Link your accounts

You can link one or more bank accounts and a debit card to your Robinhood account.

Link your bank account

Most banks you do business with make it easy to link your bank account in the app. If you don’t see your bank or credit union listed, you’ll need to verify your account manually.*

To link a major bank in your iOS or Android app:

- Select Account (person icon) → Menu (3 bars)

- Select Transfers → Linked Accounts → Add account

- Choose your bank from the list of major banks, or use the search bar to search for your bank

- Enter your online banking username and password

- Choose which account you'd like to link

If you can't find your bank:

- Enter the name of your bank in the search bar

- Select Checking account or Savings account

- Enter your account information

To link a bank on web classic:

- Select Account

- Select Add New Account under Linked Accounts → Continue

- Choose your bank from the list of banks, or use the search bar to search for your bank

- Enter your online banking username and password

- Choose which account you'd like to link

If you can't find your bank:

- Select Don't see your bank? Search instead

- Enter the name of your bank

- Select Checking account or Savings account

If you receive the error message “Error: Please disable the added/extra security placed on the account,” you’ll need to either disable the two-factor verification setting on your bank account, or contact your bank to make sure there isn’t a problem with your online banking profile.

If you’re linking a bank account, we recommend linking a checking account rather than a savings account to avoid potential transfer reversals.

You can also link an external debit card account for instant transfers to your Robinhood investing account or spending account.

Instant transfers with your debit card are different from Instant Deposits. With Instant Deposits, you may be able to instantly trade with a portion of a pending transfer from an external bank account.

*You can fund your account with an individual or joint bank account. We can’t allow funding from trust or business accounts at this time. Make sure you link the correct account type to avoid restrictions on your Robinhood account. For security purposes, we limit the number of bank accounts we can link to a single Robinhood account. We also limit the number of Robinhood accounts that a bank account can be linked to.

We encourage you to take extra care to enter this information accurately, including any leading or trailing zeroes in both the account and routing numbers.

- Savings and money market accounts are subject to regulations that may limit your allotted number of transactions per month, and they don’t always offer ACH transactions.

- If you're unsure of your bank account status, please check with your bank representative to be sure your account supports ACH transfers.

- Make sure you have sufficient funds in your account to prevent a bank overdraft fee. We won’t be able to cover overdraft fees if the microdeposits cause them.

Microdeposit errors

Microdeposits are small sums of money that are transferred online from one financial account to another to verify the account. Linking and verifying your bank account manually can be a tricky process, and you may encounter one of these errors:

- If you only see 1 microdeposit in your bank account, your bank is merging the 2 deposits together. Contact your bank or credit union to get the original amounts in chronological order.

- If you don’t see the 2 small transfers after 3 days, verify that your account and routing numbers are correct. If your information is correct, your bank may be denying access to your bank account. Contact your bank for more information on authorizing ACH transfers.

Don’t initiate multiple microdeposit verifications within a short period of time. This could make it difficult to determine which deposits to verify.

Once you’ve submitted your information, we’ll initiate 2 microdeposits to your bank account. Allow up to 48 hours for the transfers to appear in your bank account.

Once the 2 small transfers have landed in your bank account, verify them in the app or on web classic:

- Go to Account (person icon) → Menu (3 bars)

- Select Transfers

- Select Linked Accounts

- Select Verify

- Enter the 2 deposit amounts

- Select Enter

These 2 small transfers are for the sole purpose of verifying your bank account and will be withdrawn when they expire.

Link and verify your debit card

While not all cards are supported, most US-issued Mastercard, Visa, and Discover cards are supported. We don't accept prepaid cards or credit cards. We also limit the number of cards you can link to a single account.

You can link a non-Robinhood Visa or Mastercard debit card to your account that allows you to make instant transfers. Depending on your card’s eligibility, you may link your card in two ways.

To link and verify your debit card in the app or on web classic:

- Go to Account (person icon) → in the app, Menu (3 bars)

- Select Transfers → Linked accounts → Add account

- Select Debit card

- Enter your card information

- Tap Link card

When you make your first deposit or withdrawal with your newly linked card, you may be required to complete a verification for security purposes. Types of verification can differ by bank, like with SMS, zip code, or security questions.

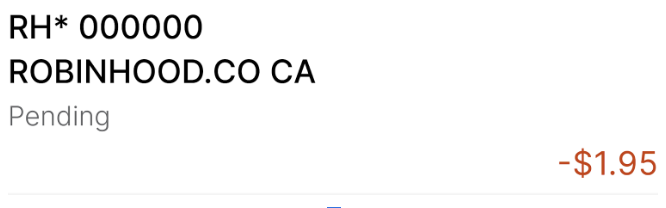

Alternatively, we may temporarily charge $1.95 to your bank to confirm your debit card. We remove this charge after your card is successfully verified.

- Check your bank account (this charge typically appears in a few minutes, but may take longer depending on your bank)

- Find the $1.95 charge with RH* followed by a 6-digit code on your statement

- Copy the 6-digit code, return to the Robinhood app, and select Continue

- Enter the code and select Confirm

You'll receive confirmation in the app when your card is successfully verified and ready to use.

Don't share your 6-digit code with anyone.

If you choose to do this later, you can verify it in Linked accounts. Keep in mind, the 6-digit code expires 3 days after you begin the verification process. If you don't complete the verification process and the code expires, the temporary $1.95 charge is automatically removed from your account.

This charge will always have RH* in the description. The rest of the description may look different depending on your bank.

If you’re unable to link your card, it may be because you’re using a new device, and some features may be limited for security reasons. Review Sign in with a new device for more information.

If you get an error message that says, “Please try again tomorrow” (as shown below), you can use standard or instant bank account transfers as alternative methods to deposit or withdraw funds.

Why can't I find my verification code?

Why can’t I find my verification code?

If you haven’t received your verification code from your bank after 24 hours, it might be for one of the following reasons:

- If you bank with Bank of America, your code may appear differently and take over 24 hours to go through.

- Your bank might flag the charge and require additional verification when an automatic charge goes through. Contact your bank and let them know you initiated this authorization from Robinhood.

- You might have insufficient funds in your account that prevents the charge from going through. Make sure you have an account balance of at least $1.95 before trying again.

Why can't I link my card?

If you’re encountering an error when attempting the linking process, it may be that our system doesn’t recognize your device. Check out Sign in with a new device for troubleshooting tips.