Basic options strategies (Level 2)

Options are some of the most flexible investment strategies. Whether you're hedging or seeking to grow your investments, you can use options to help reach the goals you set for your portfolio.

Use the information in this article as an educational tool to learn about the options strategies available with Robinhood. Before you begin trading options, it's worth taking the time to identify an investment strategy that makes sense for you.

Depending on your position, it’s possible to lose your invested principal and potentially more. So it's important to learn about the different strategies before diving in.

You can’t use covered calls with index options.

The theoretical examples in this article are examples that don’t reflect actual gains and losses, which will depend on a number of factors, such as the actual prices and number of contracts involved.

Long call

What's a long call?

A long call is a bullish strategy that involves buying a call option. Long is a term describing ownership, meaning you hold the option. Owning a call option gives you the right, but not the obligation, to buy 100 shares of the underlying stock or ETF at the strike price by the option’s expiration date. Taking advantage of this right is called exercising your option.

A standard option controls 100 shares of the underlying stock or ETF. Therefore, you must have enough buying power to purchase 100 shares for each contract you exercise. Although you have the right to exercise your option, it may not always make sense to do so. Rather than exercising, many traders buy a call option with the intention to sell it later for a profit, before expiration.

When to use it

A long call is bullish. You might consider buying a call when you think the price of the underlying is about to go up and/or you expect a rise in implied volatility. Many traders buy calls because they’re generally cheaper than purchasing 100 shares of the underlying stock. However, there are tradeoffs to buying a call instead of shares of the underlying stock.

Building the strategy

To buy a call, pick an underlying stock or ETF, select an expiration date, and choose a strike price. After you’ve selected a call to buy, choose a quantity, select your order type, and specify your price.

When buying a call, the closer your order price is to the ask price, the more likely your order will be filled. If you prefer to work your order, you can choose a price that is closer to the mid or mark price (halfway between the bid and ask prices). It’s possible you might get a fill, but more likely, you’ll need a seller to drop their asking price. Note that if there are no bids, the mark price will show as $0.01.

Confirm your order details, and when you’re ready, submit the order.

The goal

A long call is typically used to speculate on the future direction of the underlying stock. When you buy a call, you want the price of the underlying to rise quickly and implied volatility to rise. As a result, the value of your call option may rise as well. This creates potential opportunities to sell your call for a profit before it expires. As with most long strategies, the goal is to buy low and sell high.

Cost of the trade

To buy a call option, you must pay the option’s premium. Let’s say, you purchase a call for $2. Since a standard option controls 100 shares of the underlying, you’d need $200 to purchase one contract. To buy 10 contracts, you’d need $2,000, and so on.

Factors to consider

Look for an underlying stock or ETF whose price is trending up or likely to increase soon. Consider one on the lower end of its implied volatility range with potential to increase over the life of the trade. It may be advisable to look for underlyings with more liquid options that have tighter bid/ask price spreads, larger volumes, and plenty of open interest.

Choose an expiration date that aligns with your expectation for when the underlying price will increase. Technically, you can choose any available expiration date, but generally, the textbook approach is to buy a call with about 90 days until expiration. This provides more time for the underlying price to potentially rise while balancing costs and mitigating losses from time decay, which accelerate as expiration approaches. Shorter-dated calls are cheaper, but will be more impacted by time decay, while longer-dated calls are more expensive and more sensitive to changes in implied volatility.

Which strike price you choose will determine the cost of your option, its sensitivity to changes in the price of the underlying stock, and the probability of it expiring in-the-money.

- An in-the-money call is when the strike price is lower than the underlying stock price. It’s more sensitive to price movements of the underlying stock and has a higher probability of expiring in-the-money, but is more expensive.

- An at-the-money call is when the strike price equals or is closest to the underlying stock price. It’s less expensive than an in-the-money option, but has roughly a 50% chance of expiring in-the-money. As the underlying stock price changes, an at-the-money option will move roughly half of that value.

- An out-of-the-money call is when the strike price is higher than the underlying price. It’s less expensive than an in, or at-the-money option, but can be much less sensitive to price movements of the underlying stock and has a lower probability of expiring in-the-money.

Note: As the underlying stock price changes, so can an option’s moneyness.

The option’s premium (and how many contracts you purchase) determines your risk. Many traders adhere to the general guideline of not risking more than 2-5% of their total account value on a single trade. For example, if your account value was $10,000, you’d risk no more than $200-$500 on a single trade. Ultimately, it’s up to you to decide. Manage your risk accordingly.

How is buying a call option different from buying stock?

Although owning stock and buying a call are both bullish strategies, they have many differences:

Stock represents ownership in a company, whereas a call option is a contract that represents the right to buy shares of the underlying stock or ETF. As a shareholder, you may have voting rights and be entitled to any dividends paid by the company. As the owner of a call option, you have no shareholder rights (unless you exercise and convert your call into shares).

Options have an expiration date. This means there will be a day in the future when you can no longer trade or exercise your option. When you own stock, you can keep your shares for as long as the stock exists.

A call’s price may not move dollar-for-dollar with the underlying stock. Even if the underlying stock price goes up, the option’s price may only go up fractionally, or possibly decrease, depending on certain factors.

