IRA growth potential

To help you visualize the effects of compounding interest on your potential IRA returns over time, we used a hypothetical annualized rate of return of 8% for your invested IRA balance.

Keep in mind, your actual returns will vary and may be less than what’s shown in the following examples of potential growth of your IRA over the next 35-45 years. It’s important to remember that your returns are not guaranteed and these illustrations are hypothetical and not intended to represent an exact account value at any given time. Review Disclosures for more details about your risks.

Examples

Please note, the following examples do not account for the impact of investment or account fees, inflation, contribution changes, withdrawals, or any potential dividends.

You can use publicly available annual return calculators to see how much your match can grow based on your individual circumstances and time horizon.

Some of the following examples include an IRA match, which can only be earned in a self-directed IRA at this time. Accounts managed by Robinhood Strategies aren’t eligible for a match.

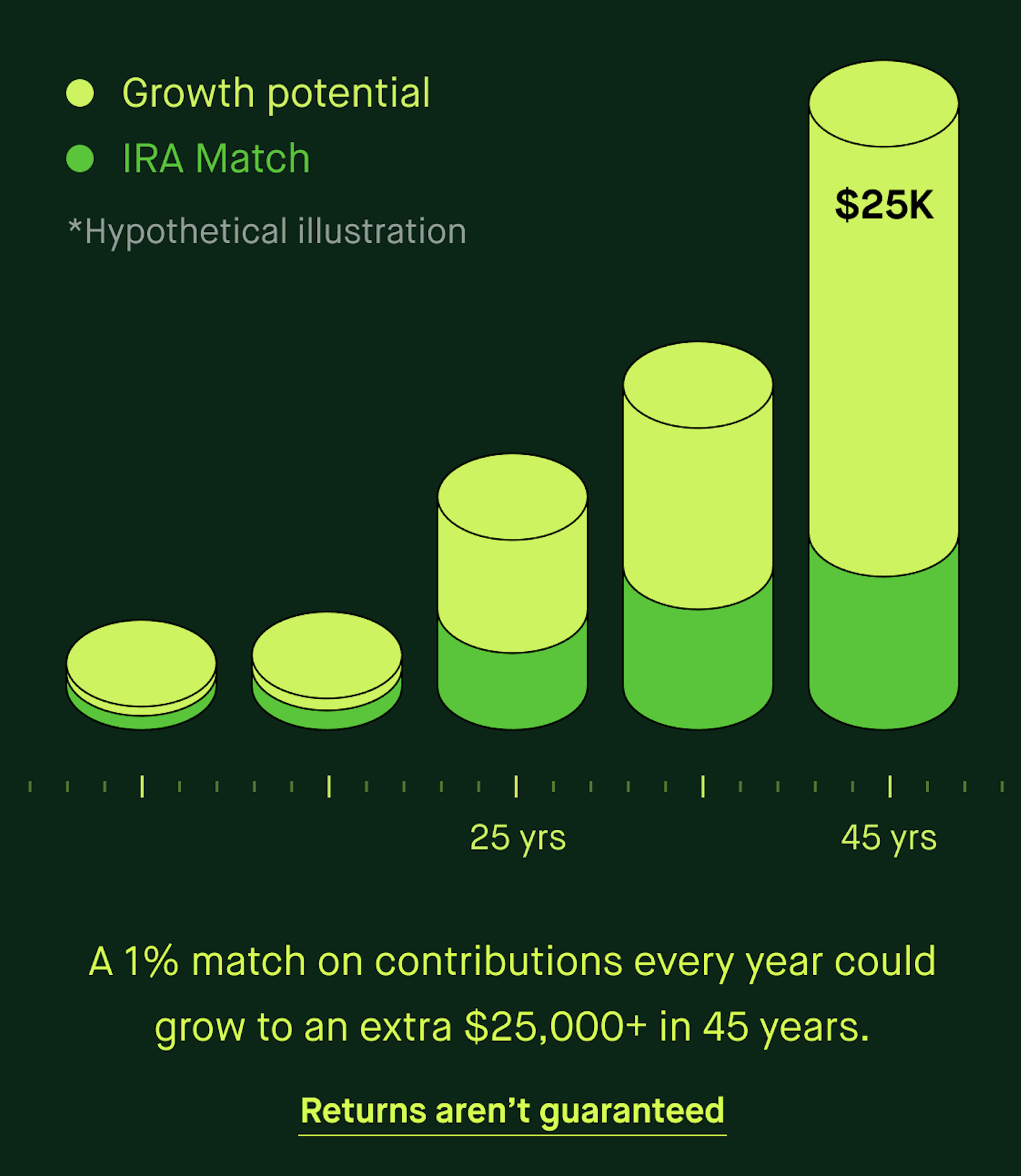

Example 1: Growth of 1% IRA match

Hypothetical and other assumptions:

- You contribute $7,500 to your self-directed IRA each year.

- You earn a 1% IRA match every year, which would be 1% multiplied by $7,500 equals $75 each year.

- You invest your full IRA match amount and earn an average of 8% each year over 45 years.

- The illustration assumes $7,500 is the maximum IRA contribution limit and doesn’t account for potential changes to contribution limits in the future. It also doesn’t account for catch-up contributions where the annual limit is more.

- For the purposes of illustrating the hypothetical growth of the 1% IRA match, the initial investment is $0. In actuality, you must contribute to earn a 1% match.

