Rate cuts, the Fed, and your money

The Federal Reserve, the central bank of the United States, sets a target interest rate—aka the federal funds rate—8 times a year. Rate changes generally depend on whether the goal is to stimulate economic growth or curb inflation. For instance, to encourage growth, Fed officials may lower the federal funds rate. While this can reduce borrowing costs on loans, it also leads to lower annual percentage yields (APYs) on many interest-bearing accounts, such as Robinhood Gold, creating both benefits and drawbacks for investors.

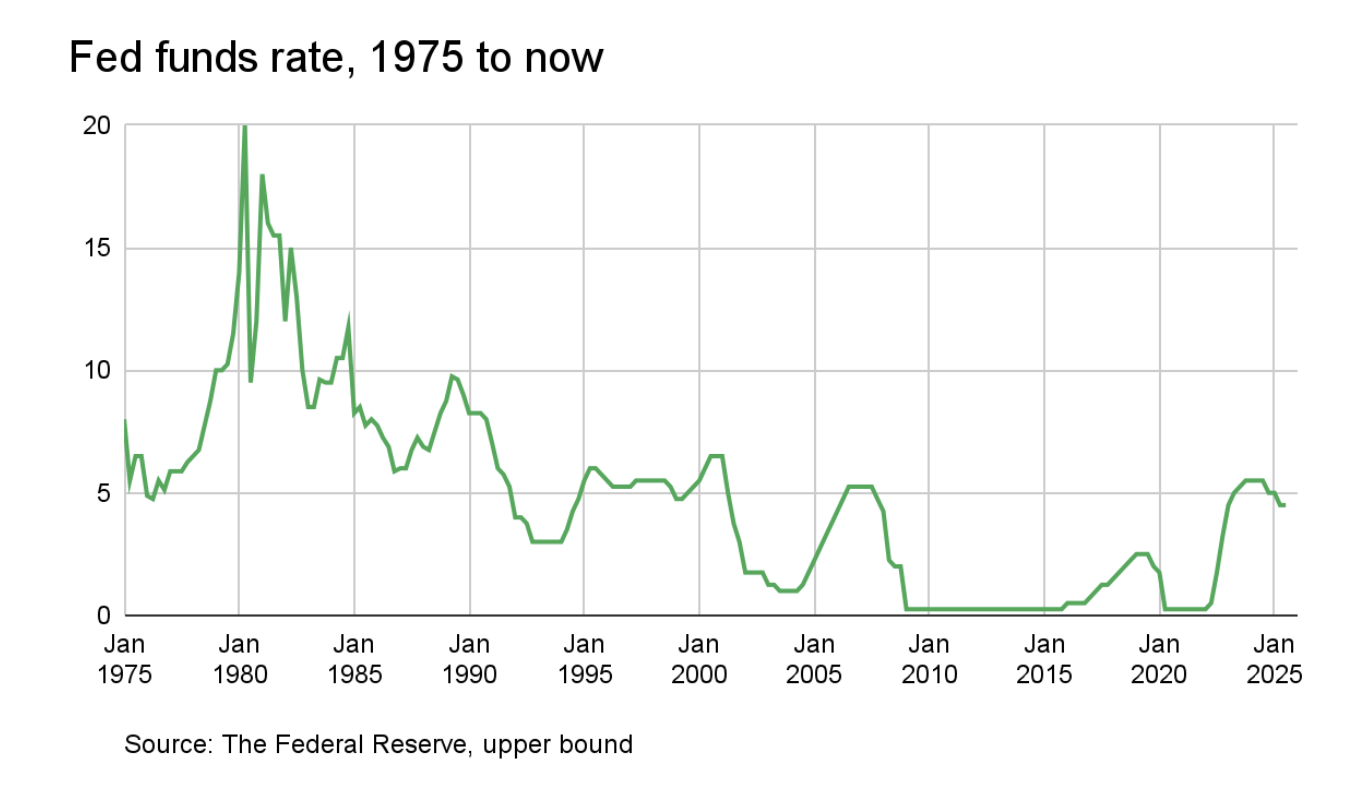

Historically, the federal funds rate has ranged from as low as 0% to nearly 23% (during the high-inflation era of the early 1980s). More recently, the Federal Reserve sharply lowered rates and took additional measures in March 2020 to respond to the COVID-19 pandemic. Consequently, inflation surged, and the Fed began raising rates in March 2022, continuing a series of hikes through July 2023. To view the current Federal Funds Rate, click here.

How Fed Policy Affects Your Money

For everyday investors, changes in interest rates can be both positive and negative, influencing two key areas: the interest earned on savings and the cost of borrowing—whether through personal loans or credit card balances.

