Before trading a futures contract

A few things to consider before trading your first futures contract are the specifications of the contract itself (contract specs), the margin requirement, the symbol, the settlement type and expiration, whether a contract is active or not, the commissions and fees, and the trading hours.

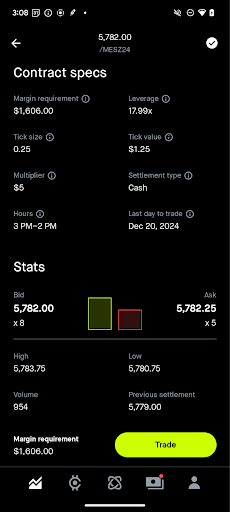

Contract specs

The specifications of a futures contract ( or “contract specs”), include the size, price movement, and last day to trade. It's important to be aware of these contract specs, as well as your margin requirements before placing a trade.

The contract size specifies the quantity of the underlying futures product for a single contract. Contract size is the same as the contract multiplier (similar to trading options), except the contract size reflects what the contract is measured in. Depending on the product, a futures contract may be measured in pounds, barrels (oil), bushels (wheat), ounces, gallons, index points, and more.

While the unit of measurement may vary, futures products have standardized quantities of measurement. For example, a single crude oil (/CL) futures contract always corresponds to 1,000 barrels and a single gold futures contract equates to 100 troy ounces.

Some contract sizes are also related to each other. For example, /MCL is 1/10th the size of /CL (crude oil). The M in this case stands for micro.

A contract’s price movement is determined by its contract multiplier, tick size, and tick value.

The contract multiplier is the dollar value of each full point (1.00) of price movement for a given contract. This equates to how much money you’ll gain or lose in a 1 point move in the futures contract. For example:

- In a crude oil (/CL) contract, the contract multiplier would be $1,000 representing a $1 move, because 1 contract represents 1,000 barrels of crude oil.

- For Micro S&P 500 Index futures contracts, the contract multiplier is $5 per full index point. So if you are long in the S&P 500 Index futures contract and the index increases in value from 5,700 to 5,701 points, then your gain would be $5. Conversely, if you are short in the S&P 500 Index futures contract and the index increases from 5,700 to 5,701, then you would lose $5.

Tick size is the smallest possible price increment that a futures contract can move up or down. These are set by the exchange. While the tick size for a stock or option is typically $0.01, the tick size for futures can vary from one contract to another.

- For example, the tick size for Micro S&P 500 Index futures (/MES) is 0.25. This means that trading will always occur in 0.25 increments. In this example, 4 ticks of movement would equal 1 point.

Tick value is the monetary value associated with a single tick size movement. Tick value = (tick size) x (the contract multiplier).

- For example, the Micro S&P 500 Index (/MES) futures represents $5 x S&P 500 Index. Since the /MES tick size is 0.25, the tick value would be $1.25 (0.25 x $5).

The last day to trade (LDTT) is the final date you can close out of a contract you hold a position in. However, for certain products, you may not be able to open new positions even before the LDTT. For more details, check out Futures contract expiration.

Margin requirement

The margin requirement is the cash needed to open a futures position.

Margin requirements are set by the exchange and may fluctuate on a daily basis. Additionally, Robinhood may periodically increase the margin requirement to be more than the exchange minimum, to further mitigate the risk.

We don’t currently offer intraday margin. All margin requirements for your positions will align with the stated margin requirement on each respective contract’s detail page under its chart. You can review a consolidated list of margin requirements by going to the preset Futures list and sorting by margin requirement.

When you have a futures position, you also need to maintain enough funds in your account to cover the margin maintenance requirement. For more details, check out Futures deficits and margin calls.

Additionally, intra commodity spreads may have lower initial margin requirements. For example, let’s say you purchase 1 /ES (E-mini S&P 500 Index) contract that has an initial requirement of $24,000. /MES (Micro E-mini S&P 500 Index) has a margin requirement of $2,400. You could enter a spread by going long 1 /ES and then separately with another order ticket, going short 10 /MES contracts without having to add the additional margin requirements of the 10 short /MES, because the 1 long /ES offsets the margin requirement.

Futures symbols

The futures symbol is a shorthand code, similar to a stock ticker, that is used to reference a specific futures contract.