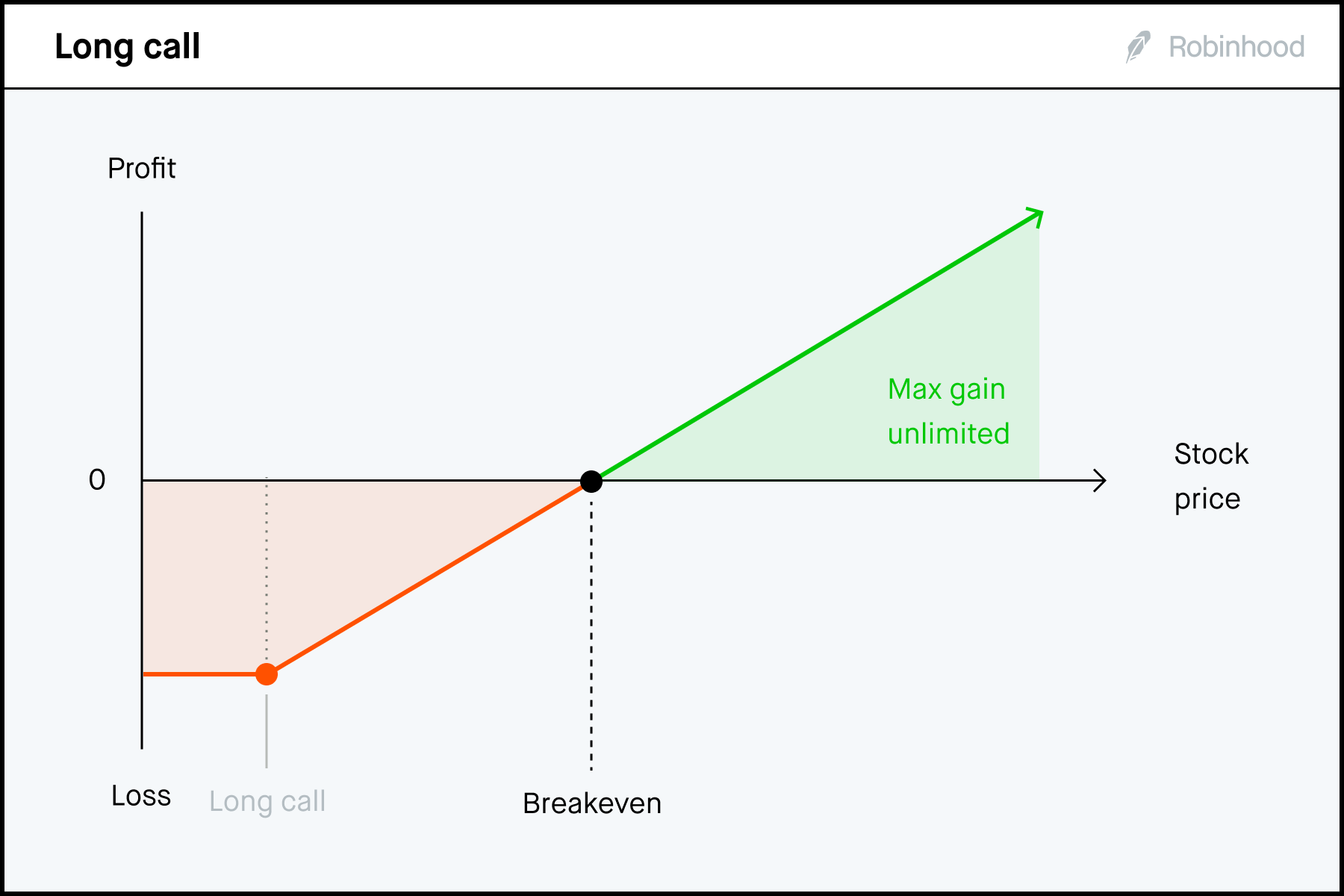

P/L Chart at expiration

A long call has unlimited theoretical profit potential and limited theoretical loss. At expiration, it profits if the underlying stock is trading above the breakeven price.

Theoretical max gain

The theoretical max gain is unlimited. Since the underlying stock price could theoretically rise forever, there’s no limit to how much the call option could potentially be worth.

Theoretical max loss

The theoretical max loss is limited to the premium paid. If the underlying stock is trading at or below the strike price at expiration, the option will expire worthless.

Breakeven point at expiration

The breakeven point at expiration is equal to the strike price plus the premium paid for the option.

Is it possible to lose more than the theoretical max loss?

Yes. For every call that’s exercised, you’ll purchase 100 shares of the underlying stock. Owning shares can result in losses greater than the premium paid for the call option.

Example

Imagine XYZ stock is trading at $100 and you think the stock price will increase over the next 3 months. You buy the XYZ $110 call option expiring in 90 days for $3.50:

Buy 1 XYZ $110 Call for $3.50

The theoretical max gain is unlimited because there’s no limit to how high the XYZ’s stock price can rise.

The theoretical max loss is $3.50 per share, or $350 total. Max loss occurs if XYZ closes at or below $110 on expiration, and the option expires worthless.

The breakeven point at expiration is $113.50. It’s calculated by taking the strike price ($110) and adding the premium paid ($3.50).

This is a theoretical example. Actual gains and losses will depend on a number of factors, such as the actual prices and number of contracts involved.

Managing the trade

A long call benefits if the underlying stock price rises quickly, ideally above the strike price. In addition, if implied volatility rises your option will likely increase in value, assuming all other factors remain constant. Meanwhile, if the underlying stock price drops, implied volatility falls, and time passes, the value of your call will likely decrease. This isn't ideal.

At some point, you must decide whether or not to sell your option, roll it, or hold it into expiration. Around 30-45 days to expiration, time decay begins to accelerate. The closer your option is to expiration, the more extrinsic value it will lose each day. Ultimately, the call option will only be worth its intrinsic value (in-the-money amount) at expiration.

If your option is profitable, consider taking action before expiration. The longer you wait, the more extrinsic value will come out of the option. Of course, this may be offset by any further gains in the underlying stock price. If the call is worth less than your original purchase price you can attempt to cut your losses by selling it before expiration. This would result in a loss on the trade. If your option is out-of-the-money at expiration, it will expire worthless, and you’ll realize a max loss on the trade.

Option Greeks

Option Greeks are a way of measuring the sensitivity of an option's price to various factors like price, time, implied volatility, and interest rates. For a long call:

Delta is positive. For each $1 increase in the underlying, the option’s price will theoretically increase by the delta value, and vice versa. As the call option becomes more in-the-money it will approach a 1.00 delta. As it becomes more out-of-the-money it will approach a 0.00 delta.

Gamma is positive. For each $1 increase in the underlying, the option’s delta value will theoretically increase by the gamma value, and vice versa.

Theta is negative. For each calendar day that passes, the option’s price will theoretically decrease by the theta value.

Vega is positive. For every 1% increase in implied volatility, the option’s price will theoretically increase by the vega value, and vice versa.

Rho is positive. For every 1% increase in the risk-free interest rate, the option's price is expected to increase by the rho value, and vice versa.

Keep in mind: Option Greeks are calculated using options pricing models and are theoretical estimates. All Greek values assume all other factors are held equal.

Closing the position

Although you have the right to exercise your option, typically, this isn't how many traders close a long call. Instead, you might consider selling your call before expiration to avoid the exercise process, and any additional risk that it may introduce. Whichever you choose, it’s best to establish an exit strategy before you enter the trade. To close a long call you can do the following that's described in this section:

- Sell to close your position

- Roll your position

- Exercise early

- Hold through expiration

Sell to close your position

Prior to expiration, you can try to sell your long call. In doing so, you’ll realize any profits or losses associated with the trade. If you sell your option for more than your purchase price, you’ll profit. If you sell it for less than your purchase price, you’ll realize a loss. And if you sell it at the same price as your purchase price, you’ll break even.

Roll your position

You can also roll your position. Rolling a long call involves selling your existing position (realizing any gains or losses) and simultaneously purchasing a new call option with a further expiration date and/or a different strike price. This allows you to establish a similar position, while managing your risk prior to expiration.

Exercise early

When you own a call, you have the right to buy 100 shares of the underlying stock or ETF at the strike price by expiration (assuming you have the required buying power). Typically, you’d only consider doing this if your option is in-the-money at expiration and you want to own the underlying shares. However, if you decide to exercise early, you’ll forfeit any extrinsic value (time value) remaining in the option. For this reason, it rarely makes sense to exercise early.

However, exercising early can make sense for some scenarios, including:

To capture an upcoming dividend payment. Remember, shareholders receive dividends, option holders do not. If your option is in-the-money, and the remaining extrinsic value is less than the upcoming dividend, it could make sense to exercise prior to the ex-dividend date.

To ensure you’re capturing the intrinsic value of the option. If you cannot sell your call option for at least its intrinsic value, you can exercise the option and offset it with the necessary sale of shares to close the resulting long stock position.

Finally, don't exercise an out-of-the-money call option. By doing so, you’re simply paying a higher price for the shares than what they’re currently priced in the open market. If you want to own the underlying shares, it’s usually better to sell your long call, and then buy the shares in a separate transaction.

