Lump sum or regular investing?

The value of your investments and the income you receive from them can go up and down, and you may get back less than you invest. Any examples are for illustration purposes only.

Two investors. One has lived by the mantra ‘time in the market beats timing the market’ so plans to invest their £100,000 windfall (lucky duck) all at once and let compounding do its job over the years. Our other investor knows time is important but what if the market drops tomorrow and takes the whole amount with it? To reduce this risk, they plan to invest their £100,000 at regular intervals over time instead. Who’s right?

Lump sum investing vs regular investing

It would take 200 months (16 years and 8 months) to dripfeed £100,000 into the market, with investments of £500 each month, so that’s the time horizon we’re working with. For this experiment, we’ll choose a reasonable 5% growth rate, which is very unlikely to stay consistent and will naturally change from year to year, so this is very much an illustrative example.

| Initial investment | Monthly investment | Average growth rate | Time frame | Future investment value |

| £100,000 | £0 | 5% | 16yrs 8mo | £225,504.38 |

| £0 | £500 | 5% | 16yrs 8mo | £154,026.23 |

Source: Robinhood

While our regular investor has achieved a 54% return on their starting amount, our first investor would have generated a 125.5% return simply by having more of their money in the market even with the ups and downs. With too much sitting on the side lines for too long, our regular investor just wasn’t giving their money the chance to compound over time.

Read more

How to pick ‘forever’ stocks

Do I need to get every stock pick right?

Your £0 to £100,000 investment journey

They may have had a smoother journey, with monthly investments catching market highs and lows, but this has been at the expense of being able to generate that snowball effect of returns building on returns over the long term. What if they were able to pounce at exactly the right times, though? Would that ability to invest precisely at market troughs make up for not having invested it all at the start?

Does timing the market work?

Let’s put it to the test.

We’ve assembled a motley crew of five investors with varying attitudes to how regular they invest. The only similarity is that they all received $2,000 at the start of every year between 2001 and 2020 to invest.

Over that time, our Perfect Pouncer managed to wait and jump into the market every year at exactly the right time. They caught the lowest point of the US S&P 500 Index consistently with every investment. You can do this when you’re hypothetical, you see.

The Automator received their $2,000, invested it in the S&P 500 and got on with their life. Every year.

Our Monthly Investor took their $2,000, chopped it up into 12 portions and invested it at the start of every month in a bid to smooth out their journey.

Someone give our Terrible Timer a hug. They tried their best to time the market but ended up catching the highest point of the market with their $2,000 every year instead.

The Snoozer was so sure a better opportunity was round the corner that they squirreled away their cash and never ended up investing it in the S&P 500. They held US Treasury bonds for the whole time.

Drumroll, please…

It’s maybe no surprise to see our Perfect Pouncer come out on top but let’s go beyond the stats for a second and add a layer of reality to the whole picture. No matter who you are, timing the market is nigh-on impossible. You might get a few calls right but basing an entire long-term strategy on achieving nothing but the best entry points is unreasonable and, frankly, stressful. Get it wrong and you could easily turn into our Terrible Timer.

Read more

How to handle volatility

Are you holding too much cash?

Freedom to invest: our UK investor survey

Probably the most interesting aspect is how close our regular investors got to the top spot. Both strategies stripped the stress and temptation to let emotions run the process out of it all. If you were to ask either if they would swap that for a roughly 12% uplift in value overall, would they take it? Critically, though, their processes are actually possible to put into practice.

The Automator might have asked you for every one of their $2,000 handouts upfront, so they could maximise their time in the market, but that brings us to another injection of reality. Most of us don’t have the luxury of a huge amount to invest right from the very beginning. Getting paid monthly, paying bills monthly and managing our accounts monthly are all the norm so it can make sense for us to follow suit with our investing. The good news is that history tells us it can be a beneficial strategy as well as a convenient one, even if past performance isn’t a guide to what returns we could achieve in the future.

Still tempted to try jumping in and out of the market?

