About the Options Strategy Builder

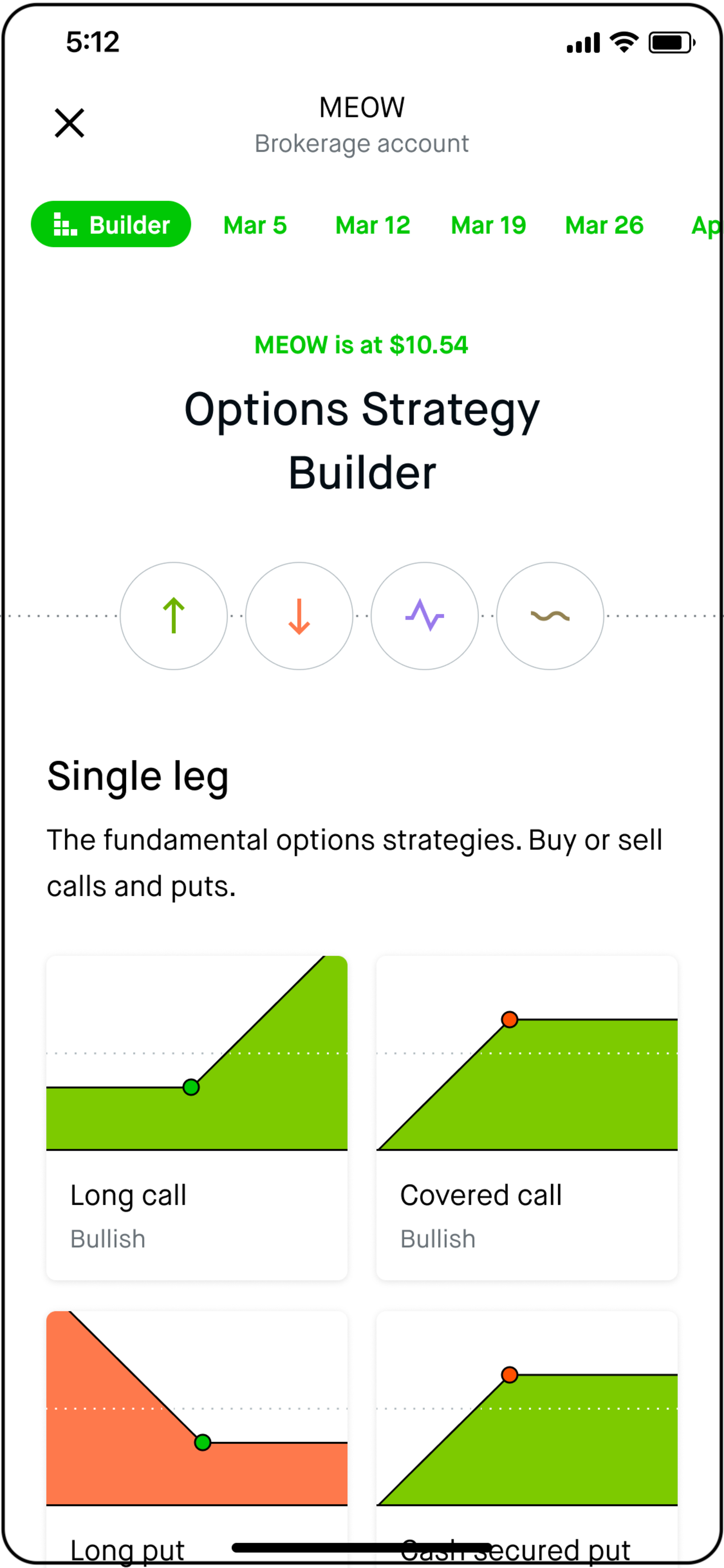

The Options Strategy Builder helps you learn about, customize, and build a wide range of basic and advanced options strategies.

With the Builder, you can seamlessly choose a strategy, adjust the strike prices or expiration dates, and place your order.

A multi-leg strategy places an order for more than one option at the same time. Each leg is a single option contract.

Options strategies

To get to the Options Strategy Builder:

- View an asset you want to trade

- Select Trade → Trade options

- Select Strategy builder (top left)

Depending on what you choose, you’ll get one or more of the following strategy options:

Single-leg strategies: The fundamental options strategies. These involve buying or selling a call or a put.

Vertical spreads: Simultaneously buy and sell similar options using different strike prices. Vertical spreads are designed to profit from gains or losses in the price of an underlying asset.

Straddles and strangles: Two-legged strategies that are designed to profit from volatility.

Calendar spreads: Simultaneously buy and sell similar options using different expiration dates. Calendar spreads are designed to profit from differences in implied volatility over time.

You can’t use calendar spreads, covered calls, or diagonal spreads with index options.

Strategy charts

When you open the Options Strategy Builder, you’ll see a list of strategies with corresponding charts. Each chart helps explain how a strategy operates.

For example, the following chart shows a call debit spread strategy:

- Vertical y-axis shows the strategy’s profit or loss

- Horizontal x-axis shows the price of the underlying asset

- Dotted line represents the break-even point

- Green dot represents buying a call or put

- Red dot represents selling a call or put

Outlook filter

Each strategy relates to an outlook, which is how you think the underlying asset will perform. Within the Builder, you can filter by outlook, such as: bullish (green), bearish (red), volatility (purple), and neutral (gray).

The outlook of some strategies (like calendar spreads) might vary depending on which strike prices you choose.

Place an order with the Builder

After you select a strategy, you’ll see the list of options contracts in order based on the strike price or prices.

NOTE: Select the question mark to see more details about the chosen strategy.

Customize the strategy:

- For multi-leg strategies with a single expiration date (such as vertical spreads, strangles, straddles, and condors), you can browse the strike prices by selecting the strike price width or the strike price of the first leg. The width is the difference between the strike prices of the legs in your strategy. Alternatively, if you set the first leg strike price, you can then browse by the strike price of the second leg.

- For calendar spreads, you will first set the expiration date for the short-dated leg, and then the expiration date for the long-dated leg.

- Depending on your strategy, you can view strategy-specific details on the chain, such as:

- Breakeven for single-leg strategies

- The bid and ask for multi-leg strategies

- After selecting a strategy, you’ll see more stats like max gain, max loss, and the Greeks

- Select the strategy price to place the order for that strategy, and then select the quantity and limit price for the order.

- Review and then submit your order.

See Things to consider when choosing an option to get more details about the expiration date, strike price, premium, break-even point and percentage, and chance of profit percentage.

Disclosures

Robinhood Financial doesn't guarantee favorable investment outcomes and there is always the potential of losing money when you invest in securities, or other financial products.

Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Review Day Trading Risk Disclosure Statement and FINRA Investor Information to learn about the risks. Examples contained in this article are for illustrative purposes only. Supporting documentation for any claims, if applicable, will be furnished upon request.

Chance of profit is an estimate based on the model assumptions and does not guarantee future results. Numerous factors that are not reducible to a model determine the actual chance of profit for a particular option contract or strategy.