Hold through expiration

Holding your position into expiration can result in a max gain or loss scenario and carries certain risks that you should be aware of. Learn more in Expiration, exercise, and assignment.

If the option expires out-of-the-money it will expire worthless and be removed from your account. You’ll lose the premium you paid for the option.

If the option expires in-the-money it will be automatically exercised. 100 shares of the underlying will be purchased for every contract exercised. If you don't have the necessary buying power, Robinhood may attempt to place a Do Not Exercise (DNE) request on your behalf.

Note: If you don’t want your options to be exercised, you can submit a Do Not Exercise (DNE) request by contacting our Support team. To implement a DNE request, you can submit it after 4 PM ET, and we must receive it by no later than 5 PM ET on the expiration date. (This only applies to regular market hour days.)

Additional risks

For a long call, be cautious of automatic exercise. As mentioned, if your option is in-the-money at expiration, your long call will automatically be exercised. If you don’t have the available funds to support the exercise, your account will be in a deficit.

Important: To help mitigate the risk, Robinhood may close your position prior to market close on the expiration date; however, this is done on a best-effort basis. Ultimately, you bear the full responsibility of managing the risk within your account.

What happens if a corporate action impacts the underlying asset?

Sometimes, the option’s underlying stock can undergo a corporate action, such as a stock split, a reverse stock split, a merger, or an acquisition. A corporate action can impact the option you hold, such as changes to the option’s structure, price, or deliverable.

Covered call

What's a covered call?

A covered call is a bullish strategy that involves owning 100 shares of the underlying stock or ETF and simultaneously selling a call option (also known as a short call). At Robinhood, you must already own 100 shares of the underlying stock or ETF to sell a call.

In options trading, short describes selling to open, or writing an option. Selling a call obligates you to sell 100 shares of the underlying at the strike price, if assigned. As the seller, you have no control whether or not your call is assigned—the buyer decides whether or not to exercise the option.

By combining a short call with 100 shares of the underlying, it becomes a covered call, meaning you already own the shares you’re potentially obligated to sell. Although you receive a cash credit at the outset, your potential profit or loss on the option isn't realized until the short call is closed. Meanwhile, the overall profit or loss on the combined position depends on the price of the underlying shares.

When to use it

A covered call is a bullish strategy. You might consider one if you think the underlying stock price will moderately rise in the near future. Having said that, it can also be used if you think the stock will remain relatively stable, or even drop slightly. Covered calls can be used for a number of reasons, including:

- To generate income. When you sell a covered call, you collect the option’s premium and can generate additional income in your portfolio by using your shares as collateral.

- To partially hedge your stock position. If the underlying stock price drops, the premium you collect for selling the call can act as a partial hedge against stock losses.

- To lower the effective cost of the shares you own. The amount of premium collected from any calls you sell can help offset the cost of your long shares.

- To exit your stock position. If the underlying stock rises above the strike price of the call by expiration, you’ll likely be assigned. You’ll sell your stock at the strike price and collect the option’s premium for doing so.

Building the strategy

To create a covered call, you must first own 100 shares of the underlying stock or ETF for each call you plan to sell. Start by selecting an expiration date and then choose a strike price. Typically, a covered call is opened by selling an out-of-the-money call option. Next, select your order type, and specify your price.

When selling a call, the closer your order price is to the bid price, the more likely your order will be filled. If you prefer to work your order, you can choose a price that is closer to the mid or mark price (halfway between the bid and ask prices). It’s possible you might get a fill, but more likely, you may need a buyer to increase their bid. Note that if there are no bids, the mark price will show as $0.01.

Confirm your order details, and when you’re ready, submit the order.

The goal

A covered call is commonly used to generate income. When selling a covered call, it’s important to view the strategy through the lens of your long stock position. Unlike other options-only strategies, a covered call is a combination of long shares and a short call option. As such, the price of the long stock ultimately determines whether the combined strategy will be profitable or not.

If you’ve sold an out-of-the-money call, the stock can rise and if it stays below the strike price of the short call by the expiration date, you’ll keep the premium. This is an ideal scenario because the value of the long shares will have appreciated and the short call will be at a max gain.

Just remember, when you sell a covered call, you make a tradeoff—you collect a premium and in exchange, you give up the profit potential of your long shares above the strike price of the short call. If the stock rises above the strike price by expiration, you’ll be obligated to sell your shares at the option’s strike price, and your potential profit will be capped.

Cost of the trade

To sell a call you must own 100 shares of the underlying which act as collateral. In exchange, you’ll collect the premium paid by the option’s buyer. Although you collect a credit to sell the call, your potential profit or loss isn't realized until you close the option, or it expires. Let’s say, you sell a call for $2. Since a standard option controls 100 shares of the underlying, you’ll collect $200 to sell one contract. You’d collect $2,000 for selling 10 contracts (but would need to own 1,000 shares), and so on.

Keep in mind: Robinhood doesn't allow uncovered or naked positions, as selling a call on stock you don’t own may involve the risk of unlimited losses.

Factors to consider

Look for an underlying stock or ETF that’s trending sideways, or one you think has the potential for limited movement in either direction. Consider one on the higher end of its implied volatility range, with potential to decrease over the life of the trade. It may be advisable to select an underlying with more liquid options that have tighter bid/ask price spreads, larger volumes, and plenty of open interest. Based on liquidity and other factors, not every stock or ETF will be an ideal candidate for a covered call.

Choose an expiration date that optimizes your window for success. When selling covered calls, traders will most often look at options expiring in 30-45 days. This timeframe provides a good balance between the collected premium and the rate of time decay, which begins to increase at 45 days to expiration. If you sell an option with fewer days to expiration, the rate of decay will be even greater, but the amount of premium may not be enough for some to justify placing the trade. Meanwhile, if you sell options with a longer expiration date, the premium will be greater but the rate of time decay will be minimal until that option gets closer to expiration.

When selecting a strike price, the most common approach is to sell an out-of-the-money option. Out-of-the-money calls are when the strike price is higher than the underlying stock price. The short call can be profitable if the stock price drops, stays where it’s at, or rises slightly (as long as it stays below the strike price by expiration). If you choose an expiration date that is further out, it may be advisable to sell a call that is further out-of-the-money, providing more room for the stock to move higher given the extended time frame.

Important: It’s usually best to avoid selling an in-the-money call option. A call is in-the money is when the strike price is lower than the underlying stock price. Although you’ll collect more premium up front, you may be at risk for an early assignment or have dividend risk.

When selling a covered call, a general rule used by traders is to try to collect a premium that’s about 2% of the underlying stock value. For example, if the underlying stock was trading for $100, you’d look to collect about $2 in premium for selling the call (assuming it meets the other criteria discussed above). Ultimately, it’s up to you to decide based on your objectives.

How is a covered call different from a naked call?

Although a covered call and a naked call both involve selling a call option, these two strategies are very different:

A covered call involves owning 100 shares of the underlying stock and a naked call does not.

A covered call has defined risk, whereas a naked call has undefined risk.

