Request shares today

Robinhood Ventures Fund I (RVI) is here. Explore some of the portfolio companies, learn more about their stories, and get a deeper look into the fund.

Fund I Roadshow

Robinhood Chairman & CEO Vlad Tenev and fund management took us through Fund I, spoke on strategy, and highlighted some of the portfolio companies. Read the RVI Preliminary Prospectus

Get to know the companies

Every company has a story.

Learn about a few of the Fund I portfolio companies straight from their CEOs.

The speakers are not employed by or affiliated with Robinhood Markets, Inc., its subsidiaries, or RVI (“Robinhood”). Views are their own and do not necessarily reflect Robinhood.

Databricks

Mercor

Ramp

Airwallex

Oura

Boom

Institutional conversations

Watch these institutional sit-downs, and hear the fund management answer questions from investors.

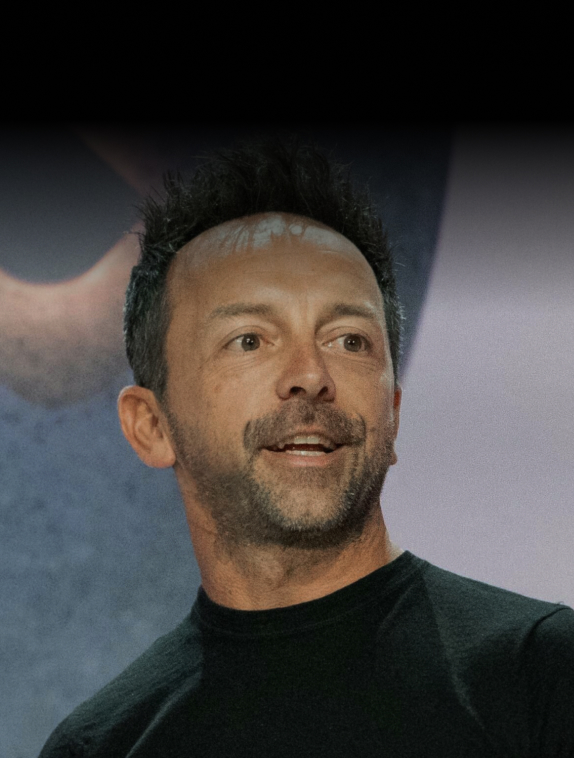

Brad Gerstner

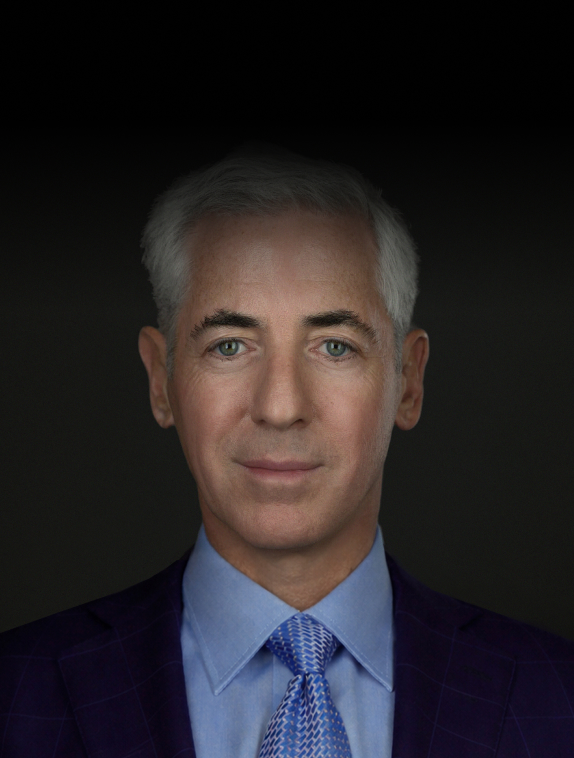

Bill Ackman

Learn More About Robinhood Ventures Fund I

What is a closed-end fund?

A closed-end fund is an investment company that is registered under the Investment Company Act of 1940. A closed-end fund does not offer investors redemption rights and can invest up to 100% of its assets in illiquid investments. RVI plans to list on a national securities exchange to provide investors with the ability to trade shares of the fund.

What will RVI invest in?

RVI’s investment program focuses on a concentrated portfolio of private companies at the frontiers of their respective industries. RVI holds investments for the long term through the initial public offering (IPO) and beyond, and seeks to invest across a number of sectors.

Will I know what companies RVI invests in?

Yes. RVI provides the public with periodic disclosures, including a schedule of investments that shows the name of each issuer in which RVI has invested.

Do I need to be an “accredited investor” to invest in RVI?

No. RVI plans to conduct an initial public offering (IPO) that will not be limited to accredited investors, and following its IPO will be a publicly traded fund.

Who manages RVI’s investments?

RVI’s investments are managed by Robinhood Ventures DE, LLC, which is registered as an investment adviser with the U.S. Securities and Exchange Commission under the Investment Advisers Act of 1940. Robinhood Ventures DE, LLC was formed in August 2025, has limited investing history and is a wholly owned subsidiary of Robinhood Markets, Inc.

A registration statement relating to common shares of beneficial interest of Robinhood Ventures Fund I (“RVI”) has been filed with the Securities and Exchange Commission (the “SEC”) but has not yet become effective. The information in the registration statement and this communication is not complete and may be changed. We may not sell these securities until the registration statement filed with the SEC is effective. This communication is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. Any offers, solicitations of offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended. The offering of common shares of beneficial interest of RVI will be made only by means of a prospectus forming part of the registration statement. You may get these documents for free by visiting the SEC website at www.sec.gov. Alternatively, copies of the prospectus, when available, may be obtained by contacting Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, New York 10282, telephone: 1-866-471-2526, or by emailing prospectus-ny@ny.email.gs.com; or from RVI by emailing corporate-legal-group@robinhood.com. Investors are advised to carefully consider the investment objectives, risks and charges and expenses of RVI before investing. The prospectus, which will contain this and other information about RVI, should be read carefully before investing.

Forward-Looking Statements

This communication includes “forward looking statements,” including with respect to RVI’s proposed initial public offering and RVI’s current and prospective portfolio investments. These statements include statements about our ability to register the public offering of shares of RVI with the SEC, RVI’s investment objectives, RVI’s intent to hold a concentrated portfolio of private companies at the frontiers of their respective industries, RVI’s intent to hold these companies for the long term, whether any of RVI’s portfolio companies will themselves conduct an IPO, and other forward-looking statements. You can sometimes identify forward-looking statements through the use of words or phrases such as “will” or “expect” and similar words and expressions of the future. Forward-looking statements involve known and unknown risks, uncertainties and assumptions, including the risks outlined under “Risks” in the preliminary prospectus and elsewhere in RVI’s filings with the SEC, which may cause actual results to differ materially from any results expressed or implied by any forward-looking statement. RVI and Robinhood have no obligation, and do not undertake any obligation, to update or revise any forward-looking statement made in this communication to reflect changes since the date of this communication, except as required by law.