Timing the market could cost you $25,000

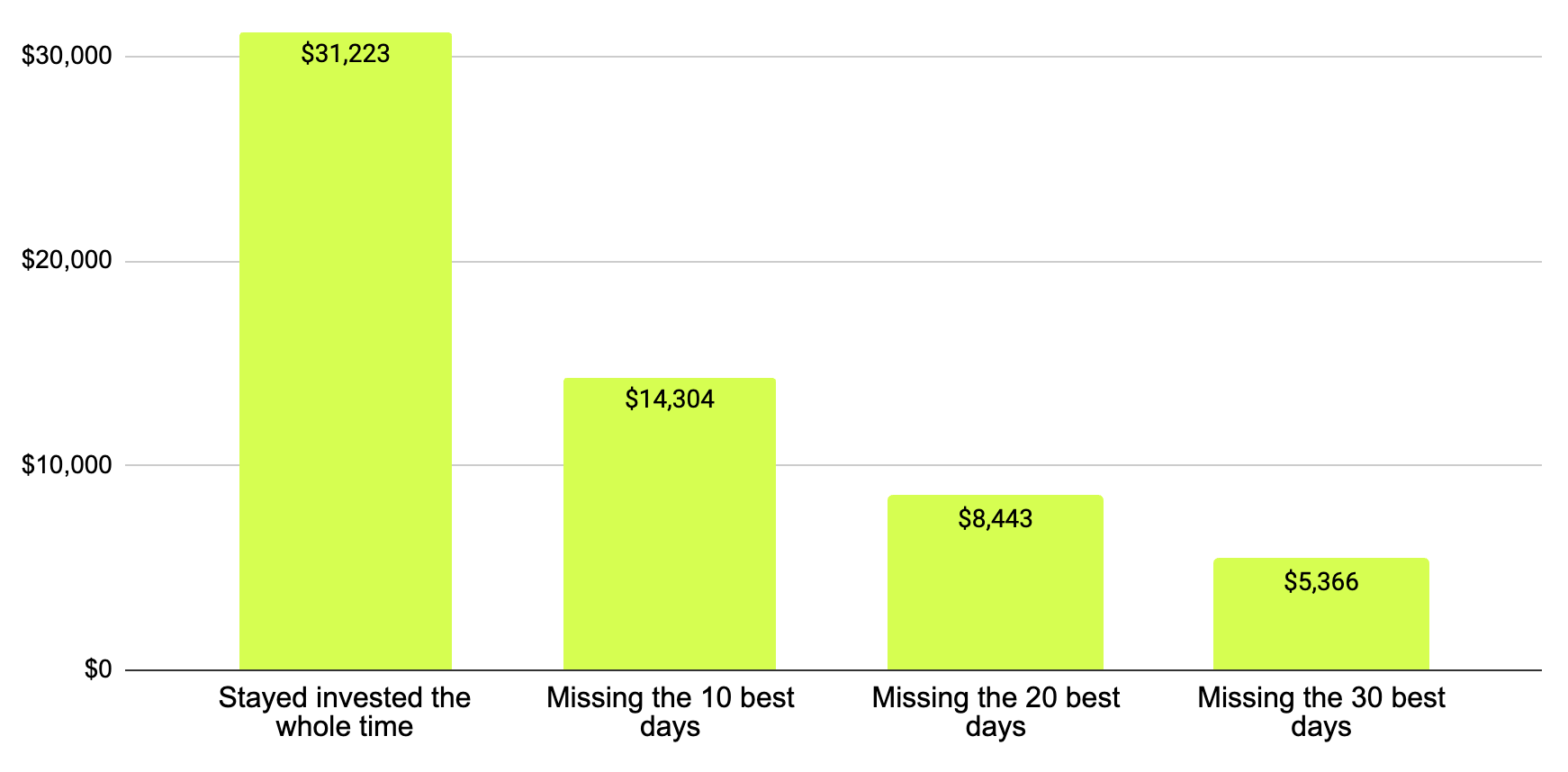

There’s a difference between opportunism and making entire leaps in and out of the market. Traders might eye up opportunities in the run up to company results but they’ll likely still have a broader portfolio humming along in the background. It’s a distinction to understand well, as Schroders shows. If, instead of staying put in the market from January 1988 to June 2022, you had hopped in and out of the market and missed some of the best days for the S&P 500, you could have done real damage to your returns.

$1,000 invested in the S&P 500, January 1988 - June 2022

Source: Schroders Wealth Management, August 2022.

The best days in the market often follow some of the worst, so itchy trigger fingers hitting the sell button when times looked tough could have stopped investors benefiting from any rebound after short-term fears cleared up.

The point here is that timing the market can work - when it’s executed perfectly. If it isn’t, you run the risk of hurting your portfolio instead. Staying invested the whole time can be better for our sanity and our returns and, failing that, having a consistent approach to investing regularly in line with our other financial responsibilities can be the most reasonable option we have.

The end result is that, as all long-term investing benefits from time and that’s what lump sum investing achieves, it can be a useful way to put that money to work. Regular investing is much more in line with how most of us live our lives and helps us stay away from trying to time the market.

Discrete calendar year performance

| 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | |

| S&P 500 | 21.8% | 0.8% | 16.6% | 25.9% | 4.5% |

As at 16 June 2025. Source: FE Fundinfo. Past performance is not a reliable guide to future gains or indicative of future performance.

Important information

When investing, your capital is at risk. The value of your investments, and the income you receive from them, can go down as well as up and you may get back less than you invest. Forecasts aren’t a reliable guide to future results or returns.

Make sure to do your own research on what investments are right for you before investing or consider seeking expert financial advice. Please note that this article is meant for information and does not constitute any financial advice. This is not an offer, recommendation, inducement or invitation to buy, sell, or hold any securities, or to engage in any investment activity or strategy.