With a covered call, if you’re assigned on your short call, you own the shares you’re obligated to sell. If you’re assigned on a naked call, you’ll be left with a short stock position and undefined risk.

P/L chart at expiration

A covered call has both defined theoretical gain and loss. At expiration, it profits if the underlying stock is trading above the breakeven price. The p/l chart assumes both the long stock position and short call are open. Once the short call is closed, or expires worthless, the risk profile returns to that of long stock (which has unlimited profit potential).

Theoretical max gain

The theoretical max gain is limited to the difference between the strike price and the cost basis of your stock, plus any premium collected for selling the call. This occurs if the short call is assigned and you sell the stock at the strike price.

Keep in mind: If your shares get called away at a strike price that is lower than their cost basis, you’ll realize a loss on your stock position.

Theoretical max loss

The theoretical max loss is equal to the cost basis of your shares minus the premium collected. This occurs if the stock price falls to $0. Like any stock owner, you risk losing the entire value of the investment—except when you sell a covered call, you would keep the premium you received up front, regardless of the stock’s performance.

Breakeven point at expiration

The breakeven point at expiration is equal to the cost basis of your long stock minus the premium collected. If the strike price of the call is below your cost basis, you could potentially sell your shares for a loss.

Is it possible to lose more than the theoretical max loss?

Assuming you hold the underlying shares, no.

Example

Let’s say you own 100 shares of XYZ stock at a price of $100, and you expect the stock to stay relatively flat or increase moderately in the near future. You decide to sell the $105 call option that’s expiring in 30 days. The option is trading for a $2 premium, which you’d receive $200 for selling:

Own 100 shares of XYZ at $100 per share Sell 1 XYZ $105 Call for $2

The theoretical max gain is $7 per share, or $700. It’s calculated by taking the strike price ($105) and subtracting the cost basis of the shares ($100) and adding the premium collected ($2). Max gain occurs if the underlying stock price is above the strike price of the short call ($105) at expiration, and you’re assigned. Your shares would be sold at $105.

The theoretical max loss is $98 per share, or $9,800. It’s calculated by taking the cost basis of your shares ($100) and subtracting the premium collected ($2). Max loss occurs if the stock dropped to $0, which may be unlikely, but is always possible. Your short call would expire worthless, but your shares would experience a max loss.

The breakeven point at expiration is $98, which is the cost basis of your shares ($100) minus the premium collected ($2).

Managing the trade

A covered call benefits if the underlying stock price rises, ideally reaching the strike price of the short call. In addition, if implied volatility drops, your option will lose value, assuming all other factors remain constant. Around 30-45 days to expiration, time decay begins to accelerate. The closer your option is to expiration, the more extrinsic value it will lose. This is ideal for the short call.

At some point, you must decide whether or not to buy back your short call, roll it, or hold it into expiration. If your option is profitable, consider taking action before expiration. Often traders will try to close or roll a short call during the week of expiration. You may not be able to keep the entire premium, but you can book a profit on the short call while eliminating the chance that your shares get called away.

Meanwhile, if the underlying stock price rises above the call’s strike price, both your shares and short call will gain value. The further the stock price rises, the deeper in-the-money your short call will be and the more it will offset your stock gains. If you want to exit the short call prior to expiration, you can buy to close, or roll it for a loss. If you do nothing, your shares will most likely be called away at the strike price. Although you’ll realize a loss on the short call, the gains on your long stock position will help offset those losses.

If the stock price drops, the call option will likely lose value (which is good) but your long stock will experience losses (which is bad). The more the stock drops, the less sensitive the short call will be to changes in the underlying stock price. At this point, your short call may have little to no value. If you want to exit the short call prior to expiration, you can buy to close it, or roll it.

Option Greeks

Option Greeks are a way of measuring the sensitivity of an option's price to various factors like price, time, implied volatility, and interest rates. The delta of the long stock and short call are combined. Meanwhile, the values of gamma, theta, vega, and rho are limited to the short call. The Greeks of a covered call are:

Long stock has a positive delta equal to the amount of shares you own. A short call has a negative delta and ranges from 0 to -1.00. When you combine the two, the net delta of a covered call will always be net positive or flat. This means for each $1 increase in the underlying, the combined strategy will theoretically increase by the net delta value and vice versa. As the short call becomes more in-the-money it will approach a -1.00 delta, offsetting more of the stock gains. As the short call option becomes more out-of-the-money it will approach a 0.00 delta, and the position will act more like a long stock position.

The gamma of the short call is negative. For each $1 decrease in the underlying, the option’s delta value will theoretically increase by the gamma value and vice versa.

The theta of the short call is positive. For each calendar day that passes, the option’s price will theoretically decrease by the theta value.

The vega of the short call is negative. For every 1% decrease in implied volatility, the option’s price will theoretically decrease by the vega value, and vice versa.

The rho of the short call is negative. For every 1% decrease in the risk-free interest rate, the option's price will theoretically decrease by the rho value, and vice versa.

Keep in mind: Option Greeks are calculated using options pricing models and are theoretical estimates. All Greek values assume all other factors are held equal.

Closing the position

Although the strategy is designed to reach max profit at expiration, you might consider closing it before then in order to avoid the risk of going through exercise and assignment. Whichever you choose, it’s best to establish an exit strategy for your trade before you enter it. To close a covered call you can exit the position in the following ways, which are described in the following section.

- Buy to close your short call

- Roll your position

- Hold through expiration

Buy to close your short call

Prior to expiration, you can buy to close your short call. In doing so, you’ll realize any profits or losses associated with the option position. If you buy your option for less than your original selling price, you’ll profit. If you buy it for more than your selling price, you’ll realize a loss. And if you buy it at the same price as your selling price, you’ll break even. Remember, these scenarios only account for the short call. The total profit or loss of the stock position is a separate calculation. To close your stock position, you must buy to close the option first, and then sell your shares using a separate transaction.

Roll your position

You can also roll your position. Rolling a short call involves buying back your existing short call (realizing any gains or losses) and simultaneously selling a new call option with a later expiration date and/or a different strike price. This allows you to establish a similar covered call position, while managing your risk prior to expiration. This is a common way to maintain your long stock position while trying to avoid assignment on your short call.

Hold through expiration

Holding your position into expiration can result in a max gain or loss scenario and carries certain risks that you should be aware of. Learn more in Expiration, exercise, and assignment.

If the option expires out-of-the-money it will likely expire worthless and be removed from your account. You’ll keep the premium you collected for selling the option. Although you’ll have a max gain on the short call, the stock price may have dropped far enough to result in losses on your long shares.

Keep in mind: As the seller of an option, there’s always a chance (although not likely) that your short call will be assigned even if it’s out-of-the-money.

If the option expires in-the-money it will likely be assigned, and you’ll be obligated to sell 100 shares of the underlying for every call that’s assigned. If the strike price of your short call is below the cost basis of your long shares, you’ll be selling your stock at a loss. If the strike price of your short call is above the cost basis of your long shares, you’ll be selling your stock at a profit. In either scenario, you’ll keep the premium for selling the call option.

Additional risks

For covered calls, be cautious of an early assignment or an upcoming dividend.

