Taiwan Semiconductor Manufacturing

Why Robinhood?

Robinhood gives you the tools you need to put your money in motion. You can buy or sell TSM and other ETFs, options, and stocks.About TSM

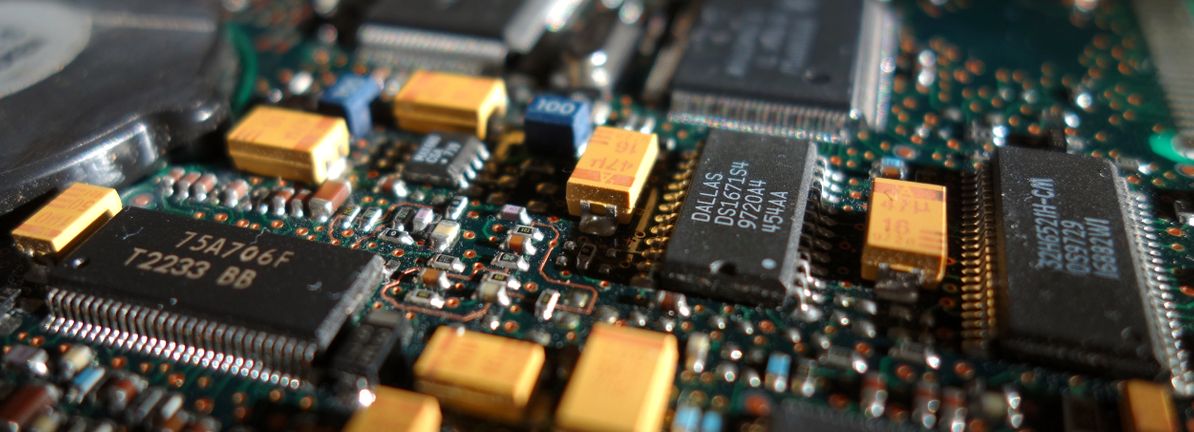

Taiwan Semiconductor Manufacturing Co., Ltd. engages in the manufacture and sale of integrated circuits and wafer semiconductor devices. Its chips are used in personal computers and peripheral products, information applications, wired and wireless communications systems products, and automotive and industrial equipment including consumer electronics such as digital video compact disc player, digital television, game consoles, and digital cameras.

TSM Key Statistics

TSM News

Key Points Several big tech companies are increasing their spending on AI hardware dramatically. Taiwan Semiconductor Manufacturing is the leader in chip manu...

Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM) is expanding its workforce and production footprint as global demand for advanced chips grows. The key c...

TSMC has secured environmental clearance for a new mega factory and is accelerating development of the facility to expand manufacturing capacity. The new plant...

Analyst ratings

98%

of 50 ratingsMore TSM News

Key Points TSMC has been a top performer on the stock market in the past year, and that trend is likely to continue. The company's influence over the global f...

TSMC ( (TSM) ) has fallen by -8.19%. Read on to learn why. Claim 70% Off TipRanks Premium Unlock hedge fund-level data and powerful investing tools for smarter,...

Key Points Users are interacting with prediction markets via agentic AI. Taiwan Semiconductor is one of the best ways to play AI, prediction markets, and all...

Key Points Nvidia expects sustained demand as AI systems and AI agents move from experimentation to the real world. TSMC’s leading-edge dominance and 2-nanome...

Nvidia (NVDA) has stopped production of its second-most advanced artificial intelligence chips, known as H200 chips, intended for the Chinese market, The Financ...

Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM) is aggressively expanding production capacity to meet relentless global demand for artificial intelligenc...

Artificial intelligence (AI) has the potential to disrupt many companies and industries, but predicting which ones will succeed is difficult. One way to play th...

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.