SoftBank

1D

1W

1M

3M

YTD

1Y

5Y

ALL

Why Robinhood?

Robinhood gives you the tools you need to put your money in motion. You can buy or sell SoftBank and other ETFs, options, and stocks.About SFTBY

SoftBank Group Corp. operates as a holding company which engages in the management of its group companies. It operates through the following segments: SoftBank Vision Fund, SoftBank, Arm, Brightstar, and Others.

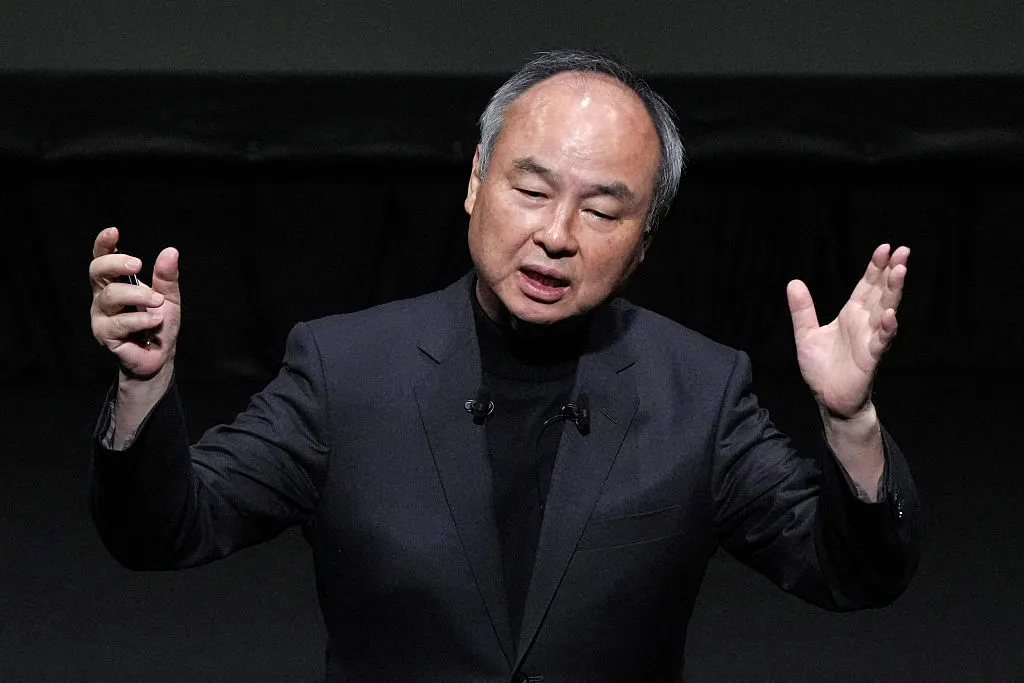

CEOMasayoshi Son

CEOMasayoshi Son

Employees67,229

Employees67,229

HeadquartersTokyo, Tokyo

HeadquartersTokyo, Tokyo

Founded1981

Founded1981

Employees67,229

Employees67,229

SFTBY Key Statistics

Market cap166.29B

Market cap166.29B

Price-Earnings ratio8.29

Price-Earnings ratio8.29

Dividend yield0.19%

Dividend yield0.19%

Average volume3.04M

Average volume3.04M

High today$15.02

High today$15.02

Low today$14.30

Low today$14.30

Open price$14.59

Open price$14.59

Volume874.18K

Volume874.18K

52 Week high$22.50

52 Week high$22.50

52 Week low$4.97

52 Week low$4.97

SFTBY News

Sherwood News 3d

SoftBank’s OpenAI investment gains drive fourth consecutive profitable quarterSoftBank’s OpenAI investment gains drive fourth consecutive profitable quarter SoftBank is up 4% in premarket trading on Thursday as the Japanese conglomerate...

Analyst ratings

68%

of 19 ratingsBuy

68.4%

Hold

26.3%

Sell

5.3%

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.