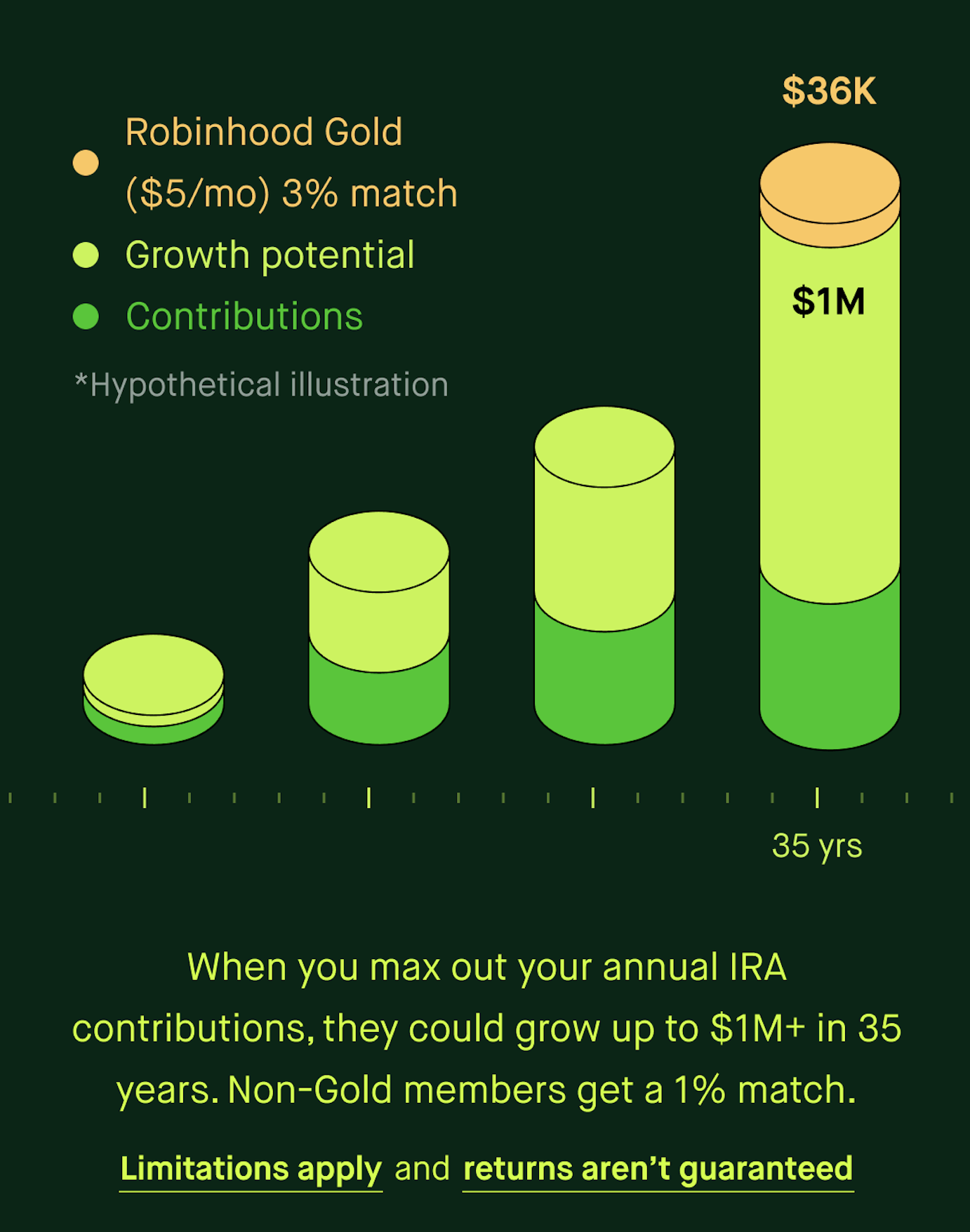

Example 2: Growth of $7,500 and 3% match per year

Hypothetical and other assumptions:

- You contribute $7,500 to your self-directed IRA each year.

- You earn a 3% IRA match with Robinhood Gold ($5/month; terms apply) every year, with each contribution, which would be 3% multiplied by $7,500 equals $225 each year. Although you earn an IRA match each year, the illustration only shows what the match compounded amount would be in 35 years.

- You invest your full IRA match amount and earn an average of 8% each year for over 35 years.

- The illustration assumes $7,500 is the maximum IRA contribution limit and doesn’t account for potential changes to contribution limits in the future. It also doesn’t account for the cost of a Robinhood Gold subscription fee (currently $5 monthly) or catch-up contributions where the annual limit is more.

- The illustration assumes a continuous subscription to Gold for the entire 35-year period. The subscription price is subject to change.

- For the purposes of illustrating the hypothetical growth of the 3% IRA match, the initial investment is $0. In actuality, you must contribute to earn a 3% match.