Early assignment risk: An early assignment occurs when the call option you’ve sold is exercised by a long holder before its expiration date. Remember, as the seller of the call, you can’t exercise it – only the buyer can. If your short call option is assigned, you’ll be obligated to sell your shares of stock at the call’s strike price. This typically occurs when the stock is well above the strike price of the call, and there is little to no extrinsic value left in the option. Learn more about early assignments.

Dividend risk: Dividend risk is the risk that you’ll be assigned a short call option the night before the ex-dividend date. Your shares will be sold and you will not receive the dividend. This typically happens when the call option is deep in-the-money and has little extrinsic value left. You can try to avoid this by buying back your short call before the end of the regular hours trading session the day before the ex-dividend date. Learn more about dividend risk.

What happens if a corporate action impacts the underlying asset?

Sometimes, the option’s underlying stock can undergo a corporate action, such as a stock split, a reverse stock split, a merger, or an acquisition. A corporate action can impact the option you hold, such as changes to the option’s structure, price, or deliverable.

Long put

What’s a long put?

A long put is a bearish strategy that involves buying a put option. Long is a term describing ownership, meaning you hold the option. Owning a put option gives you the right, but not the obligation, to sell 100 shares of the underlying stock or ETF at the strike price by the option’s expiration date. Taking advantage of this right is called exercising your option.

A standard option controls 100 shares of the underlying stock or ETF. At Robinhood, you must own 100 shares of the underlying for each put contract you exercise. Although you have the right to exercise your option, it may not always make sense to do so. Rather than exercising, many traders buy a put option with the intention to sell it later for a profit, before expiration.

When to use it

A long put is bearish. You might consider buying a put when you think the price of the underlying is about to go down and/or you expect a rise in implied volatility. Many traders buy puts to speculate on the underlying price falling. If you already own 100 shares of the underlying, you might buy a put as a form of protection against stock losses. However, a protective put is a slightly different strategy. This article focuses primarily on a long put and assumes you do not own the underlying shares.

Building the strategy

To buy a put, pick an underlying stock or ETF, select an expiration date, and choose a strike price. After you’ve selected a put to buy, choose a quantity, select your order type, and specify your price.

When buying a put, the closer your order price is to the ask price, the more likely your order will be filled. If you prefer to work your order, you can choose a price that is closer to the mid or mark price (halfway between the bid and ask prices). It’s possible you might get a fill, but more likely, you may need a seller to drop their asking price. Note that if there are no bids, the mark price will show as $0.01.

Confirm your order details, and when you’re ready, submit the order.

The goal

A long put is typically used to speculate on the future direction of the underlying stock. When you buy a put, you want the price of the underlying to fall quickly and implied volatility to rise. As a result, the value of your put option may rise as well. This creates potential opportunities to sell your put for a profit before expiration. As with most long strategies, the goal is to buy low and sell high.

Cost of the trade

To buy a put option, you must pay the option’s premium. Let’s say, you purchase a put for $2. Since a standard option controls 100 shares of the underlying, you’d need $200 to purchase one contract. To buy 10 contracts, you’d need $2,000, and so on.

Factors to consider

Look for an underlying stock or ETF whose price is trending down or likely to decrease soon. Consider one on the lower end of its implied volatility range with potential to increase over the life of the trade. It may be advisable to look for underlyings with more liquid options that have tighter bid/ask price spreads, larger volumes, and plenty of open interest.

Choose an expiration date that aligns with your expectation for when the underlying price will decrease. Technically, you can choose any available expiration date, but generally the textbook approach is to buy a put with about 90 days until expiration. This provides more time for the underlying price to potentially fall while balancing costs and mitigating losses from time decay, which accelerate as expiration approaches. Shorter-dated puts are cheaper, but will be more impacted by time decay, while longer-dated puts are more expensive and more sensitive to changes in implied volatility.

Which strike price you choose will determine the cost of your option, its sensitivity to changes in the price of the underlying stock, and the probability of it expiring in-the-money.

- An in-the-money put is when the strike price is higher than the underlying stock price. It’s more sensitive to price movements of the underlying stock and has a higher probability of expiring in-the-money, but is more expensive.

- An at-the-money put is when the strike price equals or is closest to the underlying stock price. It’s less expensive than an in-the-money option, but has roughly a 50% chance of expiring in-the-money. As the underlying stock price changes, an at-the-money option will move roughly half of that value.

- An out-of-the-money put is when the strike price is lower than the underlying stock price. It’s less expensive than an in, or at-the-money option, but can be much less sensitive to price movements of the underlying and has a lower probability of expiring in-the-money.

Note: As the underlying’s price changes, so can an option’s moneyness.

The option’s premium (and how many contracts you purchase) determines your risk. Many traders adhere to the general guideline of not risking more than 2-5% of their total account value on a single trade. For example, if your account value was $10,000, you’d risk no more than $200-$500 on a single trade. Ultimately, it’s up to you to decide. Manage your risk accordingly.

How is buying a put option different from shorting stock?

Although shorting stock and buying a put are both bearish strategies, they have many differences:

Shorting stock involves borrowing shares from your broker and selling them short whereas a put option is a contract that represents the right to sell shares of the underlying stock or ETF.

A short stock position has undefined risk, whereas the max theoretical loss of a long put is limited to the premium paid.

Options have an expiration date. This means there will be a day in the future when you can no longer trade or exercise your option. When you short a stock, you can maintain your short position unless your broker calls in your shares.

A put’s price may not move dollar-for-dollar with the underlying stock. Even if the underlying stock price goes down, the option’s price may only go up fractionally, or possibly decrease, depending on certain factors.

P/L Chart at expiration

A long put has limited theoretical profit and loss. At expiration, it profits if the underlying stock is trading below the breakeven price.

Theoretical max gain

The theoretical max gain is large, but limited. It’s equal to the strike price minus the premium paid. Max gain occurs if the price of the underlying stock falls to $0, which may be unlikely, but is always possible.

Theoretical max loss

The theoretical max loss is limited to the premium paid. If the underlying is trading at or above the strike price of your long put at expiration, the option will expire worthless.

Breakeven point at expiration

The breakeven point at expiration is equal to the strike price minus the premium paid for the option.

Is it possible to lose more than the theoretical max loss?

Yes. If your put is exercised, you’ll sell 100 shares of the underlying stock. If you don’t own the shares in advance, you’ll be short stock. Short stock has undefined risk, and it's possible to lose more than the premium you paid for the put option.

Example

Imagine XYZ stock is trading at $100 and you think the stock price will fall over the next 3 months. You decide to buy the XYZ $90 put option expiring in 90 days for $3.50.

Buy 1 XYZ $90 Put for $3.50

The theoretical max gain is $8,650 per contract. It’s calculated by taking the strike price ($90) and subtracting the premium paid ($3.50) and multiplying the total by 100. Max gain occurs if XYZ stock falls to $0 by expiration. This may be unlikely, but is always possible.

The theoretical max loss is $3.50 per share, or $350 total. Max loss occurs if XYZ closes at or above $90 by the expiration date, and the option expires worthless.

The breakeven point at expiration is $86.50. It’s calculated by taking the strike price of the put ($90) and subtracting the premium paid for the option ($3.50).

