Disney

Trade Disney 24 hours a day, five days a week on Robinhood.

Robinhood gives you the tools to revolutionize your trading experience. Use the streamlined mobile app, or access advanced charts and execute precise trades on our browser-based platform, Robinhood Legend. Risks and limitations apply.About DIS

The Walt Disney Co. engages in the business of international family entertainment and media enterprise. It owns and operates television and radio production, distribution and broadcasting stations, direct-to-consumer services, amusement parks, and hotels.

DIS Key Statistics

Stock Snapshot

Disney(DIS) stock is priced at $100.60, giving the company a market capitalization of 178.18B. It carries a P/E multiple of 15.09 and pays a dividend yield of 1.2%.

During the trading session on 2026-03-06, Disney(DIS) shares reached a daily high of $102.50 and a low of $99.95. At a current price of $100.60, the stock is +0.7% higher than the low and still -1.9% under the high.

Trading volume for Disney(DIS) stock has reached 4.43M, versus its average volume of 11.46M.

The stock's 52-week range extends from a low of $80.10 to a high of $124.69.

The stock's 52-week range extends from a low of $80.10 to a high of $124.69.

DIS News

Walt Disney (NYSE:DIS) has appointed parks chief Josh D'Amaro as its next CEO, signaling a leadership shift centered on its Experiences segment. The company ha...

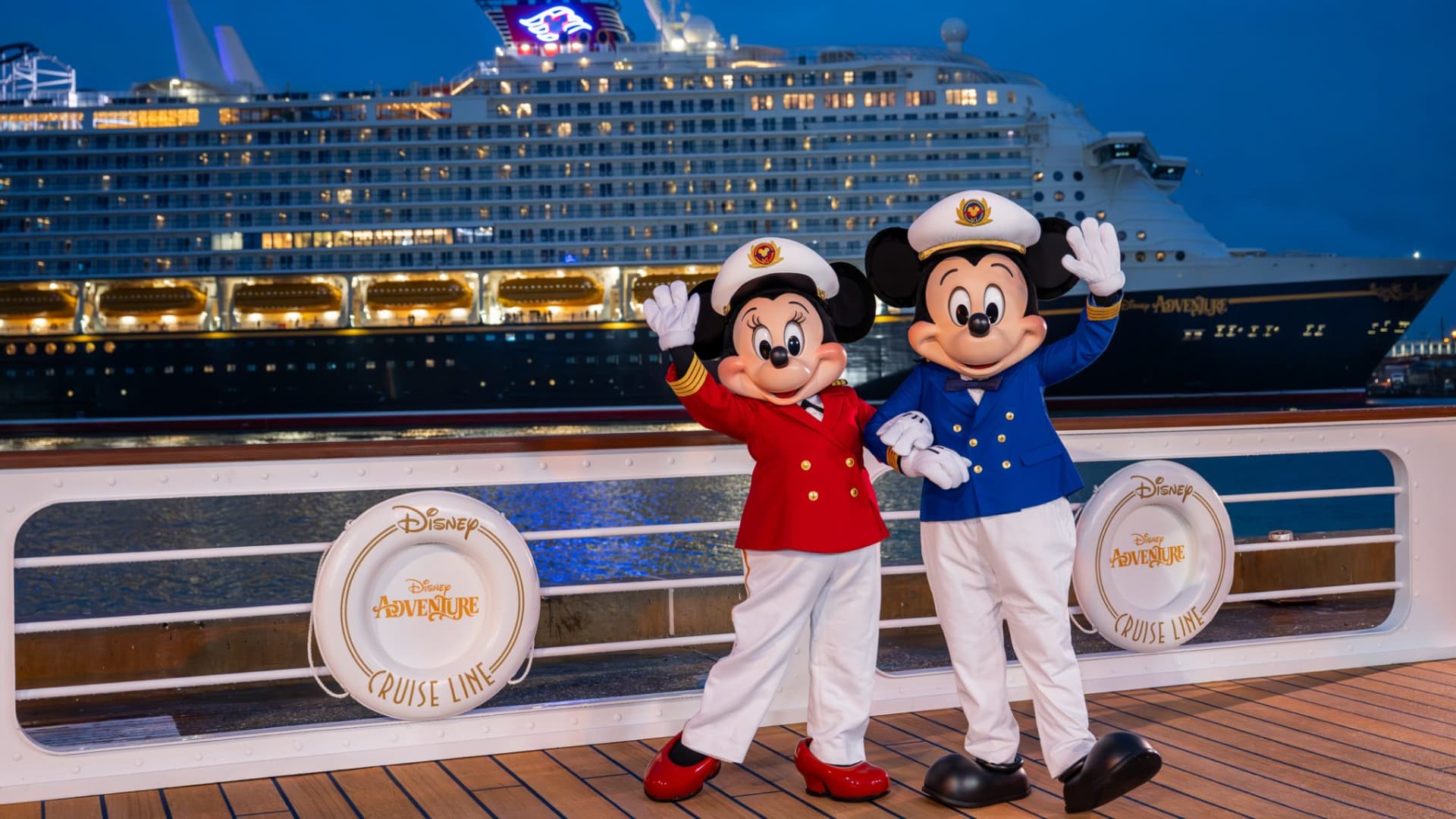

Key Points The Disney Adventure embarks on its maiden voyage this month as the eighth and largest ship in Disney's cruise line. It will set sail from Singapore...

On CNBC's “Halftime Report Final Trades,” Sarat Sethi, DCLA, said he is sticking with The Walt Disney Company (NYSE:DIS) . Burbank, California-based Disney nam...

Analyst ratings

85%

of 33 ratingsMore DIS News

Walt Disney (NYSE:DIS) announced that Senior Executive Vice President and Chief Communications Officer Kristina Schake will depart the company, aligning her exi...

An update from Walt Disney ( (DIS) ) is now available. On February 27, 2026, The Walt Disney Company renewed and expanded its liquidity framework by entering a...

Image source: The Motley Fool. Tuesday, March 3, 2026 at 4:30 p.m. ET CALL PARTICIPANTS Founder and Chief Executive Officer — Junkoo Kim Chief Financial Office...

Advertisement Recent Performance Snapshot Walt Disney (DIS) has seen mixed share performance recently, with about a 1.6% decline over the past day, flat movem...

Finally! You can open a SoFi Crypto account and access 25 plus cryptocurrencies without juggling apps or logins. This post may contain links from our sponsors...

The new CEO at entertainment giant Disney (DIS), Josh D’Amaro, has already started making changes, and one of them will be quite the heel-face turn. Disney’s Vi...

People also own

Similar Marketcap

This list is generated by looking at the six larger and six smaller companies by market cap in relation to this company.

Popular Stocks

This list is generated by looking at the top 100 stocks and ETFs most commonly held by Robinhood customers and showing a random subset

Newly Listed

This list is generated by showing companies that recently went public.