How to read your 1099-R and 5498

The Form 1099-R is required by the IRS for distributions received from individual retirement accounts (IRAs), such as with Robinhood Securities.

In conjunction with the Form 1099-R for distributions, you may also get a Form 5498 for contributions made into an IRA. If a Roth conversion is completed with Robinhood, you’ll get a 1099-R for the money that's leaving the Traditional IRA and a Form 5498 for the money that's moving into the Roth IRA. The IRS instructions for Forms 1099-R and 5498 have more details.

The IRS deadline for Robinhood to send your tax forms is February 2 for Form 1099-R and June 1 for Form 5498 for this tax year.

These examples are for informational purposes only and aimed at answering questions regarding the forms you’ll get from Robinhood. We don't provide tax advice. For specific questions about your tax situation, consult a tax professional.

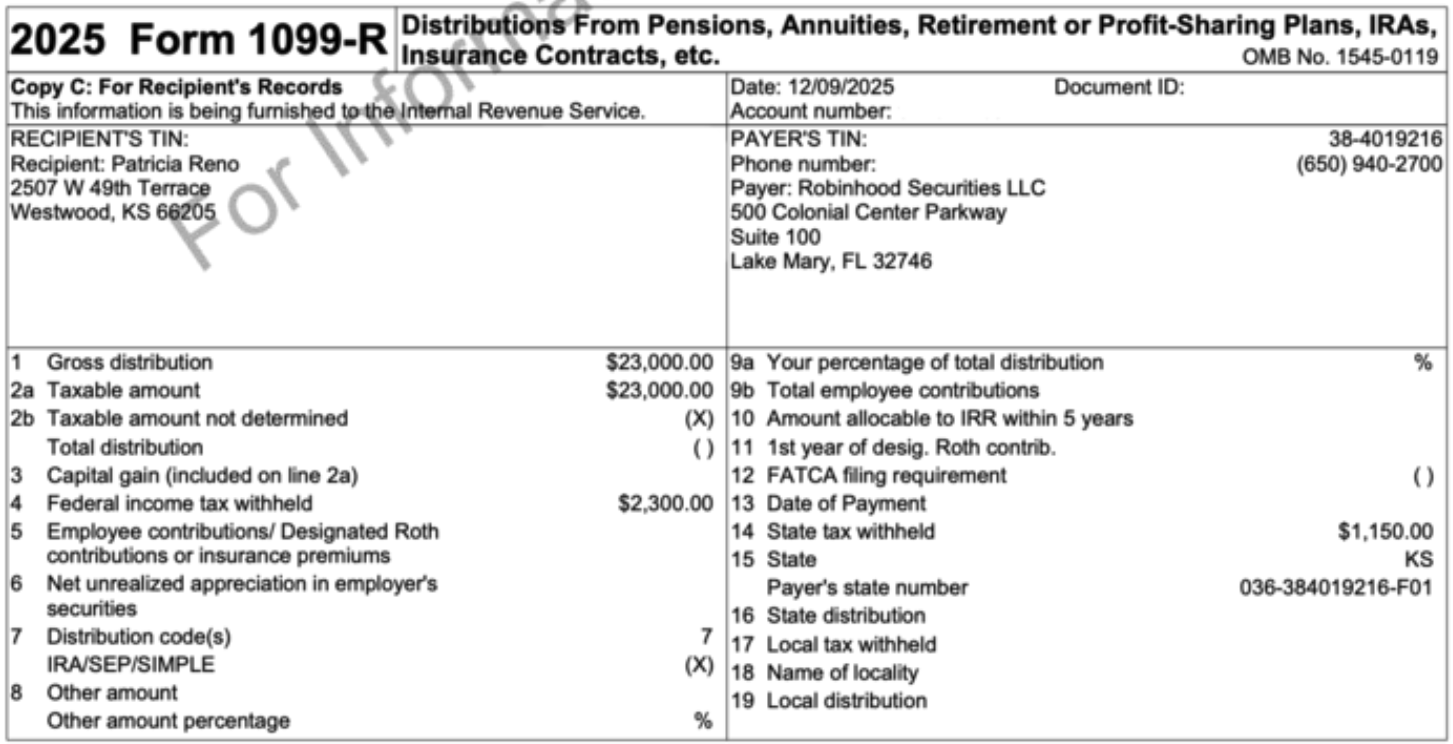

Form 1099-R

The following key information is included on a Form 1099-R:

- Robinhood’s name, address, and taxpayer identification number (TIN): You’ll need Robinhood’s payer TIN for your tax return

- Your account information, including your account number, document ID, address, and TIN: You’ll need your account number and document ID to import your 1099-R into your tax software provider

- Gross distribution: Shows what you withdrew from your retirement account this tax year

- Taxable amount: Shows the amount that could be taxable to you

- Federal income tax withheld: Shows the amount that was withheld for federal taxes

