Robinhood 24 Hour Market

You can track and trade select stocks and ETFs on Robinhood even when other markets are closed, 24 hours a day, 5 days a week.

Robinhood 24 Hour Market is available from Sunday 8 PM ET through Friday 8 PM ET. Orders entered for the 24 Hour Market generally could be executed 12 AM-8 PM ET on a full trading day (meaning Monday-Friday except for stock market holidays and half-days), 12 AM-5 PM ET on a stock market half-day, and 8 PM-12 AM ET on the day before either a full trading day or a stock market half-day.

Update on recent market volatility

For the 24 Hour Market, Robinhood uses Blue Ocean Alternative Trading Systems (BOATS) to execute overnight trading orders.

BOATS has its own risk controls to prevent stocks from trading more than 20% above or below the price established near the end of an extended hours trading session. Public exchanges have similar controls to prevent extreme price movements during market hours, including Limit Up and Limit Down halts.

BOATS uses price bands based on the 7:30 PM ET market price to help mitigate large price movements. This means individual securities in the 24 Hour Market won’t trade outside these pricing bands. BOATS may also reject orders with limit prices outside of these price bands.

Keep in mind, you can continue to place orders during market or extended trading hours, which aren’t impacted by the BOATS pricing bands.

For example, let’s say YOWL trades at $10 a share at 7:30 PM ET, which is BOATS’ reference price for YOWL during that day’s 24 Hour Market. This means that the BOATS price bands for YOWL during the overnight session are $8 (low) and $12 (high). Therefore, YOWL won’t trade outside the price bands from 8 PM ET through 4 AM ET on the next trading day. BOATS may also reject orders for YOWL with limit prices outside of these price bands.

24-hour trading

Use your Robinhood account to trade when you want to during the trading week. Check out Lists → 24 Hour Market to get started.

Place an order

You can trade whole-share, limit orders of any assets included in our 24 Hour Market list. To place an order in the app or on the web:

- Select a stock in the 24 Hour Market list

- Select Trade → Buy or Sell

- Select Dollars or Shares at top right of the screen to view the order type menu, and then select:

- Limit Order to switch a limit order

- Or for share-based orders, select Trade now to place a 24 Hour Market order (if you don’t see this option, it may not be available yet)