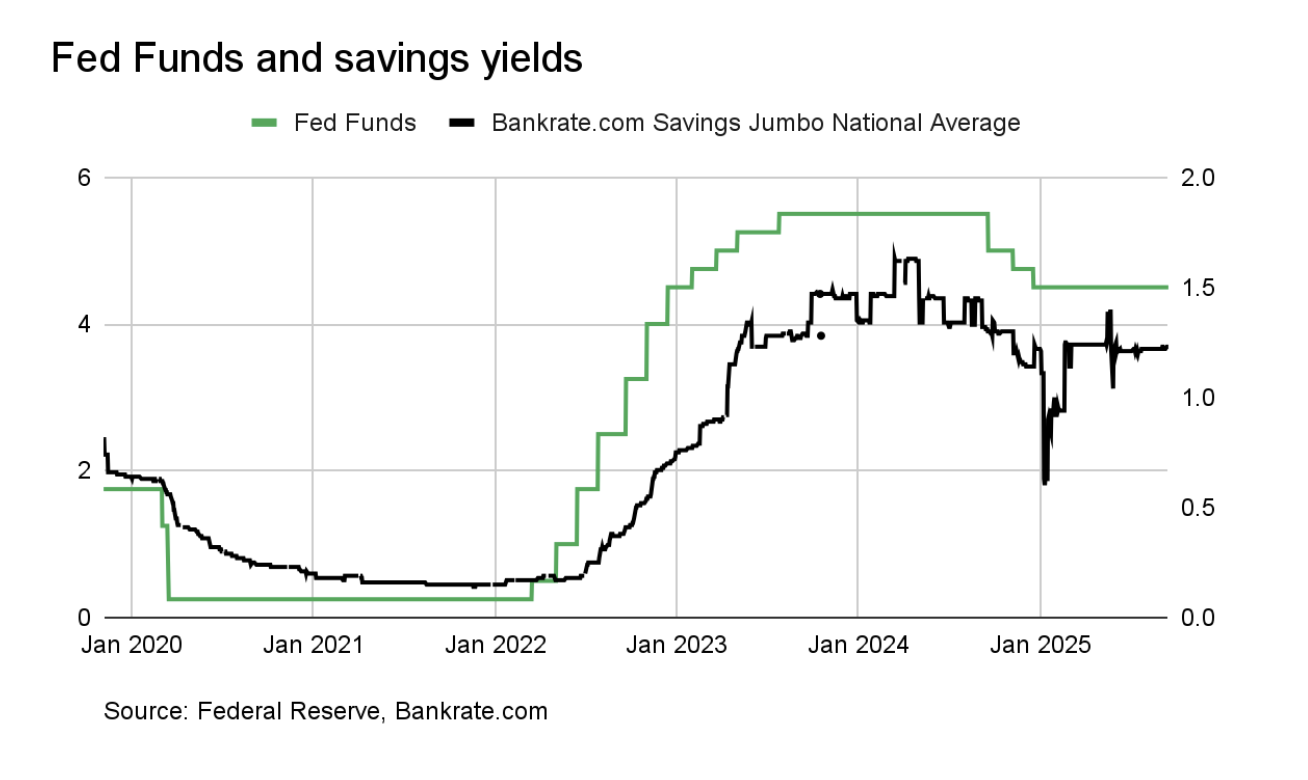

- When the Fed cuts rates, it directly affects the returns on high-yield savings accounts, new certificates of deposit (CDs), and money market funds. While these short-term vehicles can still be a place to park uninvested cash since they generate interest, their APYs typically decline following a federal funds rate cut.

- That said, lower rates can also be good news for consumers. When the federal funds rate declines, interest rates on certain credit cards, car loans, mortgages, and other types of borrowing may fall as well—though the timing and extent of those changes can vary. In practice, a Fed rate cut can mean lower costs on new loans and, in some cases, reduced rates on existing debt, such as adjustable-rate mortgages or credit cards.

- On the other hand, when the Fed raises the target federal funds rate, borrowing becomes more expensive. Interest rates on certain new loans tend to rise, but at the same time, APYs on savings and other interest-bearing accounts may also increase.

Why do interest rates change?

In periods of rapid inflation, such as in 2022, the Fed may turn to contractionary monetary policy by raising interest rates. This makes borrowing more expensive, prompting banks to charge higher rates on loans—including those made to one another. The goal of higher rates is to encourage saving over spending, slow economic activity and demand, and ultimately help stabilize prices.

On the other hand, if the U.S. is in a recession and the Federal Reserve wants to stimulate the economy, it may cut interest rates, giving commercial banks more money to lend. Banks then lower their lending rates to encourage borrowing. With cheaper loans, consumers are more likely to borrow and spend, while saving becomes less attractive because deposit returns are smaller. This boost in spending helps fuel economic growth.

Finally, changes in the federal funds rate can also sway the stock market. At its core, investing is about participating in potential future cash flows and income. To value those future earnings, investors discount them back to today’s value using interest rates. All else equal, higher rates reduce the present value of future cash flows, lowering investment valuations. Conversely, falling rates are generally seen as positive for long-term stock market valuations.

Takeaway

The Federal Reserve has a dual mandate: to support economic growth while keeping inflation under control. One of its primary tools is the federal funds rate. During periods of high inflation, the Fed raises this rate to help stabilize prices. At other times, officials may lower rates to stimulate the economy. For investors, these shifts can be a double-edged sword—affecting both the cost of borrowing and the yields earned on investments.

New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Stock rewards not claimed within 60 days may expire. See full terms and conditions at rbnhd.co/freestock. Securities trading is offered through Robinhood Financial LLC. Futures trading offered through Robinhood Derivatives, LLC.