Should I still invest when the market hits all-time highs?

The value of your investments and the income you receive from them can go up and down, and you may get back less than you invest. Any examples are for illustration purposes only.

If you’ve ever got that glorious phone call telling you you’ve got the job, you’ll remember the feeling. An initial wave of joy and relief, followed by a pang of trepidation later on. If the TikToks of newly-informed parents are to be trusted, it seems like there’s a similar pattern there too.

Stock market all-time highs tend to prompt similar reactions albeit with less of the magnitude that comes with a growing family. Investors often allow themselves a mental fist pump before the worry sets in. What comes next is normally down to our own biases, whether we snatch at the chance to make an exit at the top of the market, or freeze while we go back and forth so much the moment passes. No-one chooses to invest even more at the highest point in history, surely?...Surely?

Read more

Do I need to get every stock pick right?

Reframing risk: five points to clear the fear

Consumer stocks are the latest market barometer

It’s all particularly relevant at the moment, as UK and US indices scale new heights. The FTSE 100 edged its nose above the 9,000 level on Tuesday for the first time as some investors have sought refuge in markets relatively less exposed to US tariff trauma. At the same time, US markets have shrugged off trade tensions, choosing instead to boost the S&P 500 and NASDAQ 100 to fresh highs ahead of a slew of tech earnings.

So, taking our psychology out of the equation for a second, what does history tell us has been the best course of action when the stock market hits an all-time high? Sell up and wait for a pullback, stick around and do nothing or put a bit more into the market at its peak?

Hopefully it goes without saying that nothing we talk about here is a sign to go off and rashly buy or sell anything and any history gazing is just to provide context and to illustrate our points. As always, past performance is no guarantee of what might happen in the future.