- In Set limit price, enter the limit price, and then select Continue

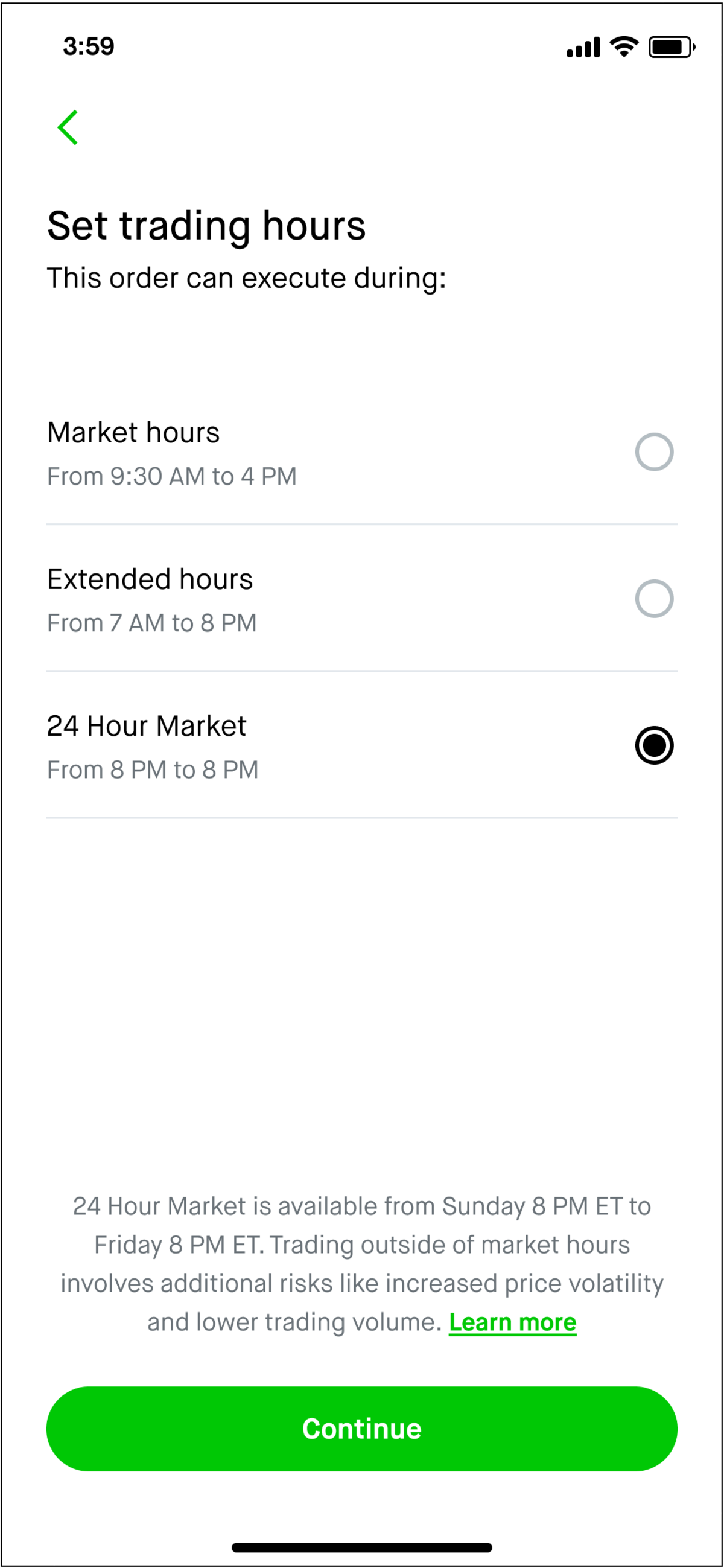

- In Set trading hours, select when you want the order to execute:

- Market hours: 9:30 AM-4 PM ET

- Extended hours: 7 AM-8 PM ET

- 24 Hour Market: 8 PM-8 PM ET

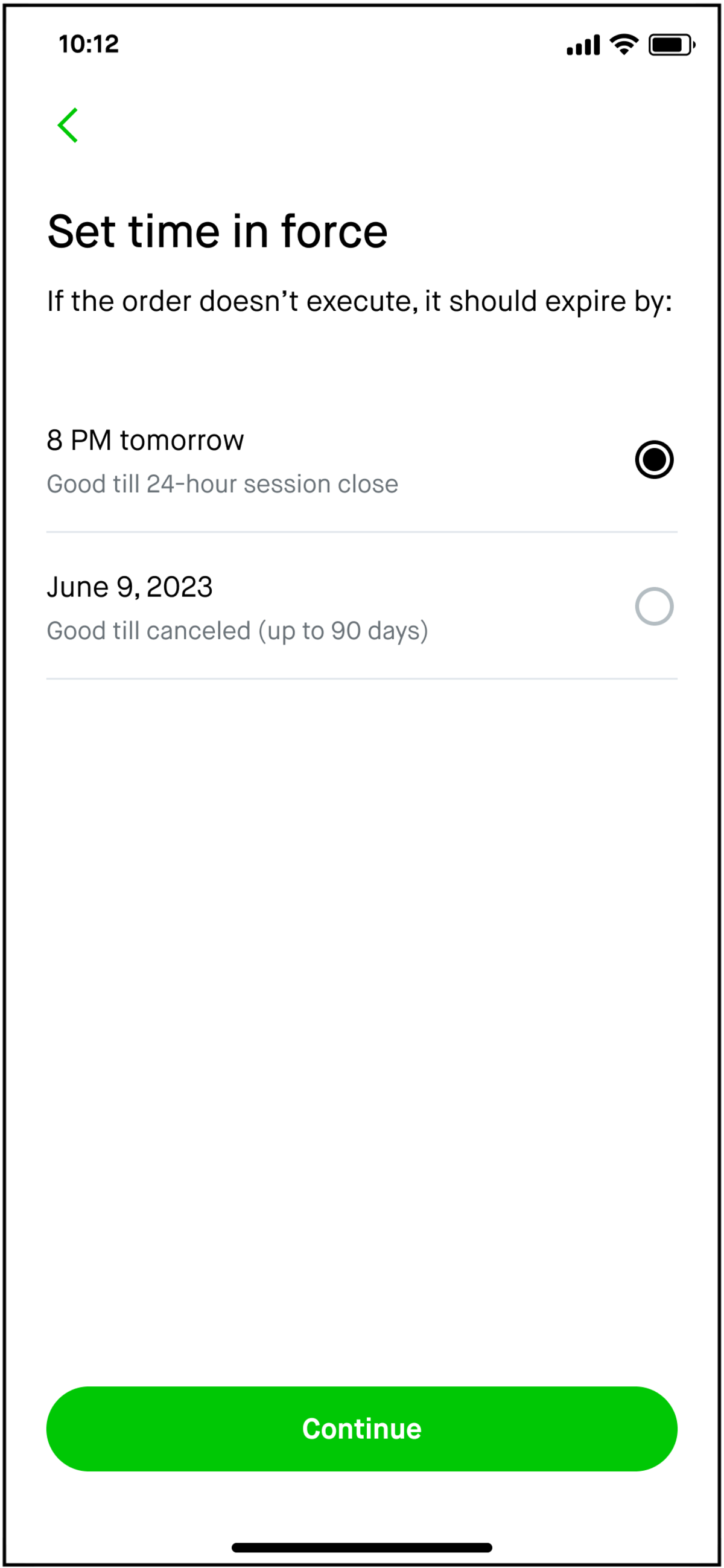

- In Set time in force, select when the order should expire, and then select Continue.

- Good-For-Day (GFD) orders are eligible for up to 24 hours. If placed before 8 PM ET, the order will expire at 8 PM ET that day, unless it has already been executed. If placed after 8 PM ET, it’ll expire at 8 PM the next day. For example, a GFD order placed at 9 PM ET will stay open for 23 hours until it expires at 8 PM ET the next day.

- Good-Til-Canceled (GTC) orders are eligible for execution 24 hours per trading day, for up to 90 calendar days.

- Review the order, and then swipe up to place it.

After you place an order, you can select Refresh at any time to get the latest order summary.