This is a theoretical example. Actual gains and losses will depend on a number of factors, such as the actual prices and number of contracts involved.

Managing the trade

A long put benefits if the underlying stock price drops quickly, ideally below the strike price. In addition, if implied volatility rises your option should increase in value, assuming all other factors remain constant. Meanwhile, if the underlying stock price rises, implied volatility falls, and time passes, the value of your put will likely decrease. This isn't ideal.

Around 30-45 days to expiration, time decay begins to accelerate. The closer your option is to expiration, the more extrinsic value it will lose. Ultimately, the value of your option will only be worth its intrinsic value (in-the-money amount) at expiration. At some point, you must decide whether or not to sell your option, roll it, or hold it into expiration.

If your option is profitable, consider taking action before expiration. The longer you wait, the more extrinsic value will come out of the option. Of course, this may be offset by any further drops in the underlying stock price. If the put is worth less than your original purchase price you can attempt to cut your losses and sell it before expiration. This would result in a loss on the trade. If your option is out-of-the-money at expiration, it will expire worthless, and you’ll take a max loss on the trade.

Option Greeks

Option Greeks are a way of measuring the sensitivity of an option's price to various factors like price, time, implied volatility, and interest rates. The Greeks of a long put are:

Delta is negative. For each $1 decrease in the underlying, the option’s price will theoretically increase by the absolute value of delta, and vice versa. As the put option becomes more in-the-money it will approach a -1.00 delta. As it becomes more out-of-the-money it will approach a 0.00 delta.

Gamma is positive. For each $1 decrease in the underlying, the option’s delta value will theoretically decrease by the gamma value, and vice versa.

Theta is negative. For each calendar day that passes, the option’s price will theoretically decrease by the theta value.

Vega is positive. For every 1% increase in implied volatility, the option’s price will theoretically increase by the vega value, and vice versa.

Rho is negative. For every 1% increase in the risk-free interest rate, the option's price will theoretically decrease by the rho value, and vice versa.

Keep in mind: Option Greeks are calculated using options pricing models and are theoretical estimates. All Greek values assume all other factors are held equal.

Closing the position

Although you have the right to exercise your option and sell shares of the underlying stock, typically, this isn't how many traders close a long put. Instead, you might consider selling your put before expiration to avoid the exercise process, and any additional risk that it may introduce. Whichever you choose, it’s best to establish an exit strategy before you enter the trade. To close a long put you can do the following that's described in this section:

- Sell to close your position

- Roll your position

- Exercise early

- Hold through expiration

Sell to close your position

Prior to expiration, you can try to sell your long put. In doing so, you’ll realize any profits or losses associated with the trade. If you sell your option for more than your purchase price, you’ll profit. If you sell it for less than your purchase price, you’ll realize a loss. And if you sell it at the same price as your purchase price, you’ll break even.

Roll your position

You can also roll your position. Rolling a long put involves selling your existing position (realizing any gains or losses) and simultaneously purchasing a new put option with a further expiration date and/or a different strike price. This allows you to establish a similar position, while managing your risk prior to expiration.

Exercise early

When you own a put, you have the right to sell 100 shares of the underlying stock or ETF at the strike price by expiration (assuming you already own the underlying shares). Typically, you’d only consider doing this if your option is in-the-money at expiration. However, if you decide to exercise early, you’ll forfeit any extrinsic value (time value) remaining in the option. For this reason, it rarely makes sense to exercise early.

However, exercising early can make sense for some scenarios, including:

To reduce your margin interest. Interest rates are an important factor in determining whether or not to exercise a put option early. While there is no hard or fast rule, you may choose to exercise a deep in-the-money put to reduce your margin interest (assuming you bought the stock or ETF on margin). When you sell shares, you reduce your margin balance.

To ensure you’re capturing the intrinsic value of the option. If you cannot sell your put option for at least its intrinsic value, you can exercise the option and offset it with the necessary purchase of shares to close the resulting short stock position.

Finally, don't exercise an out-of-the-money put option. If you do this, you’re simply selling your shares at a lower price than what they’re currently priced in the open market. If you want to sell any existing shares, it’s usually better to sell your long put, and then sell your existing shares in a separate transaction.

Hold through expiration

Holding your position into expiration can result in a max gain or loss scenario and carries certain risks that you should be aware of. Learn more about expiration, exercise, and assignment.

If the option expires out-of-the-money, it will expire worthless and be removed from your account. You’ll lose the premium you paid for the option.

If the option expires in-the-money, it will be automatically exercised. You’ll sell 100 shares of the underlying for every contract exercised. If you don’t have the necessary shares to exercise, this may result in a short stock position, and as a result, Robinhood may attempt to place a Do Not Exercise (DNE) request on your behalf.

Note: If you don’t want your options to be exercised, you can submit a Do Not Exercise (DNE) request by contacting our Support team. To implement a DNE request, you can submit it after 4 PM ET, and we must receive it by no later than 5 PM ET on the expiration date. (This only applies to regular market hour days.)

Additional risks

For a long put, be cautious of automatic exercise. As mentioned, if your option is in-the-money at expiration, your long put will automatically be exercised. If you don’t own the underlying shares, this will result in a short stock position, which has undefined risk, and isn't allowed at Robinhood.

Important: To help mitigate the risk, Robinhood may close your position prior to market close on the expiration date; however, this is done on a best-effort basis. Ultimately, you bear the full responsibility of managing the risk within your account.

What happens if a corporate action impacts the underlying asset?

Sometimes, the option’s underlying stock can undergo a corporate action, such as a stock split, a reverse stock split, a merger, or an acquisition. A corporate action can impact the option you hold, such as changes to the option’s structure, price, or deliverable.

Short put

What’s a short put?

A short put is a bullish strategy that involves selling a put option. In options trading, short describes selling to open, or writing an option. If assigned, selling a put obligates you to buy 100 shares of the underlying stock or ETF, at the strike price by the expiration date. As the seller, you have no control whether or not your put is assigned—the buyer decides whether or not to exercise the option.

At Robinhood, you must have enough buying power to purchase 100 shares of the underlying stock for each put you sell. This is a cash-secured put because the potential purchase of shares is secured by cash in your account. In exchange for selling the put, you’ll collect the premium paid from the option’s buyer. Although you receive a cash credit at the outset, your potential profit or loss isn't realized until the position is closed.

When to use it

A short put is a bullish strategy. You might consider using it when you expect the price of the underlying stock to increase moderately before a certain date. Many options traders sell a put as a way to acquire stock. Although it may not be your primary goal, you could end up purchasing 100 shares of the underlying at the strike price.

A short put has a risk profile that’s almost similar to owning 100 shares of stock. If that feels too risky, a short put may not be the right strategy for you. If the stock begins to drop below your short strike, you can mitigate assignment risk by buying back the short put, but this is typically done at a loss. If you’re extremely bullish, buying the underlying stock or a call option may provide a more desirable profit potential compared to selling a put.

