Chevron

Trade Chevron 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About CVX

Chevron Corp. engages in the provision of oil and gas energy solutions. It provides crude oil and natural gas, manufactures transportation fuels, lubricants, petrochemicals, and additives, and develops technologies that enhance business and the industry.

CVX Key Statistics

Stock Snapshot

As of today, Chevron(CVX) shares are valued at $190.52. The company's market cap stands at 380.16B, with a P/E ratio of 28.66 and a dividend yield of 3.6%.

On 2026-03-09, Chevron(CVX) stock moved within a range of $189.06 to $196.36. With shares now at $190.52, the stock is trading +0.8% above its intraday low and -3.0% below the session's peak.

Trading activity shows a volume of 7.59M, compared to an average daily volume of 11.06M.

Over the past 52 weeks, Chevron(CVX) stock has traded between a high of $196.36 and a low of $132.04.

Over the past 52 weeks, Chevron(CVX) stock has traded between a high of $196.36 and a low of $132.04.

CVX News

Crude oil prices have gone hyperbolic since the U.S. and Israel launched attacks against Iran earlier this month. Brent, the main global oil benchmark, is up ov...

Oil surging past $100 per barrel is driving gains for Exxon and Chevron while Berkshire Hathaway faces headwinds from its Apple stake and consumer-facing busine...

There are countless ways for investors to make money on Wall Street, but few are as consistently successful as buying and holding high-quality dividend stocks....

Analyst ratings

57%

of 30 ratingsMore CVX News

Chevron (NYSE:CVX) has completed its acquisition of Hess Corporation, adding a major interest in Guyana’s Stabroek block to its portfolio. The company is also...

Even before factoring in Monday's monster surge in oil and gas stocks, the energy sector was already up 24.2% year to date compared to just 0.5% for the S&P 500...

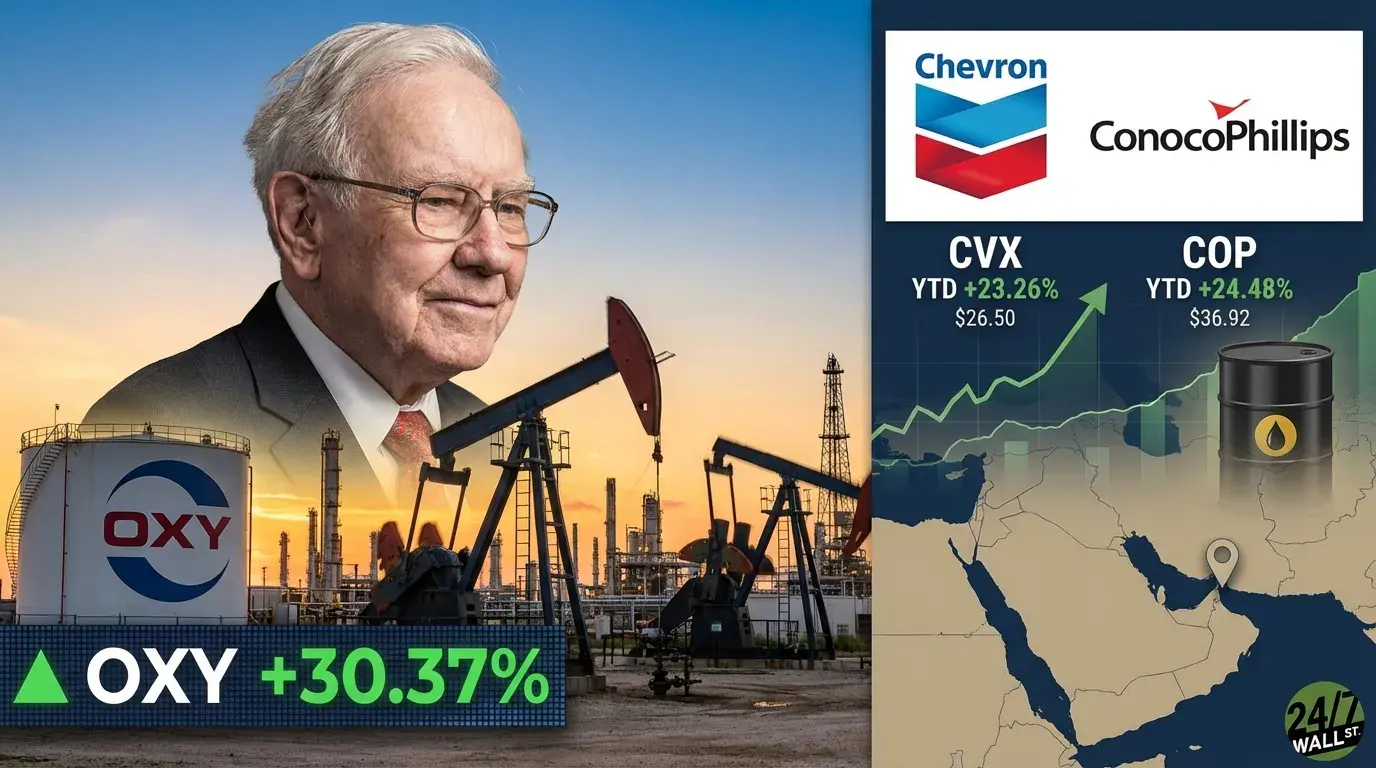

Wall Street Is Quietly Pricing In $100 Oil, And These Two Energy Giants Are the Biggest Winners Quick Read Exxon (XOM) is up 26.52% YTD and Chevron (CVX) is up...

Key Points In his letter to shareholders, new Berkshire Hathaway CEO Greg Abel listed four companies that he views as "core holdings" in the large equities por...

Chevron completed its acquisition of Hess, securing access to the Stabroek block offshore Guyana and reshaping its production profile. The company expanded int...

If Oil Hits $100 These Are the Energy Dividends You Want to Own Quick Read Exxon Mobil (XOM) is up 25.35% with $26.13B free cash flow and 2.63% yield, Chevron...

Warren Buffett’s Oil Bet Looks Genius, Here Is What to Buy Next Quick Read Occidental Petroleum (OXY) rose 30.37% year-to-date and slashed debt by $5.8B after...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.