24-hour charts

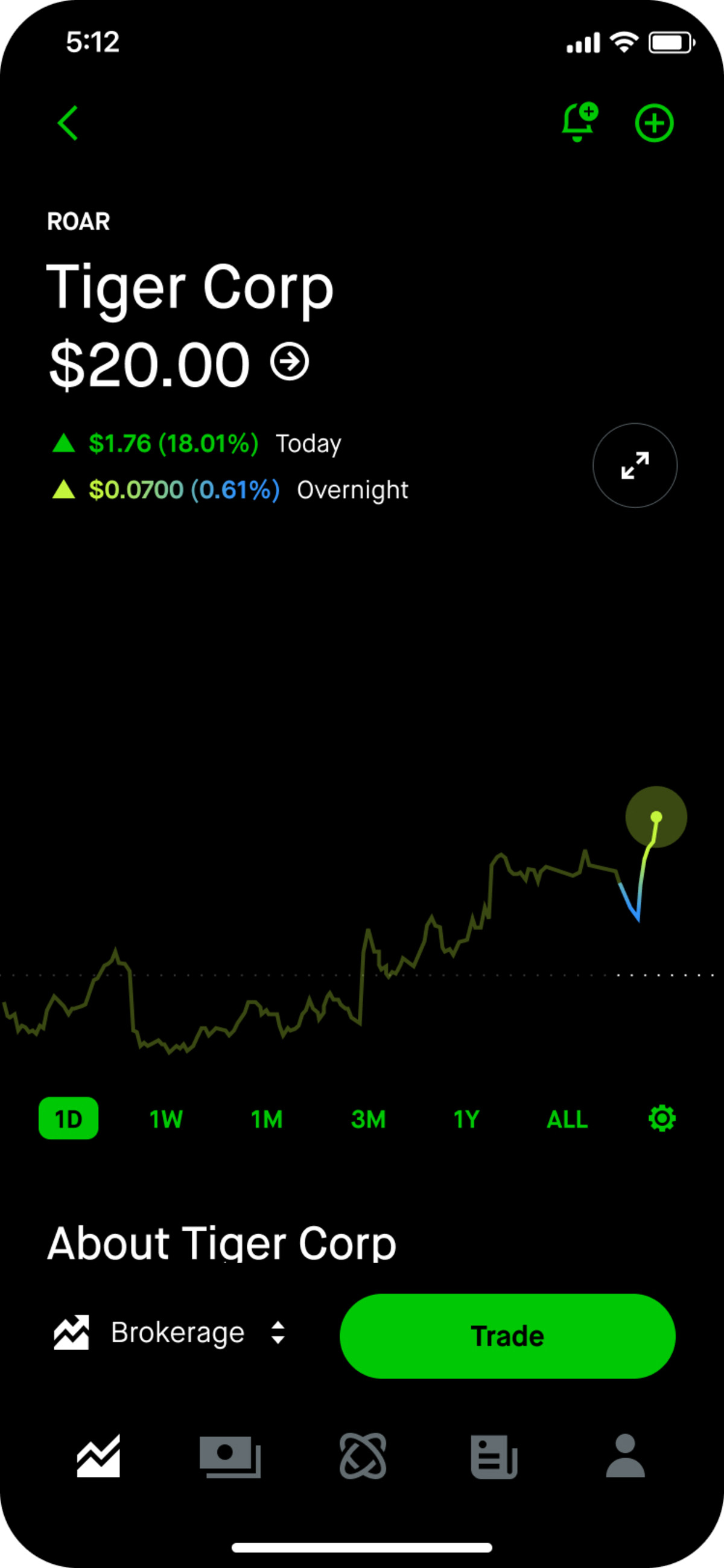

Within the charts, the 1-day (1D) and 1-week (1W) charts will continue to show active market data even during overnight and pre-market hours.

Here's how to help you delineate the price changes in our charts:

During market hours, 9:30 AM-4 PM ET Monday-Friday, Today shows price and percentage change in price relative to the market hours opening price

Depending on what time it is outside of market hours, the following additional price and percentage change in price are shown during each of the following sessions as compared to the market hours closing price:

- After-hours: 4 PM-8 PM ET

- Overnight: 8 PM-4 AM ET

- Pre-market: 4 AM-9:30 AM ET

This example chart for Tiger Corp, shows $1.76 for today’s closing market price change and $0.07 as the After-hours price change that reflects the difference between the current price and the market hours closing price:

For more details about other chart features, check out Using charts.