Building the strategy

At Robinhood, you must have enough buying power to purchase 100 shares of the underlying stock for each put you sell. Start by picking an underlying stock or ETF, select an expiration date, and choose a strike price. Typically, a short put is opened by selling an out-of-the-money option. Once you’ve selected a put to sell, choose a quantity, select your order type and specify your price.

When selling a put, the closer your order price is to the bid price, the more likely your order will be filled. If you prefer to work your order, you can choose a price that is closer to the mid or mark price (halfway between the bid and ask prices). It’s possible you might get a fill, but more likely, you may need a buyer to increase their bid. Note that if there are no bids, the mark price will show as $0.01.

Confirm your order details, and when you’re ready, submit the order.

The goal

A short put is commonly used to generate income. When selling a put you want the option to decrease in value. This happens when the underlying stock price rises, time passes, and implied volatility drops. As with most short option strategies, the goal is to sell high and buy low.

Prior to expiration, if the option is worth less than your original selling price, you can attempt to close it for a profit. If you hold the position through expiration, and the underlying stock is trading above the strike price of your short put, it should expire worthless, and you’ll keep the full premium.

Cost of the trade

When you sell a put option, you’re required to put up enough cash collateral to cover the potential purchase of 100 shares of the underlying. In exchange, you collect a credit for selling the put. For example, if you sold the $50 put, you’d need $5,000 to open the position ($50 x 100 shares per contract). Let’s say, you sell a put for $2. Since a standard option controls 100 shares of the underlying, you’ll collect $200 to sell one contract. You’d collect $2,000 for selling 10 contracts (but would have a larger cash collateral), and so on.

Factors to consider

Look for an underlying stock or ETF whose price is trending up or likely to increase soon. Consider one on the higher end of its implied volatility range, with potential to decrease over the life of the trade. It may be advisable to look for underlyings with more liquid options that have tighter bid/ask price spreads, larger volumes, and plenty of open interest.

Choose an expiration date that optimizes your window for success. When selling puts, traders will most often look at options expiring in 30-45 days. This timeframe provides a good balance between the collected premium and the rate of time decay, which begins to increase at 45 days to expiration. If you sell an option with fewer days to expiration, the rate of decay will be even greater, but the amount of premium may not be enough for some to justify placing the trade. Meanwhile, if you sell options with a longer expiration date, the premium will be greater but the rate of time decay will be minimal until that option gets closer to expiration.

When selecting a strike price, the most common approach is to sell an out-of-the-money option. Out-of-the-money puts are when the strike price is lower than the underlying stock price. A short put can be profitable if the stock price rises, stays where it’s at, or drops slightly (as long as it stays above your short strike by expiration). If you choose an expiration date that is further out, it may be advisable to sell an option that is further out-of-the-money, providing more room for the stock to fall given the extended time frame.

Important: It’s best to avoid selling an in-the-money put option. An in-the-money put is when the strike price is higher than the underlying stock price. Although you’ll collect more premium up front, you may be at risk of an early assignment.

Often, traders will decide how much premium to collect by using a measurement called return on capital. Return on capital is calculated by taking the premium you collect and dividing it by the amount of collateral required to place the trade. It’s a way to assess whether the amount of collateral being held is worth the potential return over the time period of the trade. Ultimately, it’s up to you to decide your optimal return on capital. Remember, short puts can be a capital intensive strategy and smaller account sizes may not be able to use it.

How is a short put different from a long call?

While both of these strategies are bullish, they have many differences:

A long call gives you the right, but not the obligation to buy 100 shares at the strike price. A short put obligates you to buy 100 shares at the strike price if the option’s holder exercises their rights under the contract.

You pay the options premium to purchase a call, but collect the options premium to sell a put.

A long call has unlimited profit potential, whereas a short put’s profit potential is limited to the credit collected.

A short put typically requires more cash collateral to sell compared to the amount of cash required to purchase a call option.

A long call is negatively impacted by time decay, whereas a short put benefits from it.

A short put typically has a higher theoretical probability of success than a long call.

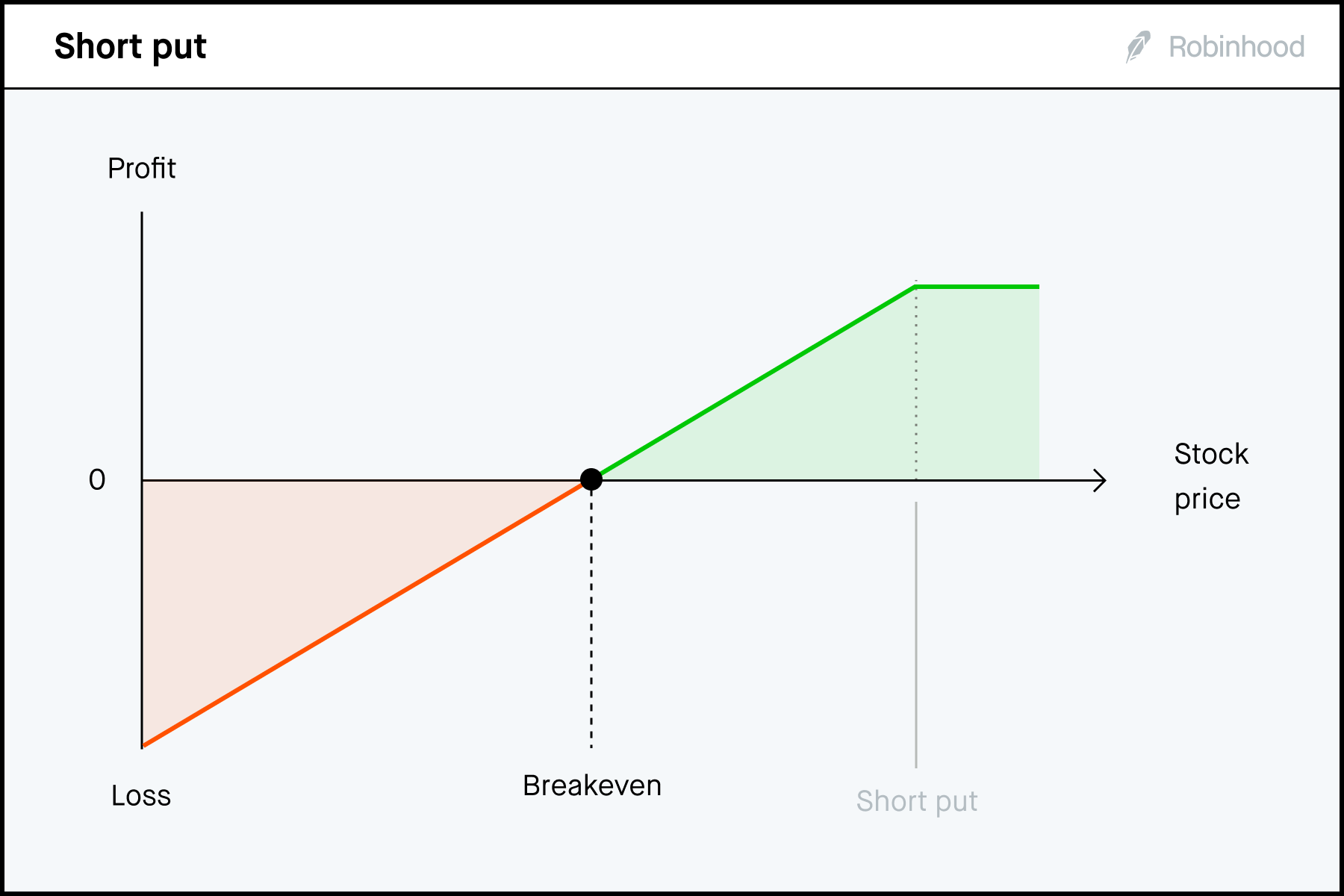

P/L Chart at expiration

A short put has both defined theoretical profit and loss. At expiration, it profits if the underlying stock is trading above the breakeven price.