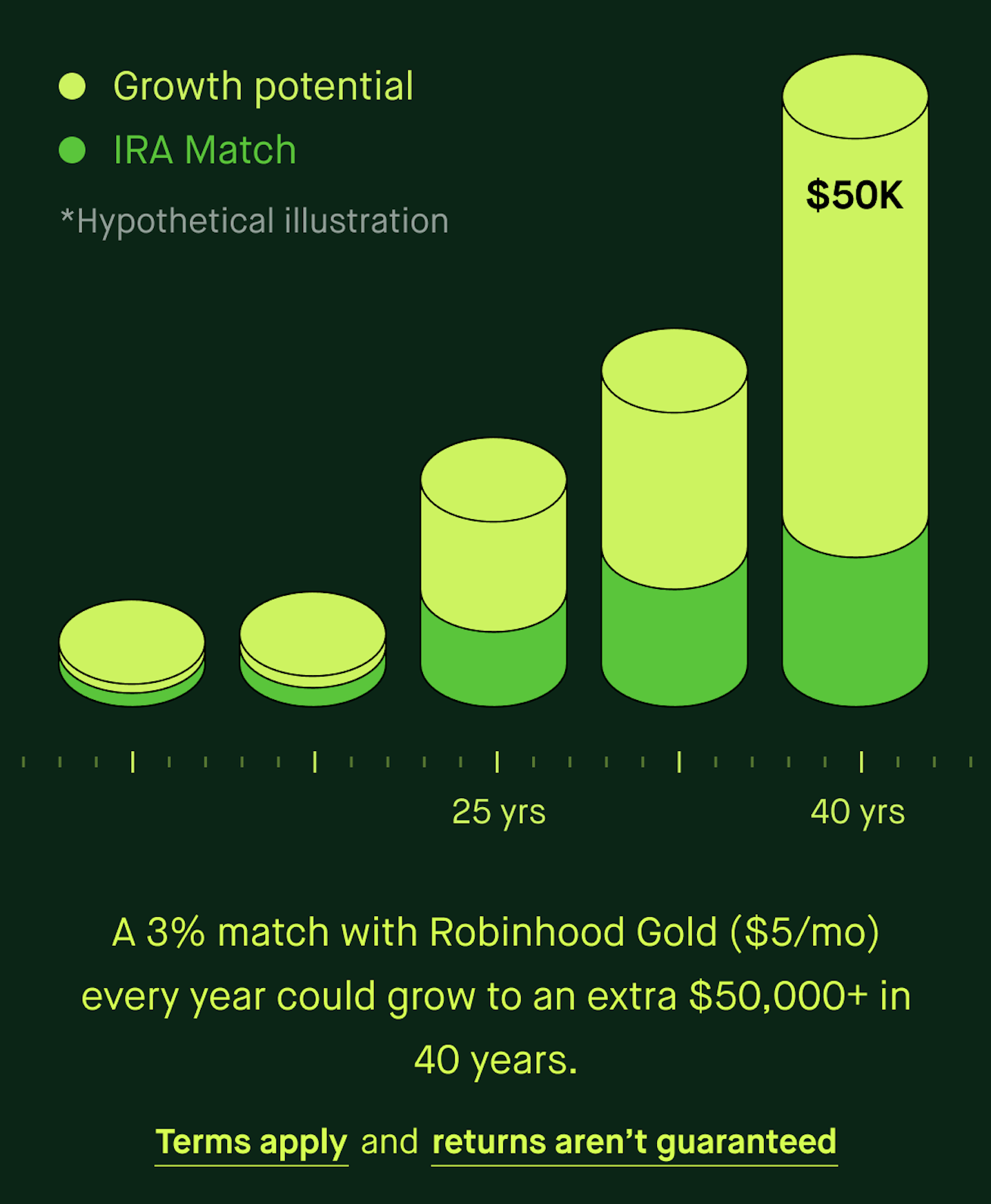

Example 3: Growth of 3% IRA match

Hypothetical and other assumptions:

- You contribute $7,500 to your self-directed IRA each year.

- You earn a 3% IRA match with Robinhood Gold ($5/month; terms apply) every year, which would be 3% multiplied by $7,500 equals $225 each year.

- You invest your full IRA match amount and earn an average of 8% each year for over 40 years.

- The illustration assumes $7,500 is the maximum IRA contribution limit and doesn’t account for potential changes to contribution limits in the future. It also doesn’t account for the cost of a Robinhood Gold subscription fee or catch-up contributions where the annual limit is more.

- The illustration assumes a continuous subscription to Gold for the entire 40-year period. The subscription price is subject to change.

- For the purposes of illustrating the hypothetical growth of the 3% IRA match, the initial investment is $0. In actuality, you must contribute to earn a 3% match.

