby? You might actually plan to keep working but reduce your hours or rebrand as a consultant and only take on the projects you want. Then there’s how you want to socialise, what you want to wear, where you plan to eat out - it all paints a different picture for everyone.

How much will retirement cost me?

There’s no one-size-fits-all answer so it pays to actually think about what you want your retirement lifestyle to look like, then try to match that up with your savings goals. It might show you where you need to compromise now or later on, in order to get there.

The Pensions and Lifetime Savings Association (PLSA) uses this approach in trying to find what the cost of retirement might be in three different instances. Those with a ‘Comfortable’ standard of retirement living can look forward to a four-star Mediterranean fortnight each year, three UK mini breaks, a range of streaming services and replacing the car every five years. Those in the ‘Moderate’ camp can afford a three-star all-inclusive European fortnight, one UK long weekend, a bit less in the way of streaming services and a car every seven years. A ‘Minimum’ standard would see a week-long UK holiday, streaming with ads and allowances for taxis and the odd train journey. You can see the full rundown of each lifestyle bucket in the latest UK Retirement Living Standards report.

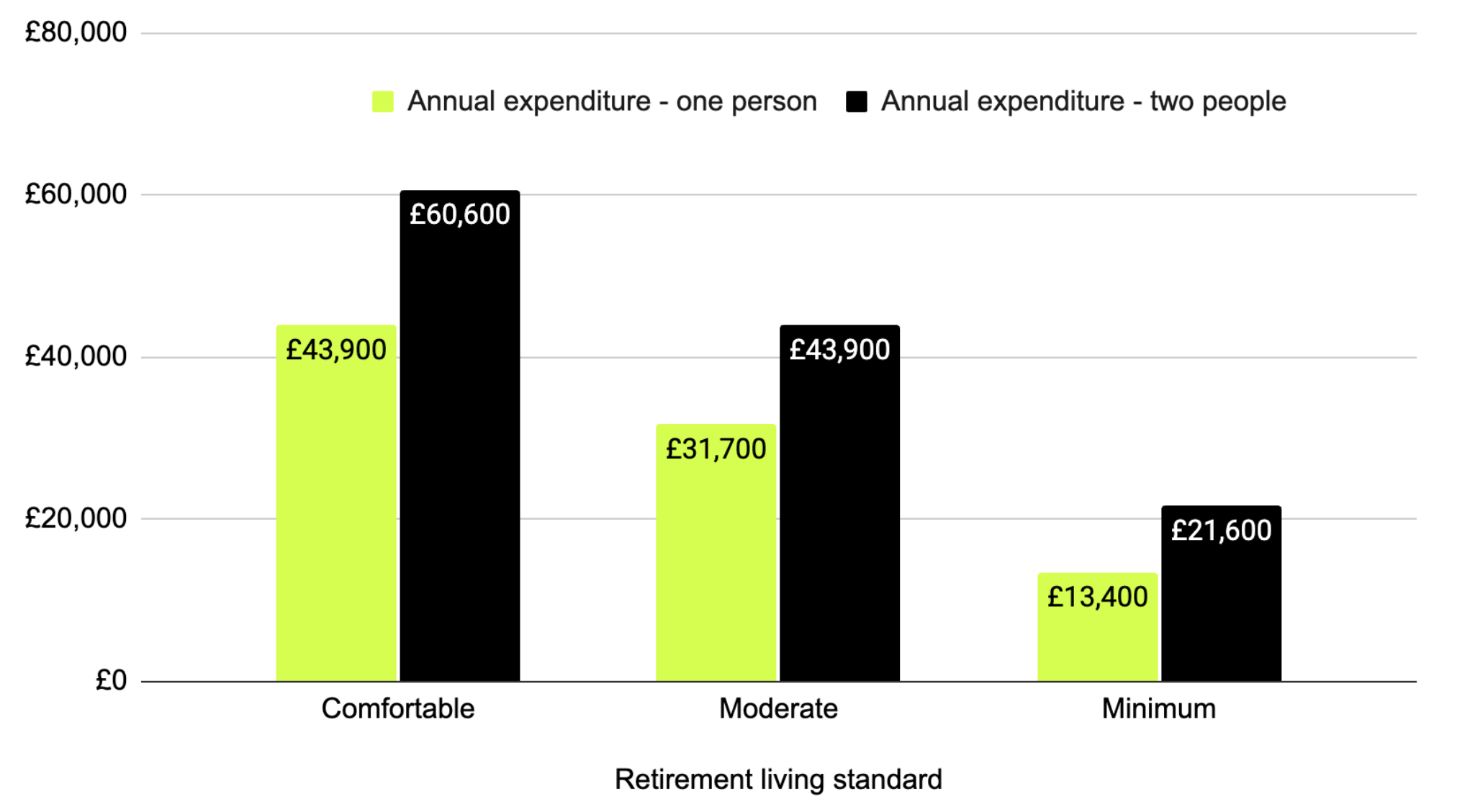

So how much would each of these notional standards of living cost us each year?