At Robinhood (like other brokers), the futures symbols start with a slash (/) to differentiate them from equities that share the same symbol. The slash is then followed by a root symbol, for example, CL for crude oil, and finally the expiration code. The expiration code specifies the month and year the contract expires. For more details, check out Futures contract expiration.

The complete formula for a futures symbol = (Forward slash (/)) + (Root symbol) + (Expiration month code) + (Expiration year).

For example, a futures contract (/) for Micro Natural Gas (MNG) expiring in January (F) 2025 (25) would have the symbol /MNGF25.

Settlement and expiration

Similar to options, all futures contracts have an expiration date and will expire. At expiration, futures contracts are either physically settled or cash settled. To avoid delivery of a physically settled futures product, you need to close your position by the last day to trade (LDTT). For more details, check out Futures contract expiration.

Active vs non-active contract tagging

Every futures product has multiple contracts with varying expiration dates. The contract with the most activity and trading volume is generally called the active contract. The active contract typically has tighter spreads and the most liquidity.

Non-active contracts typically have lower trading volumes with less liquidity and wider spreads. This adds an additional layer of risk that traders need to be aware of.

The ability to trade non-active contracts may not always be available depending on how close the contract is to the last day to trade (LDTT). For more details, check out Futures contract expiration.

Commissions and fees

There are a few costs you should be aware of before placing your first futures trade.

The first is a commission that is charged on a per-contract basis for every trade. The commission is charged by Robinhood and is a fixed rate. There’s also a fixed regulatory fee per contract traded.

In addition to the fixed costs for commissions and regulatory fees, there are exchange fees charged by the respective futures exchanges on a per-contract basis for every trade. These will vary depending on the product/symbol and are subject to change. Review exchange fees charged by the CME Group.

Commissions, regulatory fees, and exchange fees will be charged on all trades as well as on any cash settlement transactions.

Fixed costs per contract traded

Robinhood commission:$0.75

NFA regulatory fee: $0.02

Variable cost per contract traded Exchange fee for trades: $0.20 - $7.50

- Varies by symbol & subject to change

Exchange fee for cash settlements: $0.00 - $2.50

- Varies by symbol & subject to change

Trading hours

Futures products may have varying holiday and trading hours. Check out the CME Group's Holiday and Trading hours calendar for details.

Most futures products trade 23 hours a day, 5 days a week. The trading day begins at 6 PM ET the day before and ends at 5 PM ET of the current trading day. Each trading day includes a 1- hour daily maintenance window from 5 PM-6 PM ET when trading is closed, which is also known as the closed period.

- Monday: Trading day begins at 6 PM ET Sunday (the day before) and ends Monday at 5 PM ET

- Tuesday: Mon 6 PM-Tues 5 PM ET

- Wednesday: Tues 6 PM-Wed 5 PM ET

- Thursday: Wed 6 PM-Thurs 5 PM ET

- Friday: Thurs 6 PM-Fri 5 PM ET

Generally Greenwich Mean Time (GMT) is 5 hours ahead of Eastern Time (ET). However, it is 4 hours ahead between the 2nd Sunday in March and the last Sunday in March, and again between the last Sunday of October and the first Sunday in November.

Disclosures

Futures trading is offered through Robinhood U.K. Ltd. and Robinhood Derivatives, LLC, a US registered futures commission merchant with the Commodity Futures Trading Commission (‘CFTC’) and a member of the National Futures Association (‘NFA’) (NFA ID 0424278).

Futures are complex products with a high risk of losing money rapidly due to leverage. They’re not suitable for all investors. Before you invest, you should make sure you understand how futures work, what the risks are of trading futures and whether you can afford to lose more than your original investment. Please review the Futures Risk Disclosure Statement prior to engaging in futures trading.

Futures contracts and cash in futures accounts that you deposit with Robinhood Derivatives, LLC to margin futures contracts traded on the CME are held in a customer segregated funds account pursuant to regulatory requirements. Futures accounts are not protected by the Securities Investor Protection Corporation (‘SIPC’) or the UK's Financial Services Compensation Scheme (‘FSCS’).

Robinhood U.K. Ltd and Robinhood Derivatives, LLC are subsidiaries of Robinhood Markets, Inc.

Robinhood Derivatives, LLC retains the right to cancel orders and liquidate your positions at any time, without prior notice. Review see the Futures Client Agreement for more details.