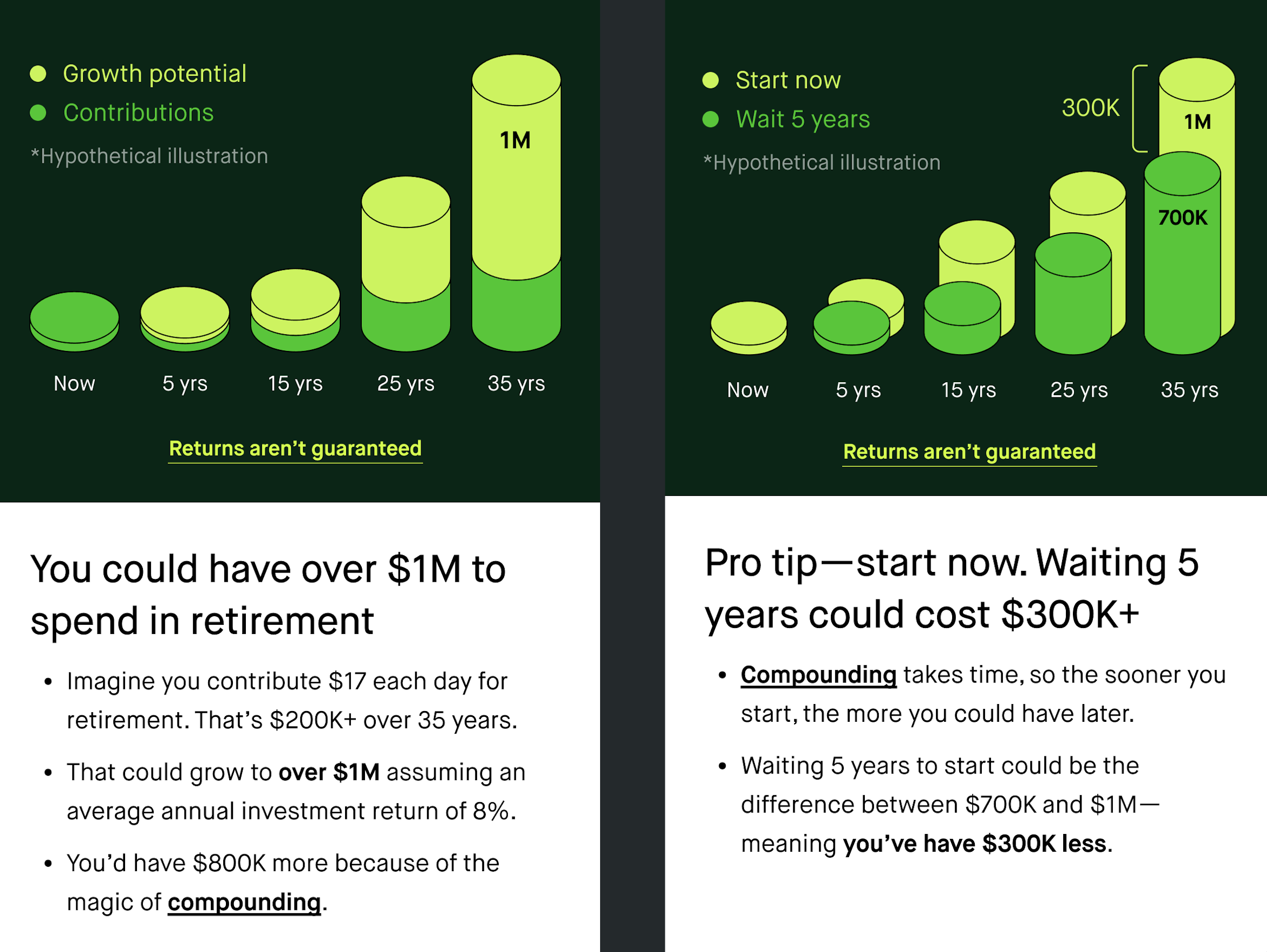

Example 4: Growth of $7,500 per year

Hypothetical and other assumptions:

- You contribute $7,500 to your IRA each year.

- You invest your full IRA balance and earn an average of 8% each year over 35 years.

- The illustration assumes $7,500 is the maximum IRA contribution limit and doesn’t account for potential changes to contribution limits in the future.

Disclosures

The hypothetical illustrations of mathematical principles that are described in this article and in the app do not predict or project the performance of any investment or strategy, nor do they represent any guarantee of returns. Individual investor results will vary.

The 3% match requires Robinhood Gold ($5/month; terms apply) for 1 year from the date of the first Gold match. Must keep funds in Robinhood IRA for 5 years. Match rate subject to change. Non-Gold customers get 1% match. 3% Gold Match terms and conditions.

The impact of the Early IRA Match Removal Fee (when applicable) and any investment fees have not been included in the examples, nor has the impact of inflation, contribution limit changes, withdrawals, or any potential dividends.

Ordinary income and, in some cases, penalty taxes may apply to distributions from retirement accounts, effectively reducing gross returns.

All investments involve risk. Investors should consider their investment time horizon and income tax bracket when making investment decisions. Past performance does not guarantee future results. Robinhood does not provide tax advice.