Annual expenditure attached to the PLSA’s Comfortable, Moderate and Minimum retirement living standards

Source: PLSA Retirement Living Standards report 2024 update, June 2025.

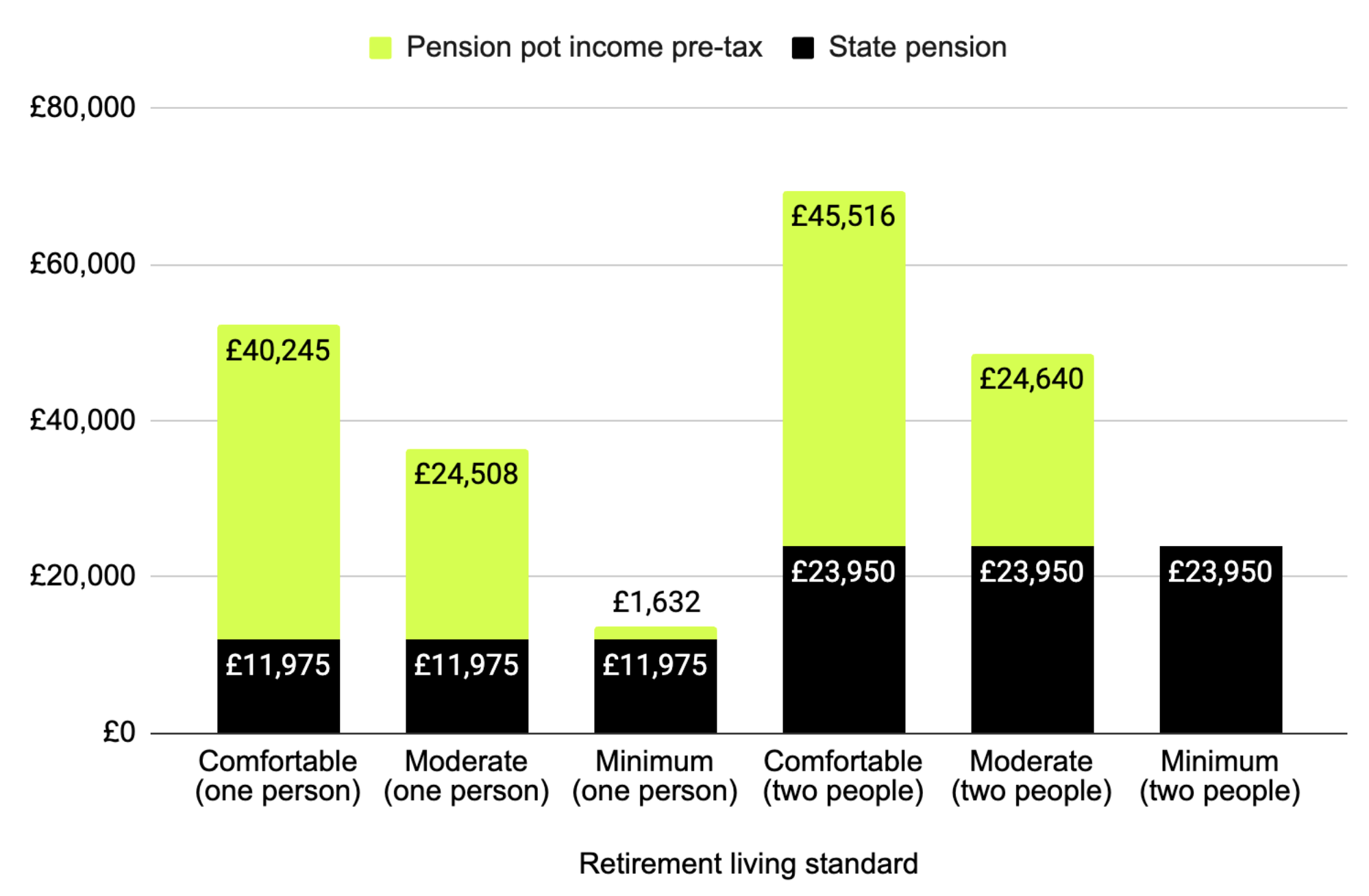

It’s important to point out that these are outgoings, funded through taxed pension pots and the state pension, with the latter providing £11,975 per year for most people (based on the full state pension for 2025-26). This means that actual pre-tax earnings would need to be higher to allow for these amounts to drop into our bank accounts, with the Comfortable cohort needing £52,220 for one person and £69,466 for two people. We’ve added the detail here:

How much do I need to retire ‘comfortably’ in the UK?