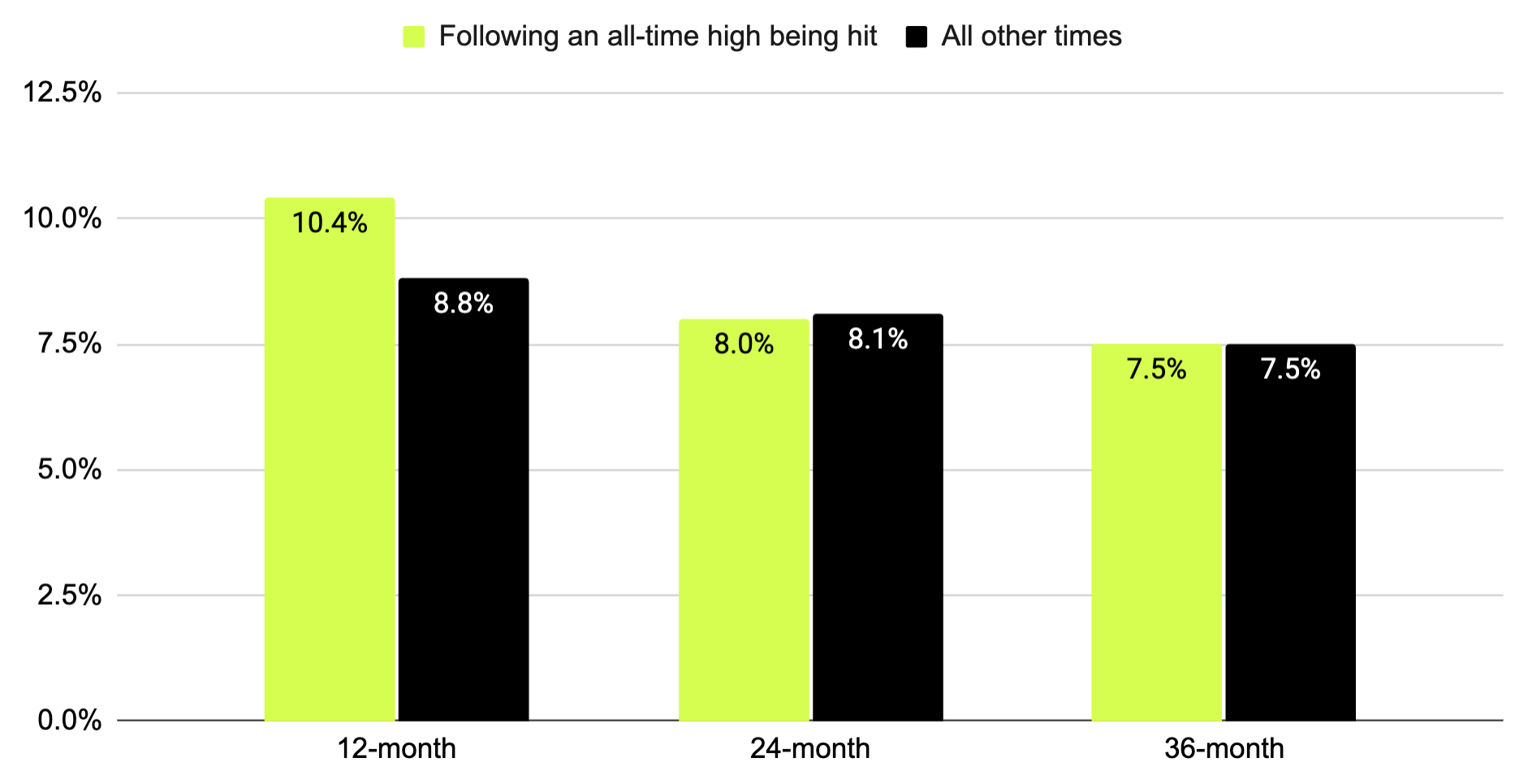

Stock market returns after an all-time high versus all other times

Average inflation-adjusted annual returns for US large-cap equities, 1926-2024

Stocks represented by Ibbotson SBBI US Large-Cap Stocks, Cash by Ibbotson US 30-day Treasury Bills. Data to December 2024. Sources: Schroders, Morningstar Direct.

The data suggests that not only has it been worth ignoring the urge to sell, it has actually been a benefit if you’ve managed to grit your teeth and invest even at the market peak.

That’s maybe at odds with what we might have thought but it goes back to markets demonstrating growth over time. So, even though market highs today might make for uneasy buying, in the long run those levels might look like just another stage on a much longer climb. It makes the case for not rushing to the exit and realising that we’re viewing the current market through our own small window of participation rather than the full widescreen version.

In fact, for long-term investors, switching to cash at market highs could end up being quite damaging.

Selling at all-time market highs can damage long-term wealth creation

| Growth of $100 invested X years ago | Invested in stocks throughout | Switched to to cash if previous month end was an all-time high | Wealth destroyed by switching |

| 10 years | $255 | $185 | -27% |

| 20 years | $433 | $268 | -38% |

| 30 years | $1,064 | $449 | -58% |

| 50 years | $5,627 | $2,035 | -64% |

| Since 1926 | $103,294 | $9,922 | -90% |

Growth of $100 in inflation-adjusted terms. Data January 1926 - December 2024. Switching strategy moves into cash for the next month when the previous month end was an all-time high, amd is invested in stocks when it wasn’t. Excluding transaction costs. Stocks represented by Ibbotson SBBI US Large-Cap Stocks, Cash by Ibbotson US 30-day Treasury Bills. Sources: Schroders, Morningstar Direct.

This underlines the fact that we can’t tell the future and trying to jump in and out of the market is a bit like switching queues at the supermarket only to see your original checkout line move without you. Unfortunately, for long-term investors leaping into cash, there’s another hurdle in finding the perfect time to get back in. If you feel a better time is just around the corner you might end up sitting on the bench for a lot longer than you had planned.

It may be that you feel a market drop coming and you’re trying to protect yourself by selling. It’s a reasonable thought but history shows us markets tend to rise over time despite whatever short-term volatility strikes. We need to remember that volatility is the price we pay, as investors, for the hopeful long-term outperformance of shares over cash.

Steadily drip-feeding your cash into the market and trying not to make note of particular high or low points can be the most sustainable way for many of us to invest. It takes the guesswork out of it all and saves us from making emotional decisions in the face of charts that might spur us into action. If you’re taking the long-term view, stick to it and try not to get swayed by the day-to-day. As history shows us, new all-time highs are hit all the time so taking yourself out of the market at the most recent one means you’re scuppering your chances of reaching the next one, however volatile the journey might be.

Discrete calendar year performance

| 2020-21 | 2021-22 | 2022-23 | 2023-24 | 2024-25 | |

| FTSE 100 | 15.2% | 6.0% | 7.9% | 14.5% | 13.3% |

| NASDAQ 100 | 26.8% | -4.5% | 18.4% | 33.5% | 8.2% |

| S&P 500 | 24.4% | 4.7% | 6.6% | 27.6% | 8.5% |

As at 15 July 2025. Source: FE Fundinfo. Total return basis, in sterling terms. Past performance is not a reliable guide to future results.

Important information

When you invest your capital is at risk. Past performance is not a reliable guide to future results. Your investments and the income you receive from them may go down as well as up so you may get back less than you invest.

Make sure to do your own research on what investments are right for you before investing or consider seeking expert financial advice. Please note that this article is meant for information purposes only and does not constitute financial advice. Any hypothetical examples are provided for illustrative purposes only. Actual results will vary.

We don't charge commission fees when you buy or sell stocks but contract fees apply to stock and index options. Other costs apply. See our fee schedule.

Options are complex products, involve significant risk and are not suitable for all investors. You could lose more than your initial invested capital. You should only invest in financial products that match your knowledge and experience. Please review Characteristics and Risks of Standardized Options prior to engaging in options trading.