How to import your 1099 to a tax provider

For this tax year, you can import your Consolidated Form 1099 into common online tax providers, such as TurboTax and H&R Block.

Robinhood Markets Consolidated Form 1099

Your Consolidated 1099s for Robinhood Securities, Robinhood Crypto, Robinhood Derivatives, and Robinhood Money will be combined into a single PDF from Robinhood Markets, Inc.

- This combined PDF includes all the forms you need, where applicable, if you had a reportable event

- If you don’t have a reportable event, you won’t receive a Form 1099

- Certain tax forms aren’t included in this PDF, such as Form 1099 for joint investing accounts, Form 1099-R for IRAs, and Form 1042-S that are provided separately, if applicable

Import your 1099

When filing your taxes with your Consolidated 1099, make sure to:

- Select Robinhood Markets as the financial institution’s name

- Enter your master account number and document ID accurately

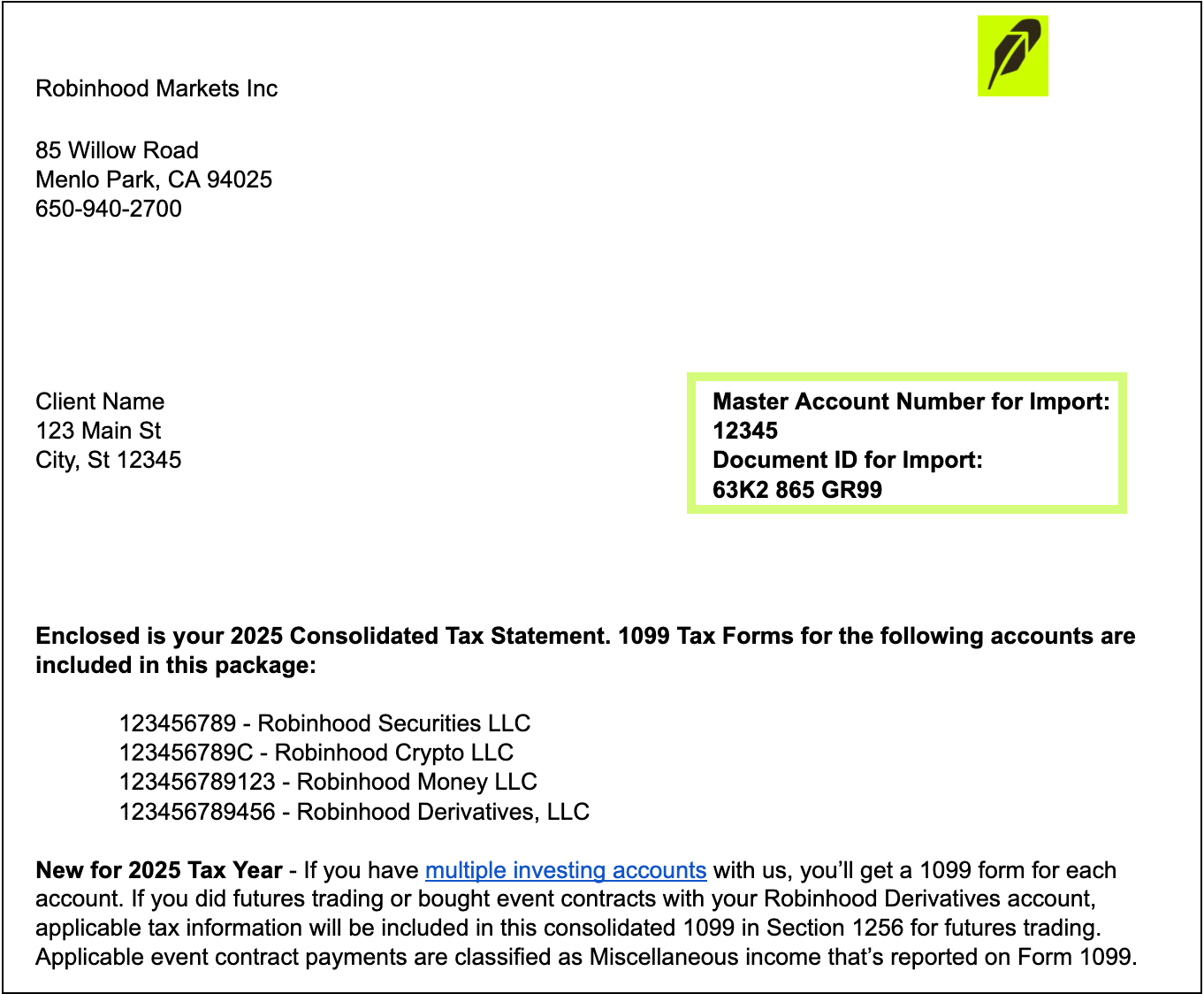

- Your master account number is a 9-digit number at the top right of the cover page of your Consolidated 1099 PDF.

- Your document ID is an 11-digit alphanumeric ID found at top right of the cover page of your Consolidated 1099 PDF. Enter this ID without the spaces.

If you have information in section 1256 of your Form 1099-B for this tax year, it will not automatically import to some tax providers like TurboTax or H&R Block. You’ll need to manually enter this information into their system.

Here’s an example of where you can find your master account number and document ID:

Import limits are dependent on the tax filing software you’re using. If you have more than 10,000 total transactions or more than 4,000 uncovered transactions (e.g., crypto), reach out to your tax provider for help importing.

My consolidated 1099 form file won’t import correctly

Here are some common reasons for why your file may not import correctly:

- If you have 1256 contracts included in your Consolidated 1099, you can’t import to TurboTax. You’ll need to enter the information manually into TurboTax.

- Sometimes tax forms take additional time to load for auto-import into tax software. If your data is unavailable the first few days after your tax document is issued, try again after a week.

- The master account number or document ID were entered incorrectly. You can find both of these numbers at the top of your cover page, and they should be entered without spaces.

- If you have more than 10,000 total transactions or more than 4,000 uncovered transactions (e.g., crypto), reach out to your tax provider for help importing.

Reach out to your tax provider directly for further questions on importing your 1099s.

How do I file for Robinhood Retirement and my 1099-R?

For Robinhood Retirement, if applicable, your Form 1099-R will be available by February 2, 2026 and your Form 5498 will be available by June 1, 2026. For reporting your 1099-R reportable transactions in your tax filing with a tax provider like TurboTax or H&R Block, make sure to select Robinhood Retirement when selecting your financial institutions.

Disclosures

All investments involve risk and loss of principal is possible.

TurboTax isn't an affiliate of Robinhood Markets, Inc. (“Robinhood”) or any of its subsidiaries. Robinhood makes no representations as to the accuracy or validity of TurboTax products.

Robinhood doesn't provide tax advice. For specific questions, you should consult a tax professional.