Figures per year. This information is based on current living standards and may change in the future as inflation increases and living standards change. Based on current tax levels, which may also change in the future. Source: PLSA Retirement Living Standards report 2024 update, June 2025.

There’s a big asterisk here though. The PLSA’s figures “assume you own your own home with no mortgage” so you might need to add the cost of repayments or rent if you think it’ll apply to you later down the line. There’s also no allowance for care costs, which can range from around £40,000 to over £70,000 [5] (although government help may be available).

The aim here isn’t to scare anyone into saving more - for a lot of us a tactic like that would stun us into inaction or just cause more worry. Instead, the lifestyle-first approach is a great way to help you think about the type of retirement you want, what that might cost and how making changes to your savings and investments now could help you get there.

How much will I need in my pension to retire?

The report uses annuities (in which pension savers swap their pot for a guaranteed-for-life stream of annual income payments) to estimate what we’d need upfront to kick off our retirement spending. Annuity maths is complicated business and rates change all the time so they stress these are just illustrations:

| Retirement living standard | Approximate fund size required per person if purchasing an annuity |

| Comfortable (one person) | £540,000 - £800,000 |

| Moderate (one person) | £330,000 - £490,000 |

| Minimum (one person) | £20,000 - £35,000 |

| Comfortable (two people) | £300,000 - £460,000 |

| Moderate (two people) | £165,000 - £250,000 |

| Minimum (two people) | £0 (fully covered by the state pension) |

Rounded illustrative figures based on indicative annuity rates ranging from £5,000 to £7,500 per £100,000. Rates vary according to the type of product and saver circumstances including location and health. Provided as an illustration only, annuity rates change frequently. Source: PLSA Retirement Living Standards report 2024 update, June 2025.

Another way to give a rough guide to your starting amount might be to think about staying invested in the stock market and regularly withdrawing amounts as you leave the rest of the pot to hopefully grow. There are lots of moving parts here as we might want to retire at the point that we can access our pension (currently age 55, rising to age 57 from April 2028) rather than at the state pension age (currently 66 for both men and women and due to rise to 67 between 2026 and 2028). As well as that, we need to factor in any income from part-time jobs, other savings sources and our life expectancy.

With these different paths in mind, it’s perhaps better to get back to basics and use a simple illustrative example of what we mean here. We’ll look at how an investor might use a starting pot to plan their retirement income, with no state pension involved or accounting for tax-free lump sums. Using an average annual growth figure of 5% for our investments (excluding fees and bearing in mind returns will change from year to year) and a 35-year retirement, we would need a pot of £740,000 in order to spend in line with our Comfortable lifestyle (£3,658.33 per month; one person). That drops to £531,000 for the Moderate case (£2,641.66 per month; one person) and £225,000 for the Minimum scenario (£1,116.66; one person). Our gains help to offset the money we withdraw, to a certain extent, and hopefully give us longer to keep withdrawing before we eventually whittle the pot down. Bear in mind we have not taken into account the effect of inflation in projected retirement savings.

Again, there’s no state pension or allowance for differing strategies around taking tax-free lump sums here and annual returns will vary but the exercise does illustrate two things. First, funding our own retirement lifestyle is a very personal journey both in terms of what we want and what we can afford. The gap between Comfortable and Minimum is sizable and we shouldn’t be afraid to take parts from both in order to help us plan and save. Second, whichever lifestyle we gravitate towards, investing early and regularly kicks off the compounding effect we all need to help us get there. ‘Progress, not perfection’ should be the pension saver’s motto and doing what we can with what we have, aided by the snowball effect of compounding, should go some way to reduce those retirement worries in today’s young people.

The government’s Pension Wise service offers free, impartial guidance to people approaching retirement with a defined contribution pension. You can access the guidance at www.moneyhelper.org.uk or on 0800 138 3944.

Sources:

[1] Don't Look Back in Anger when you reach retirement, L&G, June 2025. [2] Retirement Voice report, Standard Life, 2024. [3] Retirement of tomorrow, FSCS, 2023. [4] PLSA Retirement Living Standards report 2024 update, June 2025. [5] Age UK, Kingfishers Care Home.

Important information

When investing, your capital is at risk. The value of your investments, and the income you receive from them, can go down as well as up and you may get back less than you invest. Forecasts aren’t a reliable guide to future results or returns.

Make sure to do your own research on what investments are right for you before investing or consider seeking expert financial advice. Please note that this article is meant for information and does not constitute any financial advice. This is not an offer, recommendation, inducement or invitation to buy, sell, or hold any securities, or to engage in any investment activity or strategy.

Eligibility to invest in a pension and tax treatment depends on individual circumstances and all tax rules may change in the future. Withdrawals from a pension product will not be accessible until you reach minimum pension age (currently 55, increasing to 57 from 2028).