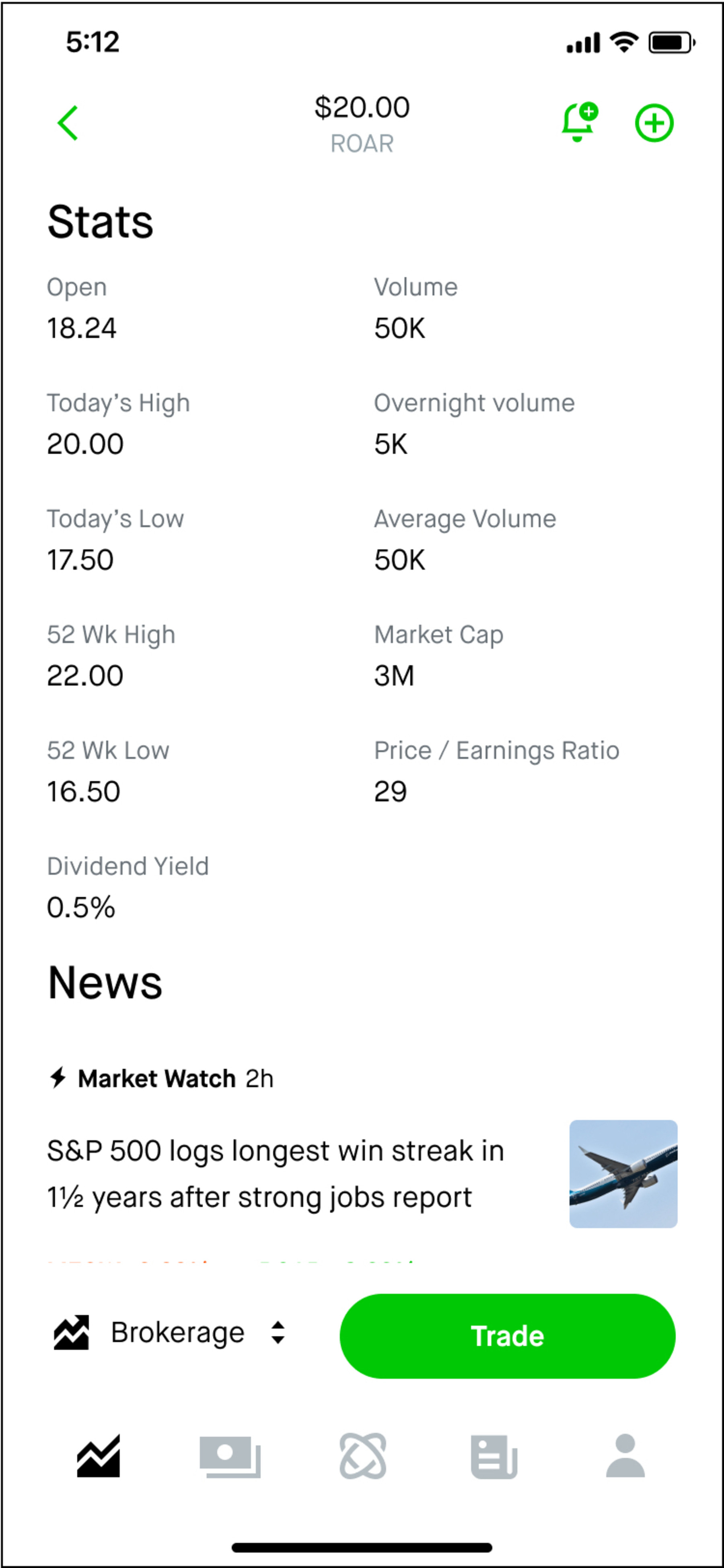

24-hour volume

For supported symbols, the Overnight volume will show the number of shares traded during the overnight hours of 8 PM-4 AM ET. Keep in mind, this volume data will be static during market and extended-hours trading sessions.

As always, Today’s volume will continue to show the number of shares traded during regular and extended hours of 4 AM-8 PM ET.

Check out Technical indicators for more details about the volume and other chart data shown during market and extended hours.

24-hour stats

In Key statistics for supported symbols in the Robinhood 24 Hour Market, the prices shown in High today and Low today represent the highest and lowest values from 12 AM-12 AM (midnight), Monday-Thursday (24 hours a day, localized to your time zone within the U.S.). And for the beginning and end of the week, they’ll show as follows:

- On Sundays, the highest and lowest values will reflect any changes from 8 PM ET until 12 AM in your time zone

- On Fridays, the highest and lowest values will reflect any changes starting from 12 AM in your time zone until 8 PM ET

Check out Technical indicators for more details about key statistics.

The following shows an example of the key statistics that may be available for a supported stock during overnight trading:

FAQ

Trading your favorite stocks and ETFs during extended or overnight hours can help you take action in response to breaking news and get a jump start on potential market opportunities when regular markets are closed.

Check out Risk factors to consider that you should be aware of before engaging in trading during extended or overnight hours, such as: lower liquidity, higher volatility, changing prices, unlinked markets, news announcements, and wider spreads.

You can place whole-share, limit orders on any of the assets available within our 24 Hour Market list. For more details about limit orders and orders that aren’t available through the Robinhood 24 Hour Market, check out Why didn’t my order execute

You can trade any of the assets listed in our 24 Hour Market list, which includes some of our most popular and top-traded stocks and ETFs.

Also, if you place an order for a symbol that’s not currently supported, you won’t be able to select the 24 Hour Market session but can select a different trading session for it. For details, check out the Default order schedule and Extended-Hours Trading Disclosure.

When you make a trade during overnight hours (between 8 PM-12 AM ET), the trade date will actually be the next trading day. For example, if you buy 2 shares of ABC on Monday at 9 PM ET, and then sell 2 shares of ABC on Tuesday at 10 AM ET, it counts as a day trade. The calendar dates are different but the trade dates are the same.

The spread refers to the difference between the price at which a security can be purchased and the price at which it can be sold. Lower liquidity and higher volatility in overnight or extended-hours trading may result in wider than normal spreads for a specific security, which in turn can cause you to receive an inferior price.

You can only place limit orders for the Robinhood 24 Hour Market. Limit orders don’t execute except at your limit price or better. Keep in mind, if your limit order doesn’t execute, it’ll expire based on the time-in-force (GFD or GTC) that you selected when placing the order.

Also, if you place an order outside regular market hours for a symbol that’s not currently supported, you won’t be able to select the 24 Hour Market session but can select a different trading session for it. For details, check out Default order schedule and the Extended-Hours Trading Disclosure.

Your account may be restricted if flagged for pattern day trading (PDT). Check your day trade settings after 4 AM ET on the day after the restriction occurs to learn what you can do to possibly resolve it. Check out Pattern day trading for more details.

We may pause trading during corporate actions, just as we may during other times of day. Check out Mergers, Stock Splits, and More for more details.

Disclosures

Trading outside of market hours involves additional risks, such as increased price volatility and lower trading volume. You can learn more in the Extended-Hours Trading Disclosure.