Theoretical max gain

The theoretical max gain is limited to credit received. This occurs if the underlying is trading at or above the strike price of at expiration. In this scenario, the option will likely expire worthless, and you’ll keep the premium you collected for selling the option.

Theoretical max loss

The theoretical max loss is large, but limited. It’s equal to the strike price of the put and subtract the premium collected. Similar to someone who owns stock, this occurs if the stock price falls all the way to $0, which may not be likely, but is always possible.

Breakeven point at expiration

The breakeven point at expiration is equal to the strike price minus the premium collected.

Is it possible to lose more than the theoretical max loss?

No. If you’re assigned on your put, you’ll buy 100 shares of the underlying stock. In this scenario, the potential max loss is the same as the theoretical max loss of the short put. Although the stock can still go to $0, you’ll keep the premium collected for selling the put.

Example

Imagine XYZ stock is trading at $100 and you think the stock price will rise in the next 30 days. You decide to sell the XYZ $95 put option expiring in 30 days for $2.10:

Sell 1 XYZ $95 Put for $2.10

The theoretical max gain would be $2.10 per share, or $210. Max gain occurs if XYZ is trading at or above the strike price ($95) at expiration. In this scenario, the option will likely expire worthless, and you’ll keep the full credit.

The theoretical max loss is $92.90 per share, or $9,290. It’s calculated by taking the strike price of the put ($95) and subtracting the premium collected ($2.10) and multiplying by 100. Max loss occurs if XYZ falls to $0.

The breakeven point at expiration is $92.90. This is calculated by taking the strike price of the put ($95) and subtracting the premium collected ($2.10).

This is a theoretical example. Actual gains and losses will depend on a number of factors, such as the actual prices and number of contracts involved.

Managing the trade

A short put benefits if the underlying stock price rises quickly, and ideally stays above the strike price of your put option. In addition, if implied volatility drops your option will likely lose value, assuming all other factors remain constant. Around 30-45 days to expiration, time decay begins to accelerate. That being said, the strategy won't approach its maximum gain or loss until it’s near expiration and the time value of the put option is greatly reduced.

At some point, you must decide whether or not to buy back your option, roll it, or hold it into expiration. If your option is profitable, consider taking action before expiration. The longer you wait, the more chances the stock has to fall. You may not be able to keep the entire premium, but you can book a profit while reducing your risk.

Meanwhile, if the stock price drops and implied volatility rises, the put option will likely gain in value. This isn't ideal. In this scenario, your position might take on losses. If you want to exit the position prior to expiration, you’ll likely have to buy to close the option for more than what you sold it for, resulting in a loss. If you hold it until expiration and the option expires in-the-money, you’ll be obligated to buy 100 shares of the underlying for each short put that is assigned.

Keep in mind: Any time you have a short put option in your position, there’s a possibility of an early assignment, which exposes you to certain risks, like owning the underlying stock.

Option Greeks

Option Greeks are a way of measuring the sensitivity of an option's price to various factors like price, time, implied volatility, and interest rates. The Greeks of a short put are:

Delta is positive. For each $1 increase in the underlying, the option’s price will theoretically decrease by the absolute value of delta, and vice versa. As the put option becomes more in-the-money it will approach a 1.00 delta. As the put option becomes more out-of-the-money it will approach a 0.00 delta.

Gamma is negative. For each $1 increase in the underlying, the option’s delta value will theoretically decrease by the gamma value, and vice versa.

Theta is positive. For each calendar day that passes, the option’s price will theoretically decrease by the theta value.

Vega is negative. For every 1% decrease in implied volatility, the option’s price will theoretically decrease by the vega value, and vice versa.

Rho is positive. For every 1% increase in the risk-free interest rate, the option's price will theoretically decrease by the rho value, and vice versa.

Keep in mind: Option Greeks are calculated using options pricing models and are theoretical estimates. All Greek values assume all other factors are held equal.

Closing the position

Although the strategy is designed to reach max profit at expiration, you might consider closing it before then in order to free up capital and avoid the risk of going through exercise and assignment. Whichever you choose, it’s best to establish an exit strategy for your trade before you enter it. To close a short put you can do the following that's described in this section:

- Buy to close your position

- Roll your position

- Hold through expiration

Buy to close your position

Prior to expiration, you can try to buy back your short put. In doing so, you’ll realize any profits or losses associated with the trade. If you buy to close your option for less than your selling price, you’ll profit. If you buy it for more than your selling price, you’ll realize a loss. And if you buy it at the same price as your selling price, you’ll break even.

Roll your position

You can also roll your position. Rolling a short put involves buying your existing position (realizing any gains or losses) and simultaneously selling a new put option with a further expiration date and/or a different strike price. This allows you to establish a similar position, while managing your risk prior to expiration.

Hold through expiration

Holding your position into expiration can result in a max gain or loss scenario and carries certain risks that you should be aware of. Learn more about expiration, exercise, and assignment.

If the option expires out-of-the-money, it will typically expire worthless and be removed from your account. You’ll realize a max gain on the position.

If the option expires in-the-money, it will likely be assigned, and you’ll be obligated to buy 100 shares of the underlying for every put you’ve sold. The buying power that’s being held in your account will be used for the purchase, and you’ll keep the premium for selling the put option.

Additional risks

When selling a put, be cautious of an early assignment. An early assignment occurs when the put option you’ve sold is exercised by the buyer before its expiration date. Remember, as the seller of the put, you can’t choose to be assigned–only the buyer can exercise the option. If you’re assigned on your short put option, you’re obligated to buy 100 shares of the underlying security at the strike price for each contract that’s assigned. Typically, this occurs when the stock is far below the strike price, and the option has little to no extrinsic value left. Learn more about early assignments.

What happens if a corporate action impacts the underlying asset?

Sometimes, the option’s underlying stock can undergo a corporate action, such as a stock split, a reverse stock split, a merger, or an acquisition. A corporate action can impact the option you hold, such as changes to the option’s structure, price, or deliverable.

Disclosures

Any hypothetical examples are provided for illustrative purposes only. Actual results will vary.

Content is provided for educational purposes only, does not constitute tax or investment advice, and isn't a recommendation for any security or trading strategy. All investments involve risk, including the possible loss of capital. Past performance doesn't guarantee future results.

Options trading entails significant risk and isn't appropriate for all customers. Customers must read and understand the Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount.

Robinhood Financial doesn't guarantee favorable investment outcomes. The past performance of a security or financial product doesn't guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.