- State tax withheld: Shows the amount that was withheld for state taxes

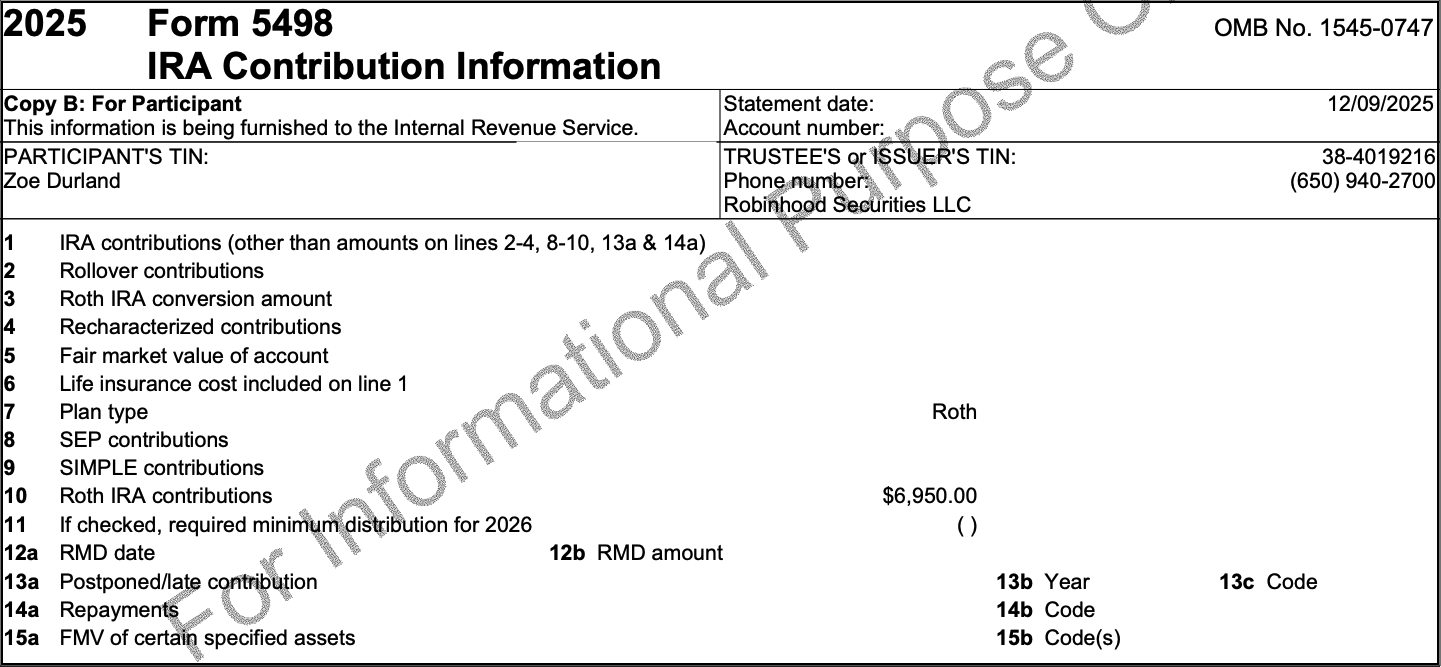

Form 5498

The following key information is included on Form 5498:

- Robinhood’s name, address, and taxpayer identification number (TIN)

- Your account information, including your account number, document ID, address, and TIN: You’ll need your account number and document ID to import your 5498 into your tax software provider

- IRA contributions: Shows the amount (other than amounts in Rollover contributions) of IRA contributions that were made from January 1, 2025 through April 15, 2026, designated for 2025

- Rollover contributions: Shows the amount of rollover contributions that you received during 2025

- Roth IRA conversion amount: Shows the amount converted from a traditional IRA to a Roth IRA in 2025

- Recharacterized contributions: Shows the amount recharacterized from transferring any part of a contribution (plus earnings) from one type of IRA to another

- Roth IRA contributions: Shows the amount contributed to a Roth IRA in 2025 and through April 15, 2026, designated for 2025

- If checked, required minimum distribution (RMD) for 2026: If required to withdraw an RMD in 2026, this box will be checked. You can request an RMD calculation from us, if necessary

Funds being contributed into or distributed from retirement accounts may entail tax consequences. Contributions are limited and withdrawals before age 59 1/2 may be subject to a penalty tax. Robinhood does not provide tax advice; please consult with a tax adviser if you have questions.

The Robinhood IRA is available to any of our US customers with a Robinhood brokerage account in good standing. Note, if you have a B-Notice, you won’t be able to open an IRA until your account restrictions are lifted.

FAQ

Yes. Per IRS rules, we’re required to report Forms 1099-R and 5498.

- Yes, you do need to file Form 1099-R with your taxes.

- You’ll use information from Form 5498 when filing your taxes, but generally don’t need to file this informational form with your taxes.

The IRS instructions for Forms 1099-R and 5498 have more details.

If you’re expecting a corrected Form 5498 because you requested an adjustment to a 2025 5498 reportable transaction, we typically send them monthly starting July 1, 2026.

Retirement contributions are reported based on the year for which they’re designated. For more details, review IRS instructions for Forms 1099-R and 5498.

Conversion contributions are reported in the year that they occur. If you converted to a Roth in 2026, then the conversion contribution will be reported on your Form 5498 for the 2026 tax year. For details, review Recharacterizations and Roth conversions.